Central banks have come under heavy criticism in recent months as they let inflation rise dramatically and now try to rein it in with rapid interest rate hikes. I have expressed my dissatisfaction with the current policy makers quite strongly, but why don’t we have a look at what economists around the world think about central banks and their work?

The Bank of Finland has surveyed some 600 professional economists around the globe for their views on what the target of monetary policy should be and whether they think central bankers will be able to achieve these targets. The survey contains a lot of details that are interesting for economists, but I will stick to the responses that I think are relevant to a broader investment audience.

First of all, inflation targeting – with or without a dual mandate to target full employment – remains by far the preferred target for a central bank. Three out of four economists think that inflation targeting is a good approach for central banks. Theories like nominal GDP targeting or the fiscal theory of the price level have some appeal but remain niche for now, with less than 10% of economists stating that this would be their preferred target for monetary policy. Note though that these theories, which most investors will likely have never heard of, are gaining some support from economists which is a reflection of their growing importance in academic discussion.

What should the central bank’s target be?

Source: Ambrocio et al. (2022)

Where the survey gets interesting, however, is what that inflation target should be. At the moment, most central banks in developed countries have adopted a 2% inflation target, but there is a push for the adoption of somewhat higher inflation targets. About half of the surveyed economists were in favour of keeping the current inflation targets, but about one in three economists said that inflation targets should rise, with an increase from 2% to 3% the most common answer.

Given current high inflation rates and my personal view that it will be very difficult for most central banks to get inflation down to 2% in the long run, I think we will have some increasingly influential discussions on whether the Fed or the Bank of England should adopt a different target.

The Fed, for one, has already adopted a more flexible inflation target of achieving 2% inflation on average, giving it some leeway to let inflation run above 2% for some time. The ECB has engaged in a fundamental review of its monetary policy targets and while the ECB currently is obliged to target 2% inflation by law, there is considerable room for interpretation of what that 2% inflation target means in detail. I wouldn’t be surprised if the Bank of England and the ECB follow in the footsteps of the Fed and start to target a more flexible inflation regime where inflation is allowed to overshoot the target rate for some time.

How high should the inflation target be?

Source: Ambrocio et al. (2022)

The survey also asked about an important number that is not often discussed in investor circles. What is the natural real rate of interest? The natural real rate of interest that is used in most academic studies of the Fed as well as in the (in)famous Tayler Rule for monetary policy rates is 2%. If the central bank targets 2% inflation and thinks that the real rate of interest is 2%, then the average policy rate over the cycle should be 4%. But it turns out that economists think that the real rate of interest today is 0.5%. Together with a 2% inflation target that implies a monetary policy rate of 2.5% on average over a cycle. That sounds more reasonable, though personally, I fear that the natural real rate of interest is 0% or even negative. And apparently, I am not alone. The estimates of economists for the real rate of interest range from -3% to +5% with one in three economists estimating that the natural real rate of interest is 0% or negative.

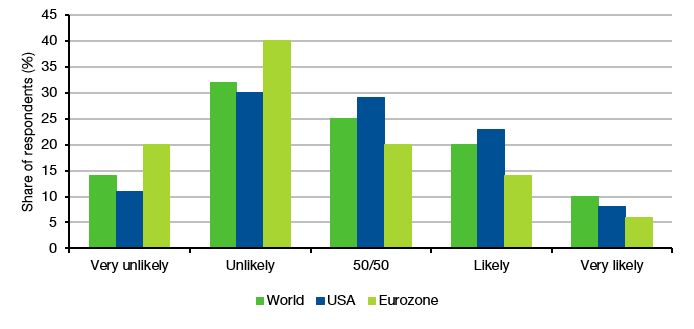

Finally, and probably most important for the future of central banks and the discussions about the appropriate inflation target, the vast majority of professional economists don’t expect their central bank to hit its target over the next three years. The chart below shows how likely or unlikely it is that central banks will hit their inflation targets. A whopping 70% to 80% of economists think that central banks are unlikely to hit their inflation targets over the next three years. This shows quite some loss of trust in central banks by professional economists and in my view, it heralds a period of soul searching where the discussion about how monetary policy should be conducted will intensify.

Likelihood of hitting the inflation target over the next three years

Source: Ambrocio et al. (2022)

"The estimates of economists for the real rate of interest range from -3% to +5% with one in three economists estimating that the natural real rate of interest is 0% or negative."

The estimates of weather forecasters for tomorrow's weather ranges from severe hurricanes to slightly clouded with one in three forecasters estimating that temperatures could go as low as -15 degrees or as high as +45.

Is the implication of central banks underestimating the natural real rate of interest that central banks are overcooking their policy response? In other words, is the policy rate higher than it should be and therefore monetary policy is likely to cause economic headwinds?