Transparency -> Accountability -> Performance

It has become gospel that increased transparency leads to accountability and this incentivises people to do better. The entire set of ESG regulations that are being passed into law in Europe at the moment has the goal to increase transparency for investors about the climate impact their investments have. And the hope is that by making this information public, fund managers will start to take climate risks more into account.

Similarly, by having to disclose conflicts of interest and the performance of their investment decisions, financial analysts and fund managers can’t get away with the shenanigans of old and have an incentive to put clients’ interests first.

We can debate about any specific regulatory measure and whether it is really helpful and advantageous for investors, but reading a new paper by Richard Evans and his colleagues opened my eyes to a field that I hadn’t even considered as problematic before: Whether funds are managed by named managers or anonymously.

In the United States, a 2004 SEC rule required funds to disclose who (team or individual) is managing funds and in the Anglo-Saxon world, it is largely unknown to have funds managed by an anonymous team or individual that is not disclosed in public documents. But in Switzerland, where I lived and worked for 21 years, things are different. There it is quite common that investors are not informed about who runs their money in a specific fund. This practice is particularly widespread amongst funds launched by the big private banks where investors are buying into these funds mostly because they trust the company and its brand (and because of perverse incentives that funnel client assets towards funds of a bank’s own asset management arm). The result is that in 2015, 36% of funds managing 43% of the money invested in mutual funds was managed anonymously. Austria and Brazil are even worse and in Germany, about the same share of funds is managed anonymously as in Switzerland but they account for only 18% of assets. Compare that to the UK where only 16% of funds with 9% of assets are managed anonymously.

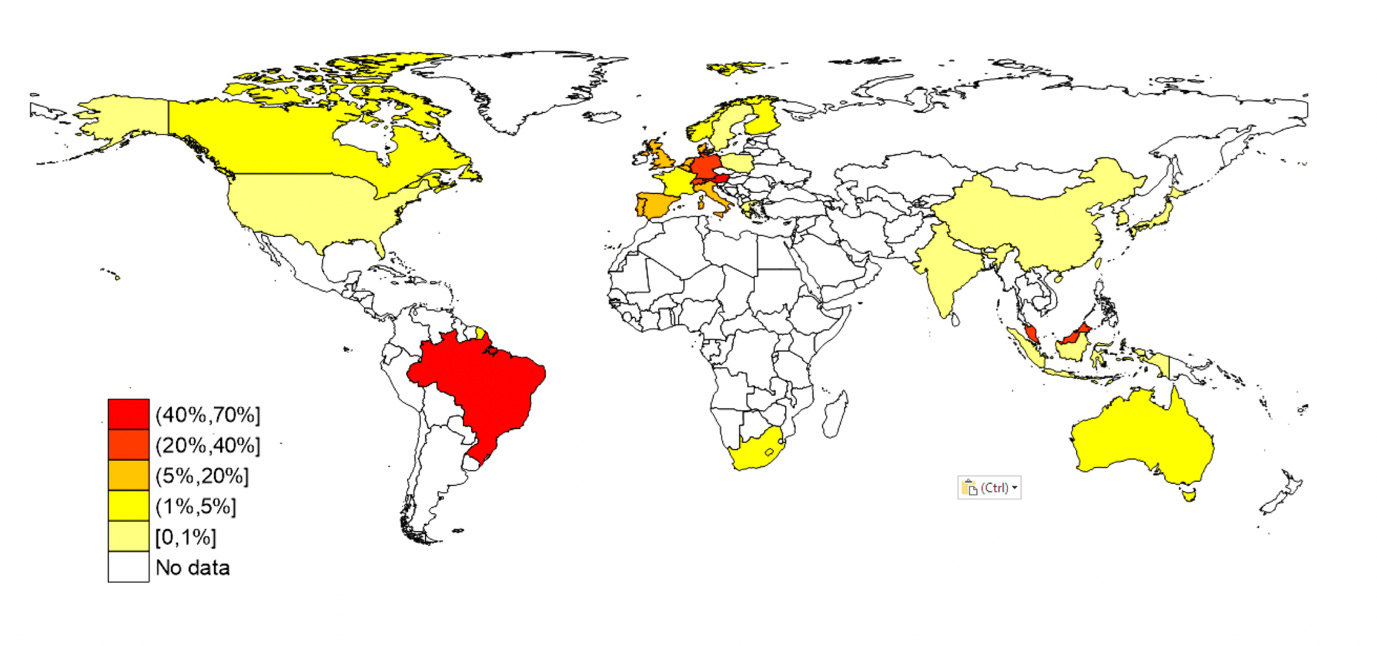

Share of funds that are managed anonymously

Source: Evans et al. (2021)

But if funds are run anonymously, who is going to hold the fund manager accountable for weak performance? Investors and the media certainly can’t because they don’t even know who is to blame. The only entity that can hold a fund manager in an anonymously managed fund accountable is the employer. And that means that the only consideration for the people who run these funds is career risk. They have no incentive to deviate from the benchmark in order to outperform. Instead, the less they underperform the more likely it becomes they will keep their jobs and won’t get fired. And that means that these anonymous fund manage3rs have an incentive to reduce tracking error and active share in their funds and become closet indexers. And that is exactly what the study found. Funds managed anonymously have a lower tracking error and lower active share than funds that are managed by a named individual or team. And the performance net of fees is correspondingly dismal. On average, anonymously run funds underperform named funds by 0.84% per year.

In the end, the study shows that while not all regulation is successful, the 2004 SEC ruling in the United States did the right thing and forced public accountability for performance. The study even found that the performance of previously anonymously run funds in the United States improved after the fund managers were publicly disclosed due to the rules change. I wish every country would adopt a simple and effective rule like that.

Hi Joachim. Couldn't be the other way around? that the best fund manager tend to be disclosed because they want to emerge (and have they own share of fame) while underperforming funds tend to be kept anonymous until the portfolio manager improve the performance?

Also, improving the focus of transparency on fund manager could also increase the risk of a "Star Single Manager" approach, don't you think?

Given that the performance statistics for US actively managed funds are pretty dismal (as per SPIVA reports) this implies that European fund performance (on average) is likely to be even worse - or am I reading too much into this?