We all know that retail investors are driven by past performance. Yet, for decades, personal finance writers, newspapers and influencers on social media have educated investors about the important role fees play and the dangers of performance chasing. Did these efforts bear fruit?

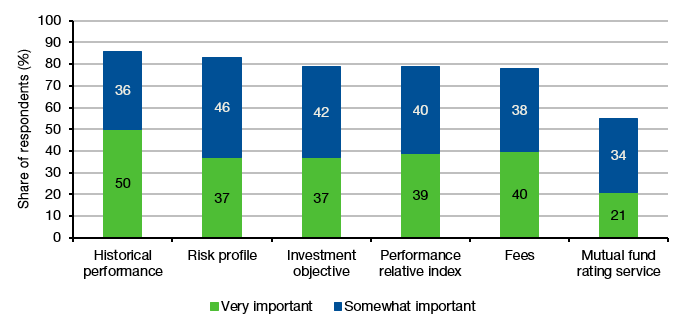

Well, the Investment Company Institute in its annual survey of US mutual fund investors indicates a mixed bag. On the positive side, fund investors have become far more fee sensitive than they used to be. The proliferation of ETFs and index funds and the rising popularity of these funds with retail investors has pushed the asset-weighted average fee paid by mutual fund investors down from 1.0% in 2002 to 0.47% in 2021. The chart below also shows that 78% of mutual fund investors consider fees and expenses a very or somewhat important criterion to review before investing in a fund.

Criteria to review before investing in mutual funds

Source: Investment Company Institute

But the chart also shows some concerning tendencies. The number one criterion of fund investors to review is the historical performance of the fund. And as we all (should) know, this is one of the least informative criteria to assess if a fund is going to perform well in the future or is right for the portfolio of a specific investor. Similarly, 79% of investors review the performance of funds relative to a benchmark. Financial planners keep emphasising that the S&P 500 (or any other benchmark) have nothing to do with your personal financial goals and your personal ability to take on risks. Yet, performance both absolute and relative to an artificial benchmark remain high on the list of criteria to use in investment decisions.

I am somewhat relieved to see the high percentages of investors focusing on fund objectives and the risk profile of the fund, but the relative unimportance of fund rating services worries me. I am not a big fan of these fund rating services. They get many things wrong. But surely, they do a better job than someone who is just looking at past performance.

In the end this survey indicates to me that investors are human after all. Financial planners keep educating investors about the pitfalls of investing, yet, in the end, too many people still follow the siren song of past performance. It is what we are born to do. To use Daniel Kahneman’s terminology, chasing past performance is a system 1 process. It is fast, intuitive, and salient. Examining a fund’s investment process and the risks associated with it is a system 2 process: Slow and deliberate. The unfortunate thing is that system 1 processes tend to win out on system 2 processes most of the time unless we actively slow ourselves down to think about the decision we are about to make.

One would think that when it comes to our financial future, we would take the time to consider our options and make an informed decision. Yet, what we do instead is log into our pension fund admin website, select a few funds during our lunch break and then let these 15 minutes decide our life.

One thing that caches my eyes is the two different level of confidence in responses. When I see the confident answers(green bars), I can see the traditional biases around previous performance as a success metric. Moreover, the second and third ones are related to fees and relative performance. However, when I see the non-confident responses(blue bars), it is obvious that the criteria have been changed and more investors know that there might be other factors that are vital for investment, such as risk profile or objectives. I think it is associated with the investors' financial literacy, and the community should generate more simple and easy-to-use information to level up the social knowledge and educate the investors. Thank you for sharing this valuable data.