When you ask rich people how much taxes they should pay they will inevitably come up with a lower number than when you ask poor people how much rich people should pay. Rich people argue that their wealth is deserved based on the hard work they put in to get rich. But what happens when a poor person becomes rich? Or when wealth is clearly not the result of effort, but luck?

A team from the University of Warwick ran two separate experiments, one in the UK and one in the US, to find out if people’s attitude to taxes changes when they become rich.

To do this, they asked half of the participants to spend 5 minutes adding 2-digit numbers. The more numbers they could successfully add up the more money they made. Then they asked the participants how much taxes they should pay to redistribute wealth from the richer people to the poorer ones.

As you might have guessed, the people who did better at the effort task thought their higher income was deserved and as a result, thought they should pay less tax than people who didn’t do that well in the effort task. The gap was a whopping 30 percentage points. No surprise there.

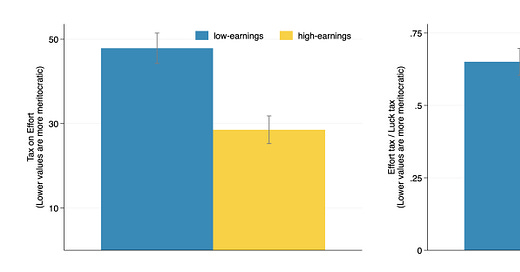

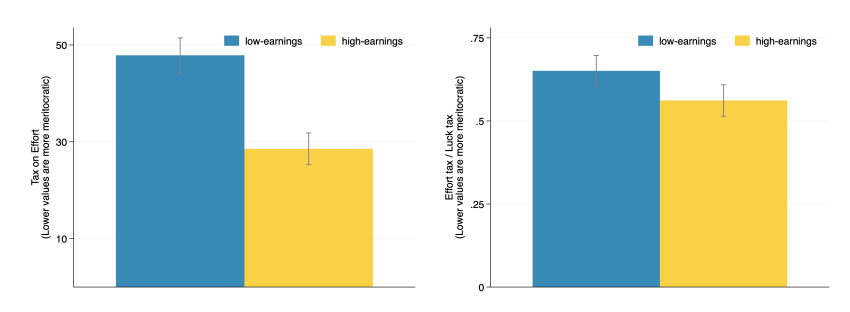

In a second experiment, the researchers distributed wealth not based on the result of the effort task (adding up numbers) but based on a lottery. Then they asked both the volunteers who won the lottery and those who didn’t how much the wealthy should pay in taxes. Note that the wealthy knew their wealth came from a lottery and was entirely due to luck, not effort. Yet, the chart below shows that the lottery winners still argued that the taxes on their wealth should be some 20 percentage points lower than what the people who didn’t win the lottery thought (left hand chart).

The right-hand chart shows that the relative level of tax on effort-based income vs. lottery-based income is also lower for lottery winners, which means that lottery winners think that taxes, in general, should be lower, whether wealth is based on effort or luck.

Lottery winners argue for lower taxes than people who didn’t win the lottery

Source: Blouin et al. (2024)

Further analysis shows that the moment someone becomes wealthy, whether through effort or luck, their arguments change. Compared to people who did not get wealthy the rich ignore arguments for redistribution and try to seek out information that contradicts their preferred outcome of lower taxes. They put themselves into an opinion bubble that prevents them from seeing or contemplating arguments for redistribution of income. Even if they are fully aware that their wealth is entirely due to luck, they argue that they deserve their luck.

Ask anyone how much they need to earn to be ‘comfortable’ and they say something like “£10,000 more than I earn now.”

Most of us accept we need to pay taxes to fund public services, but have various ideas as to what amount is “fair”. This applies to (1) where the tax falls, and (2) the rate of tax.

I do not begrudge Jeff Bezos or Bill Gates $ of their wealth. They were the risk takers who made it. Gates is admirable by giving away most for good purposes.

Conversely I do begrudge some of the directors of existing S&P or FT 100 companies. They award themselves large salaries and stock options, but take no risk.

The other party is HMG which sets taxes. The record over the last 7 months has been lamentable: taking away Winter Fuel Allowance, raisin employer NIC, and prospectively taxing pension funds via IHT. At the same time they do not say how the money will be spent: the bottomless pit of the inefficient unreformed NHS? More windmills so we pay the highest price in the world for energy?

I think very rich people like Bill Gates understand that the path from taxation to actual benefit is sketchy at best. Government agencies, opaque decisions and plenty of money laundering and grift. But one thing that surprises me is how little Gates and others have done to set up working non-profits in the US that help people advance and get into the "sweet spot" of US abundance. I am supportive of getting clean drinking water and toilets in poor parts of the world but they have so much *intelligence* and resources that they could do better than than the US government in figuring out how to improve, educate and enrich poor people here in the US.