Using discount to NAV to forecast listed private equity

I have long had a soft spot for closed-end funds investing in illiquid assets like private equity. One of the key metrics investors use to assess the value in these investments is the Price/NAV measure. A new paper has updated how well this measure can forecast share prices of listed private equity companies like Apollo or 3i.

Because one of the authors works at LPX, the index provider for liquid private equity funds, they didn’t look at the much broader universe of listed closed-end funds (see here for what is available in the UK alone). But alas, their results are instructive, nonetheless.

First, they looked at which factors drive the returns of listed private equity companies. No surprises there. Just like so many other studies, they found that private equity investments are essentially small cap value investments with leverage.

What I found comforting, though, is that they found that the discount or premium to net asset value (NAV) at which the company trades remains indicative of future share price returns. This wasn’t so clear in recent years because with the normalisation of interest rates, these vehicles now trade at a much larger discount to NAV than before 2020. And the study bears that out. The predictive ability of the discount to NAV has declined since the pandemic.

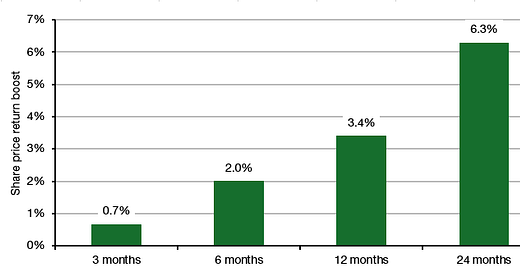

But if we cut out the pandemic, there still is a lot of predictability left. Crucially, though, it is the change in discount to NAV not the level of discount to NAV that explains future share price returns. Below is their estimate how much share price returns increase after the discount to NAV widens by one percentage point in the case of the listed private equity companies.

Share price returns in reaction to a 1-point increase in discount to NAV

Source: Enders et al. (2024)

In short, investors who look at the size of the discount to NAV look at the wrong metric. The world has changed, and the equilibrium level of discounts has changed since interest rates have normalised. But if you look at the movement in discounts to NAV, you can still get valuable information about future share price returns.