What comes next and how to help

For many years, we have been wondering how we could face a crisis if interest rates were very low before the onset and the central banks had little to no ammunition to fight a recession. We are in the process of finding out.

The ineffectiveness of the Fed actions in recent weeks show that fiscal policy is not only what investors expect, but likely the only thing that can help reduce the impact of the coming economic downturn in Europe, the UK and the United States.

As a reminder for the younger readers, the chart below shows what happened to the US economy in 2008 and 2009. The first victim of an economic downturn is sentiment. Consumer sentiment tanks pretty much at the same time as stock markets do. About two to three quarters later, unemployment rates start to pick up. Mark Garmaise, Yaron Levi and, Hanno Lustig have shown nicely, how this uptick in unemployment creates increased uncertainty amongst consumers. When the local unemployment rate in an area reaches a new 12-month high, consumers in that area on average cut discretionary consumption by 2% within two weeks of the announcement, or about a month after the increase in unemployment rates.

The evolution of an economic downturn

Source: Garmaise et al. (2019).

Looking at consumer spending during the 2008/2009 downturn more closely, it is interesting to see that back then travel, restaurant spending, and other leisure activities did not experience declines that were worse than the overall decline in non-durable consumption. But given the unique nature of the Covid-19 pandemic, it seems likely that these social activities will this time suffer more and take longer to recover.

What is important for policy measures to consider is how much different consumer groups start to reduce spending. And here the message is clear: households with a higher income reduce their consumption less than poorer households. It is simply a matter of necessity for poorer households to cut back on discretionary spending and reduce repayments on credit card debt (which drop by about 3.6% in the aftermath of a new 12-month high in unemployment rates) in order to be able to pay the bills for food, electricity, and heating. And of course, the longer the downturn lasts, the more consumption gets cut. If a region observes five months of new highs in unemployment rates in a row, consumption drops on average by 4.6%, not just 2%.

Thus, a fiscal stimulus package will be more effective if it is geared towards poorer households and immediate help in the form of cash payments, increased take-home pay for employed workers or other forms of immediate assistance. The chart below shows the fiscal multipliers as calculated by Moody’s Analytics, which are in line with the multipliers the Congressional Budget Office (CBO) uses in its official estimates of the impact of government policies. Fiscal multipliers measure by how much growth increases for every Dollar spent by the government.

Fiscal multipliers in the United States

Source: Zandi (2011).

The most effective measures are direct transfer payments to poorer households (for example by increasing social security payments, food stamp payments or extending unemployment benefits). In the medium to long run, infrastructure investments are amongst the most effective measures, but their impact is not immediate. It takes a while for these projects to ramp up.

Fiscal multipliers differ from country to country and in the UK the Office for Budget Responsibility in the UK provides only scant information about the fiscal multipliers they use. Their latest disclosure shows that for a 1% increase in government spending they calculate a 0.3% boost in UK GDP growth for measures such as tax cuts or cuts in National Insurance Contributions, while increased government investments like the ones announced in the latest budget should boost economic growth by £1 for every £1 spent. Qualitatively, the picture remains the same, though. Tax cuts have little impact while transfer payments and direct investments help the most.

Hence, in the United States, the best fiscal stimulus package would be one where the government literally provides helicopter money and promises every household with a taxable income below a certain limit a monthly check to spend as they like. This can be done in the form of a payroll tax cut for employees or by literally sending everyone a check for $1,000 (see chart below). These measures wouldn’t be cheap but far more effective than the Fed’s rate cuts or a cut in income taxes or corporate taxes.

GDP impact of different policy measures

Source: Klement on Investing, OSPC.

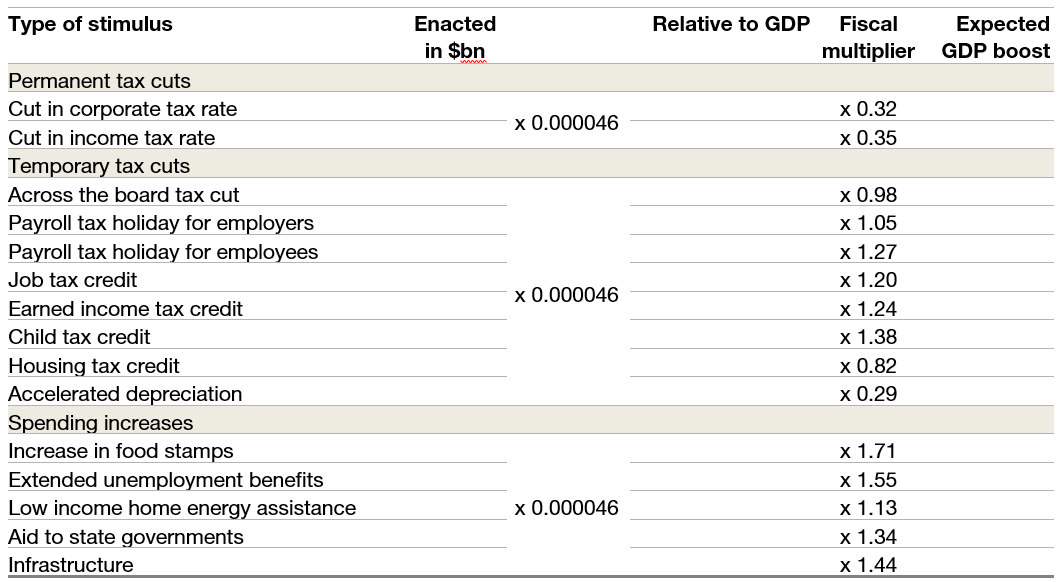

Finally, as the fiscal stimulus will take shape, I am willing to bet a lot of money that many different ideas will be proposed both on the left and on the right. To help you assess their potential impact on the US economy, I have created a simple cheat sheet that you can fill with the numbers thrown around in the media. Just enter the estimated stimulus in billion Dollars in the left column, multiply it by 0.000046 to calculate the spending as a share of GDP and then with the fiscal multiplier to estimate the likely boost to US growth.

Fiscal stimulus cheat sheet

Source: Klement on Investing.