We all know there is no intrinsic value to Bitcoin and other cryptocurrencies and even less to NFTs. And spare yourself the hate mails and comments trying to explain to me how crypto has use cases (other than criminal ones) or how NFTs are artworks. They don’t, and they are not. That is a fact. But how do you value a bunch of zeros and ones in a computer?

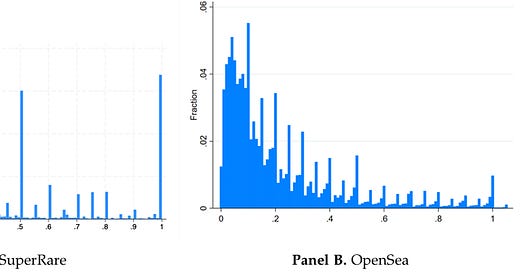

Samuel Rosen and Christophe Spaenjers investigated NFTs listed and traded on the SuperRare and OpenSea marketplaces. Because you can only pay with one currency on these marketplaces (Ether), there is no confusion about the numbers expressed in different currencies. So here are two charts showing the transaction prices on SuperRare and OpenSea. Notice something?

Transaction prices up to 1 ETH by platform

Source: Rosen and Spaenjers (2025)

Most transactions cluster heavily around round numbers like 0.1 ETH, 0.2 ETH, 0.3 ETH, etc. This is not the result of marketplace limitations. In theory, people could trade at any price, but because there is a lack of fundamental value, the only anchor speculators have is the psychology of round numbers.

Of course, this also happens in stock markets, currencies, and commodities, but the difference is that in the absence of any other anchor, the effect is much more substantial in the crypto/NFT world. Indeed, the study by Rosen and Spaenjers shows that 64% of listings, 74% of offers and 77% of transactions occur at round numbers.

If you invest in these ‘assets,’ it truly is pure speculation. And the heart of this speculation is to get an NFT from one round number to the next.

Proportion of round list prices and offers

Source: Rosen and Spaenjers (2025)

Perhaps a preference for round numbers is part of the reason Nasdaq still has a minimum bid price of $1.00 per share; if the stock stays below that round level, it is eventually delisted. A reverse stock split to get off of the OTC "pink sheets" is one of the greatest sins for a publicly-listed company.

Prior to decimalization, stock prices had fractional elements 3/4, 1/2, 1/4, 1/8 (and towards the end, 1/16, or "teenies"). If a "penny stock" had a fractional price below $1, it was called a "drill bit" https://en.wikipedia.org/wiki/Drill_bit_sizes#Fractional-inch_drill_bit_sizes , a wonderfully derogatory term which works on two levels, as it evokes not only diminutive size, but conjurs the image of augering into the ground.

Decimalization doesn't appear to matter for intrinsically worthless assets. After all, $MELANIA trades for $0.3746 https://coinmarketcap.com/currencies/melania-meme/ ... and $DTJR for $0.00005473 https://coinmarketcap.com/currencies/donald-trump-jr/ .

must mention the more famous and durable numerology ; retail investors preference for a low price-per-share stock. i maybe be recalling faultily this was once <$10, and influenced the naming of one of fidelity's most famous value fund?

would not be surprised to see 'low' inflation-adjusted shareprice and round numbers still work jointly on behavior.