We all pay for it – one way or another

A couple of weeks ago, I wrote how lifecycle models of saving and consumption predict that retired people should dissave. As the population of a country ages, this dissaving in retirement should lead to less and less demand for bonds and other safe investments and to higher real interest rates.

Instead, what we observe is exactly the opposite. In an aging society, real interest rates decline and one of the reasons for this observation is that older people continue to save even in retirement. In the United States, this “retirement savings puzzle” has recently been confirmed using three different datasets for thousands of people. In every case the researchers found that with the onset of retirement, savings rates increase as retirees reduce their liabilities and debt and increase their current account balances.

There are different reasons why retirees continue to save. The first and most obvious one is to save money for children and grandchildren. Besides this bequest motive, retirees may want to continue saving money because they know they live longer and thus their retirement nest egg may have to last longer. And finally, in countries like the United States, health care costs may be so high that retirees need a bigger nest egg just to be able to pay their bills as they grow older and become frailer.

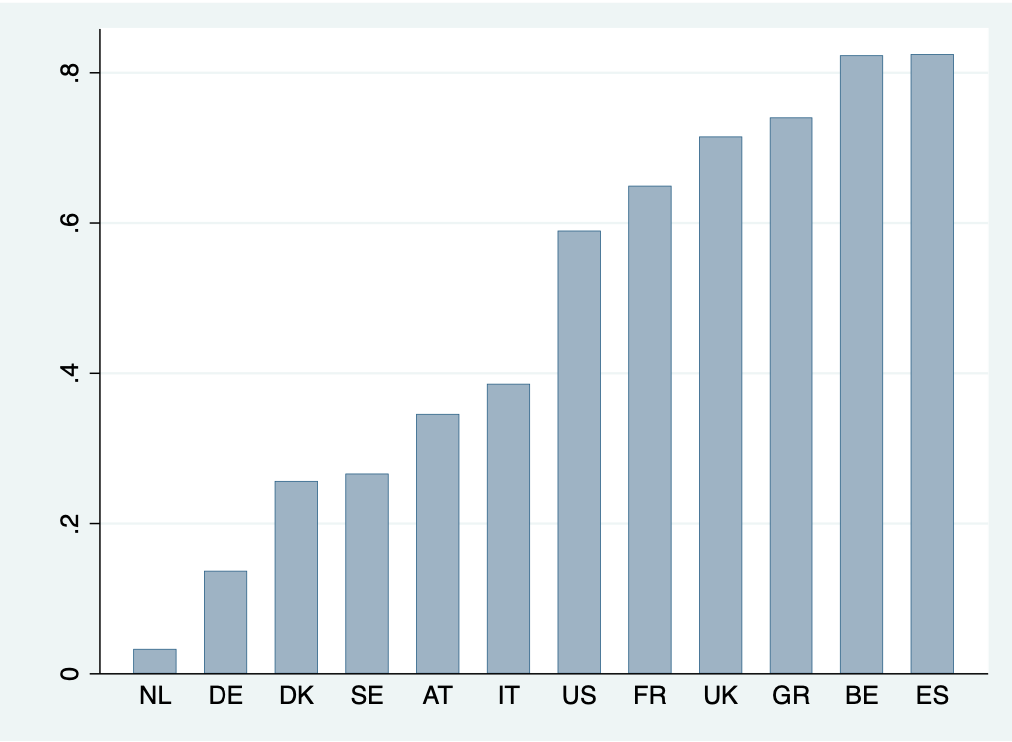

In this respect, it is interesting to look at international comparisons of the development of net worth during retirement. The chart below comes from a study from Makoto Nakajima and Irina Telyukova. While savings rates remain high and even increase in some cases during retirement, net wealth still declines during retirement because the new savings do not compensate for additional expenses such as unanticipated costs for health care, accidents, etc. and gifts to children, grandchildren, and other family members (the famous “bank of mom and dad”). Yet, it is still surprising that the median wealth of individuals aged 86 to 90 in the United States is just 40% below the median wealth of individuals aged 65 to 69. In twenty years of retirement less than half the nest egg of US retirees is spent.

Ratio of median wealth age 86-90 vs. median wealth age 65-69

Source: Nakajima and Telyukova (2014).

However, there are large differences from country to country with retirees in Scandinavian countries as well as Germany and the Netherlands spending down almost all their retirement nest eggs and retirees in countries like Spain, Greece, or the UK spending less of their nest egg than Americans.

There are probably many factors at work here, but research points to several key incentives for retirees to keep their nest egg in place as much as they can.

First and foremost, countries with a health care system with high out-of-pocket costs for medical care and eldercare tend to have higher savings ratios and less consumption by the elderly. In these countries, the elderly know they have to keep their money together to pay for the care home and their medical treatments.

A second driver is the generosity of the pension system. Countries with more generous pension systems tend to have retirees who save less and spend more.

And finally, the housing market plays an important role. In countries with high homeownership rates like the UK and the United States, the availability of rental properties is reduced and thus retirees can’t simply sell their homes and move into rented accommodation in the same village or town where they live. Thus, they are stuck with their assets locked in their homes and cannot access their savings to the same degree as retirees in countries with a more established rental property market.

The irony of it all is that these factors conspire in such a way that taxpayers of working age have to pay for the elderly either way.

Either they can directly pay for a more generous pension system and health care system via higher taxes which allows retirees to consume more and save less and thus support the economy to a larger degree and indirectly create more jobs, or…

…working age taxpayers get lower taxes, which typically come at the cost of a less generous social safety net. Less generous pensions and health care systems then incentivise retirees to save more and consume less during retirement, creating less economic growth and a surplus of savings. This surplus of savings then helps lower real interest rates, which means that house prices rise and interest on bonds and other save assets decline. This means that savers face confiscation of their savings in the form of negative real rates. At the same time, house prices rise, locking in more of the savings in illiquid assets. And if their children want to buy a new house, they have to ask their parents and grandparents for financial help on the down payment. Thus, the working age taxpayers face extra spending demands in the form of gifts and loans to their children.

In the end, we all pay for the elderly, either directly or indirectly.