If you look at the US administration’s drive against all things ESG (particularly DEI), you’d think that traditional and sustainable investing are mutually incompatible. However, a survey of 509 portfolio managers, about half of which were based in the US, shows that ESG investing beliefs are similar between the two groups.

Alex Edmans and his collaborators asked the portfolio managers what they thought about companies’ efforts to become more sustainable and whether E and S factors helped improve returns. It’s a broad survey, so I want to focus on two things that I found noteworthy.

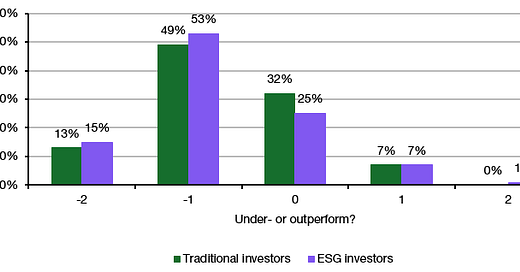

First, they asked if companies with poor environmental and social credentials underperform the broader market in the long run. As you can see from the responses below, there is not much difference between traditional and ESG investors. Both groups think that companies with poor ES credentials underperform the market. Similarly, on average, both groups think that companies with good ES credentials tend to outperform the market in the long run.

Do companies with poor ES credentials underperform the market in the long run?

Source: Edmans et al. (2024)

There is agreement that better environmental and social performance is financially material for investors. There is a bit of disagreement about whether investors are willing to give up performance to improve the ES credentials of their portfolios.

47% of ESG investors say there is no trade-off between a portfolio’s ES credentials and investment performance compared to 35% of traditional investors. But among those that say there could be one, the plurality says they would not be willing to give up any performance to improve the ES credentials of their portfolio. In other words, investment returns are more critical than ES credentials for traditional and ESG investors.

How much performance per year would you be willing to sacrifice to improve your portfolio's ES credentials?

Source: Edmans et al. (2024)

On other subjects, such as the need to include ESG considerations in stock selection, traditional investors and ESG investors are again largely in agreement.

This brings me to another result I found interesting in the survey. Portfolio managers were asked to assess which environmental and social factors influence long-term returns the most and where they think companies are over- or underinvesting. If you combine both questions in a scatter plot as below, you can see that there are some areas where companies should focus more on and where they are overemphasising their efforts compared to the long-term benefits.

Long-term benefits of actions vs. company over- and underinvestments in these areas

Source: Edmans et al. (2024)

What stands out is companies’ overinvestment in GHG emissions reduction and demographic (i.e. gender and racial) diversity efforts. GHG emissions are perceived as one of the most important drivers of long-term value creation, but compared to other, similarly important issues, companies are heavily overinvesting in trying to reduce these emissions. Meanwhile, companies are also overinvesting in demographic diversity efforts, which has little long-term benefit for the company in the eyes of portfolio managers.

Meanwhile, companies seem to treat their supply chains and other environmental issues, such as biodiversity and water usage and treatment, with benign neglect. Given their importance for long-term shareholder value creation, companies should focus more on these issues.