Traders are different

In my book, I wrote about the laboratory experiments with different investors that show that if you let people trade with each other they naturally create bubbles where share prices deviate significantly from fair value and then crash towards the end of the experiment when the game is about to end and the stocks will expire worthlessly.

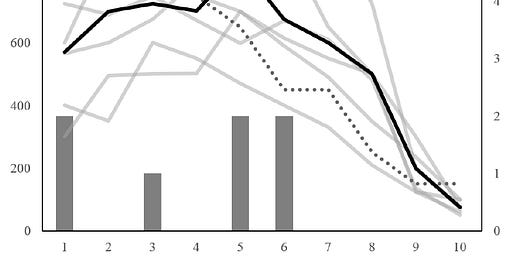

Students participating in a lab market trading stocks

Source: Cirpriani et al. (2020). Note: Dotted line is the fair value of stocks, grey lines are the median share prices for different groups of participants, the black line is the median share price over all experiments, grey bars are the periods of peak share price. In a rational market, the median share price should follow the fair value closely and the peak share price should be reached in periods 1 or 2.

The typical experiment is shown in the chart below. People are put into a laboratory and asked to trade stocks with each other. The game proceeds in 10 rounds. In every round, the stocks pay a random dividend and at the end of round 10, the trading will stop, and the stocks are worthless. The fair value of the stocks in every round is given by the sum of all future dividends and easy to calculate. Yet, students, finance students, financial advisers, etc. all create share price bubbles like the ones shown in the chart. Share prices are bid up by people who speculate on a high dividend in the next period and then hope to sell it to another investor. These bubbles are so ubiquitous that this finding has been a major reason why Vernon Smith was awarded the 2002 Nobel Prize for Economics for these kinds of experiments.

Imagine my surprise when I came across a new paper where professional traders were asked to participate in the same lab experiments that have been used for decades to investigate investor behaviour – and they behaved differently. Unlike more or less sophisticated private investors and other groups of finance professionals, the traders did not create a bubble. In fact, they are so far the only group I know of that traded rationally. The difference in share prices in the lab experiments with students is striking.

Professional traders and students participating in a lab market trading stocks

Source: Cirpriani et al. (2020). Note: Dotted line is the fair value of stocks, grey lines are the median share prices for different groups of participants, the black line is the median share price over all experiments, grey bars are the periods of peak share price. In a rational market, the median share price should follow the fair value closely and the peak share price should be reached in periods 1 or 2.

This is remarkable insofar, as professional traders seem to act far more rationally than most market participants. It confirms a result that has been shown almost two decades ago by Lo and Repin. They wired up traders and measured blood pressure, heart rate, and other physiological signals to evaluate their emotions and stress as they traded assets during the day. They found that experienced traders are cool as a cucumber as they say and do not show the typical emotional reactions to high volatility events. And this coolness, which is likely a result of years of experience because younger traders do not have the same level of coolness, leads to better performance.

It seems as if there is a small group of rational investors out there. And while everybody is losing their heads in a tumultuous market, traders do not – and make money as a result of it.