We don’t “need” inflation

Let’s face it, the world is drowning in too much debt. In particular, constant deficit spending by governments and the stimulus measures of the financial crisis and the last recession have led to government debt levels that look unsustainable. Countries like the United State and the UK are now saddled with outstanding debt that exceeds GDP. And the key concern for the long run is whether this debt will ever be repaid and in what way?

In these discussions, it is often said that we need inflation to lower the debt/GDP-ratio. And there is truth to this. If you want to lower the debt/GDP-ratio of a country, you need debt to grow slower than nominal GDP. The way to do this is to either reduce the budget deficits of governments to reduce the growth of debt, to increase real GDP growth, or to increase inflation to increase nominal GDP growth. The first one requires politicians to exercise self-constraint in their spending habits (good luck with that) and the second one requires a substantial increase in productivity or capital investment (since we can’t bet on higher population growth). Increasing real GDP growth is very hard to do and probably requires a productivity miracle to get us out of trouble. So, inflation it has to be.

Or does it?

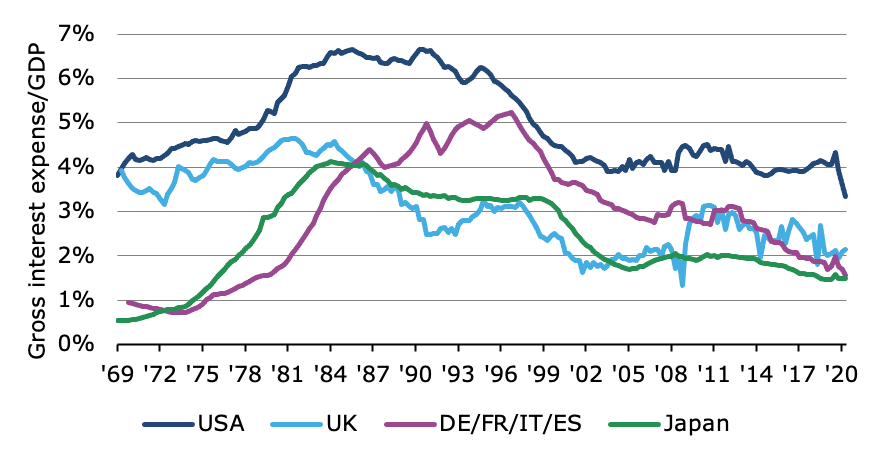

One of the key problems with debt/GDP-ratios as a metric is that it compares a stock (the amount of debt outstanding) with a flow (the national income produced in a given year). A better way to look at debt is to look at flows vs. flows like the annual payments a government has to make to service its debt vs. the national income. The chart below shows the gross interest expense/GDP-ratio for the United States, the UK, Japan, and the four largest Eurozone countries. This chart has become quite popular in 2021 because it shows that we are nowhere near the stress levels in terms of debt affordability that we saw in the 1980s and 1990s. Debt is so cheap that we can easily afford a lot more of it at current interest rates.

Interest expense as a share of GDP

Source: OECD, Note: DE/FR/IT/ES = Sum of Germany, France, Italy, and Spain

And this hints at why we don’t “need” inflation to deal with our debt problem. If governments and central banks can keep interest rates low for the foreseeable future, we can continue to service government debt and simply replace maturing government bonds with newly issued ones. Japan has successfully done this for two decades now and it is nowhere nearer to the long-feared debt collapse than it was 10 years ago.

What I am saying is that if we keep interest rates low enough forever, we can kick the can down the road not just for a couple of years, but for a couple of decades. We don’t need to have Japan-like deflation to do this. We can easily do this with inflation at 2% and 10-year government bond yields hovering around 3% or so. That would still keep debt payments in check, provide room for additional debt to be issued, and not get into any trouble with our budgets or our credit ratings.

Yes, it is kicking the can down the road and you may not like it. Heck, I don’t like it (remember, I am German, and we are notoriously averse to debt). But we don’t get to live in the world we like but the world we have. And if we can kick the can down the road with central banks limiting the upside to government bond yields through permanent quantitative easing and/or guaranteeing to buy all bonds trading at more than 3% yield, for example (remember, the Bank of Japan guarantees to buy every 10-year bond with a yield of more than zero already) then so be it.

Yes, it is financial repression. Yes, it is not a permanent solution. But does that mean that heaven will fall down and bonds will be devalued through inflation? Not at all. And if politicians and central bankers can choose between a permanent solution to the debt problem that involves high inflation or kicking the can down the road for a decade or two by keeping interest rates low, I think I know which outcome they aim for.