Germany is one of the countries that has introduced a debt brake into its constitution. Basically, it says that the German government must balance its budget in the medium term and can only run excess deficits in times of emergency. Ironically, this has backfired recently when the German constitutional court struck down the 2024 budget and forced the government into austerity right at the height of a recession. Yet, the debt brake remains very popular with Germans as a new analysis shows.

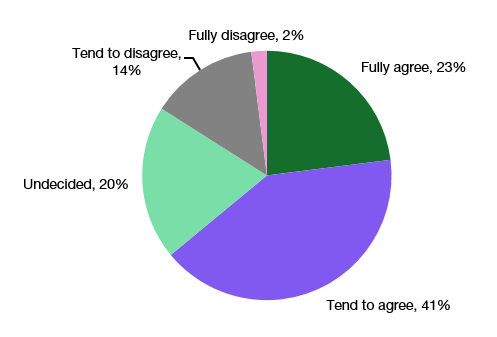

Germans are notoriously debt averse and proud of solid government finances and low inflation. Asked about the current level of government debt, two thirds of Germans agree or largely agree with the notion that its public debt is a problem. Notably, Germany’s debt/GDP-ratio is 66%, compared to 97% in the United States, 99% in the UK and 101% in France.

Answers to the statement “Public debt is a major problem”

Source: Behringer et al. (2024)

Clearly, Germans have a lower tolerance for debt. This is also reflected in their attitude towards the debt brake. More than half the population understands the debt brake and a plurality prefers the existing rule (37%). Yet, almost as many Germans (36%) would prefer the debt brake to become even stricter with 22% in favour of Germany trying to repay all its debt as fast as possible and the rest demanding ‘just’ a balanced budget every year.

Wow. As somebody trained in economics, this is pretty strict and I most certainly would not get behind such a policy because it is going to kill growth.

Germans’ preferences for the debt brake

Source: Behringer et al. (2024)

Having said that, I am in favour of debt brakes as I have pointed out in a recent article. Personally, I would put myself in the group of people who would allow governments to run deficits only for government investments but not for government consumption and running costs.

This apparently puts me on the centre-right of the German population because that is roughly the stance of supporters of the centre-right Christian Democrats and the liberal FDP. It is also the position most commonly held by people with higher education and higher financial literacy.

Supporters of the centre-left social democrats or the Green Party, meanwhile, confirm the stereotypes many conservatives have about them insofar as they are on average less concerned about the level of debt or the need for a debt brake. The only political group that is more in favour of tightening the debt brake and a zero-debt policy are supporters of the right-wing Alternative für Deutschland.

Where things become more interesting is when people are asked to guess how high Germany’s debt is and then are told how high it really is. On average only about 10% of the population knows how big Germany’s debt really is. But what would you guess does the rest think?

Half of the population thinks the German debt/GDP-ratio is 30% or less and the average estimate for the debt/GDP-ratio is 35%. That is mindbogglingly low. No wonder then that when told the correct number, Germans are much more likely to say that debt is a major problem for the government.

Yet, interestingly, whether they estimated debt to be higher or lower than the true level, the attitudes of Germans towards the debt brake did not budge. If they found out that debt is higher than they expected, they were not shifting their opinion towards favouring stricter debt rules and if they found out debt was lower than they expected, they were not willing to relax the debt brake.

Which tells you at least one thing. For most people how to handle your finances (or rather how the government should handle its finances) is not a matter of the current situation but a matter of principle. And Germans with their culturally high aversion to debt want their government to be frugal and sensible.

Treating national accounts like a household budget is, to my way of thinking, as disconnected from reality as imagining that your local bank has a box with all your deposits in cash in a drawer in a a safe, or that an exclusively pay-as-you-go national pension system based solely of government debt issuance will remain solvent https://www.ft.com/content/21c2f283-be8c-45b1-ab2f-75aa4564bc8d . One way I've found to make people think about this is to ask whether it's better for the economy in the long run to let families borrow with little money down and move into a house big enough to raise growing kids, or make them wait around in a cramped apartment until they've squirrelled away a 40% down payment ... or 100%. "In God we trust, all others pay cash".

The guy who founded the company for which I used to work once said "Germans are fantastic savers, and fantastic speculators, but lousy investors". In a sense, an "debt brake" is an artificial constraint that appears virtuous, but is likely starving public investment that could drive future growth. Look where "austerity" left Britain, which now has stripped public services and sewage-filled rivers.

I suppose I've become an inadvertant MMT advocate https://us5.campaign-archive.com/?e=9539ad5b50&u=6557fc90400ccd10e100a13f4&id=e3ae49317a , but perhaps Germany is indeed a special case, as while it benefitted greatly from seamless trade and being able to export deflation via the euro, it has limited its ability to fully reap the benefits of its self-imposed low public debt/GDP ratio, but had it retained the D-Mark, it likely would'rve roofed it like the Swiss Franc and made its exporters uncompetitive. A delicate balance indeed.

"To take full advantage of the special powers that accrue to the currency issuer, countries need to do more than just grant themselves the exclusive right to issue the currency. It's also important that they don't promise to convert their currency into something they could run out of (e.g., gold or some other country's currency). And they need to refrain from borrowing (i.e., taking on debt) in a currency that isn't their own. When a country issues its own nonconvertible (fiat) currency and only borrows in its own currency, that country has attained monetary sovereignty. Countries with monetary sovereignty, then, don't have to manage their budgets as a household would. They can use their currency-issuing capacity to pursue policies aimed at maintaining a full employment economy."

Love this! :-)

Count me in in the debt-averse.