One of the major problems of private equity investments is the same problem that many alternative investments suffer from. As the asset class matures, returns decline significantly. However, not all private equity investments seem to be created equally in that respect.

I recently read a recommendable review of what we know about private equity as an asset class by Alexander Ljungqvist. The article provides you with all the references and studies you need to understand that private equity historically outperformed publicly listed stocks after fees, but this outperformance is declining and it is not at all clear whether this outperformance also persists when private equity investments are properly adjusted for risk, the implicit leverage in the funds or the lack of liquidity.

To be perfectly honest, at a previous employer, we used to model private equity returns as small cap value stocks with a 10% to 20% leverage. Works like a charm when it comes to constructing a multi-asset portfolio. This makes you wonder why one wants to pay the high fees of private equity funds instead of simply buying a small cap value fund and levering the investment a little bit. That would probably be cheaper and more liquid at the same time.

In any case, a recent study by Sara Ain Tommar, Serge Darolles, and Emmanuel Jurczenko examines private equity funds that focus on investments outside North America and shows that the returns in different global regions can differ a lot from the US. Once again, testing a result outside the US can quickly demonstrate which results are robust to small changes and which ones aren’t.

Good news then that the new research of Tommar and colleagues confirms the trend towards declining returns of private equity funds seen in the US. Of course, that may not be good news to private equity investors, but it is good news for my purposes here.

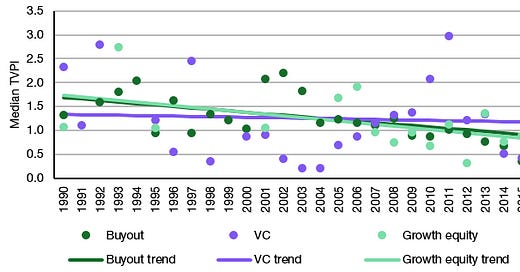

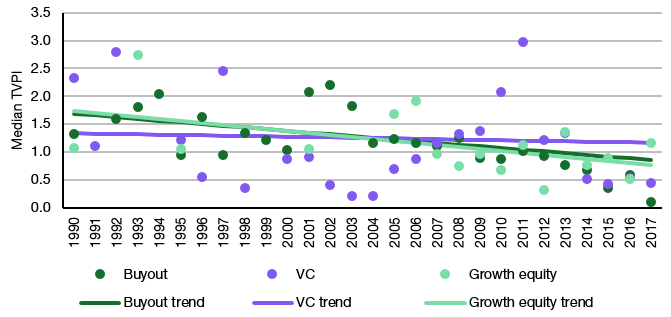

What this new research allows me to do is to estimate the rate at which returns decline for different investment strategies. The chart below shows the median total value per paid-in capital (TVPI, commonly referred to as money multiplier) for buyout funds, growth equity funds and venture capital funds by vintage. I also estimate a trend based on the results for vintages from 1990 to 2013 (I leave out vintages that are less than ten years old since they may not have fully developed their investments).

As you can see, the trend in money multipliers is virtually identical for buyout and growth equity funds with median TVPI dropping by about a third every ten years. But note that the median TVPI for venture capital funds remains almost constant (dropping by about 5% per decade). It seems like venture capital is immune to the erosion of returns over time. I don’t know why that is or whether it will continue but venture capital has bucked a common trend for 30 years now, so there might be something real to it.

Median TVPI by vintage and long-term trend

Source: Tommar et al. (2024)

highly interesting point about private equity and small-cap value. Never heard of such a thing, thanks!

Still beats me how one could make proper money with the likes of VBR. For instance risk parity with VBR and GLD works acceptably but not exceptionally, is not much of a diversifier, and adding leverage just increases the pain in the usual years ('08, '15, '18, '22).

I'm not a statistician, but I'm looking at the dots for VC and they look all over the place. Could it be that we see a 'trend' when there's none?