There is more than one global central bank

As investors, we are used to thinking of the Federal Reserve in the United States as the global central bank because if the Fed tightens monetary policy as it is prone to do throughout 2022, the repercussions are felt throughout the world through a stronger US Dollar and higher interest rates on US Treasuries. So, as the Fed hikes interest rates in 2022, we should expect European and UK bond yields and credit spreads to rise as well because money is becoming more expensive in the largest economy of the world, and that tightness reverberates in the Eurozone, the UK, and everywhere else where there are close trade links with the United States.

But strangely, people in the US and Asia, but even in the UK tend to look at the actions of the European Central Bank as if it would only affect the Eurozone. But the Eurozone has more people in it than the United States and its GDP is about the same as China and about two thirds of that of the US. Furthermore, the Eurozone is the economic area in the world with the largest trade share of all major economies. The eurozone is the true global hub of international trade. So if the ECB decides to tighten monetary policy European firms are retrenching which should leave a mark in the US and around the world through international trade links and an appreciation of the Euro.

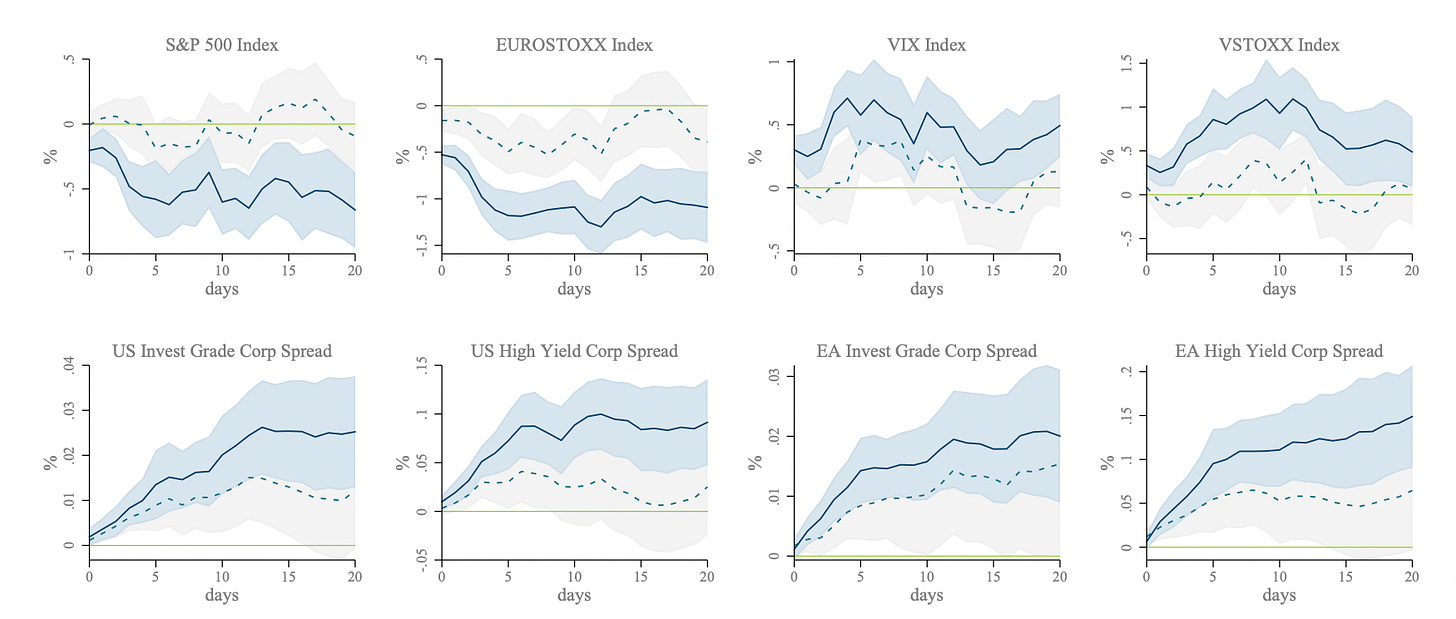

This is exactly what a study by researchers from the Bank of England and the London Business School found. The chart below shows how a tapering by the ECB (not a rate hike, but only a reduction in asset purchases with long maturity) reverberates through financial markets in the month after an announcement (dotted lines) or the actual implementation of the policy (solid line). It’s not just that European equity markets decline and credit spreads for European bonds rise. The same happens in the United States.

Impact of ECB tapering on financial markets

Source: Miranda-Agrippino and Nenova (2021)

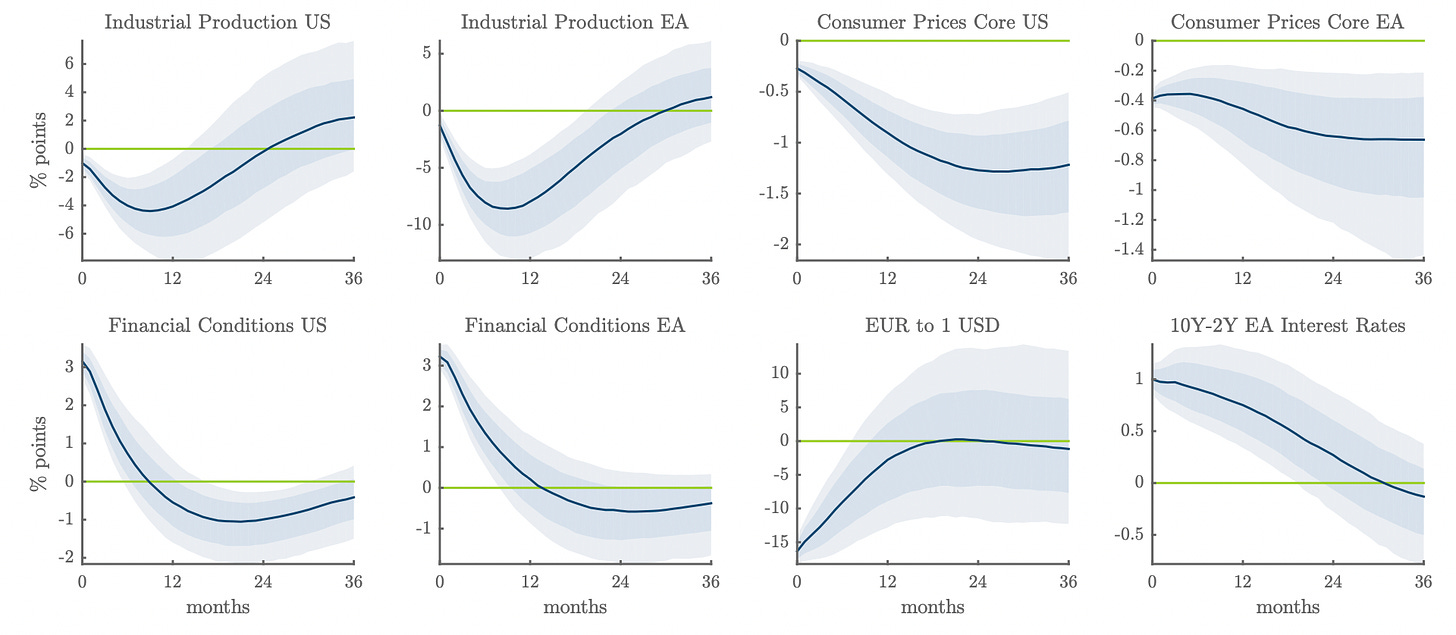

And that is not an irrational reaction. Because money becomes more expensive in one area of the globe, money becomes more expensive everywhere growth starts to slow down and inflation starts to decline. Note in the chart below how tapering by the ECB within one year leads to a decline in US industrial production of 0.4 percentage points and a decline in US Core inflation by 1 percentage point, even if the Fed does nothing.

Impact of ECB tapering on the US and Eurozone (EA) economy

Source: Miranda-Agrippino and Nenova (2021)

I am saying this because while the Fed is expected to hike interest rates this year, the common expectation by investors is that the ECB is not hiking rates but may taper its asset purchases. But that is supposed to be largely a non-event that pales in comparison to the rate hikes by the Fed and the Bank of England. Not so, as these charts show. Tapering by the ECB this year should not only reduce Eurozone inflation, but also inflation in the United States, the UK, Switzerland, and other places and I doubt that many investors have reckoned with that.