One of the enduring concepts introduced by Daniel Kahneman in his book “Thinking, Fast and Slow” is “What you see is all there is”, our tendency to only process salient information. How true this is in practice – and how consequential for our investment decisions – has once again been demonstrated in a new study about fund fees.

The authors of the study recruited 2,000 Americans and asked them to review simplified fund fact sheets that displayed both the fund fees and the performance track record of the funds. However, the size of the fees, performance charts and their position on the factsheet changed as shown in the figure below.

Different salience conditions for fund performance and fees

Source: Khoo et al. (2025)

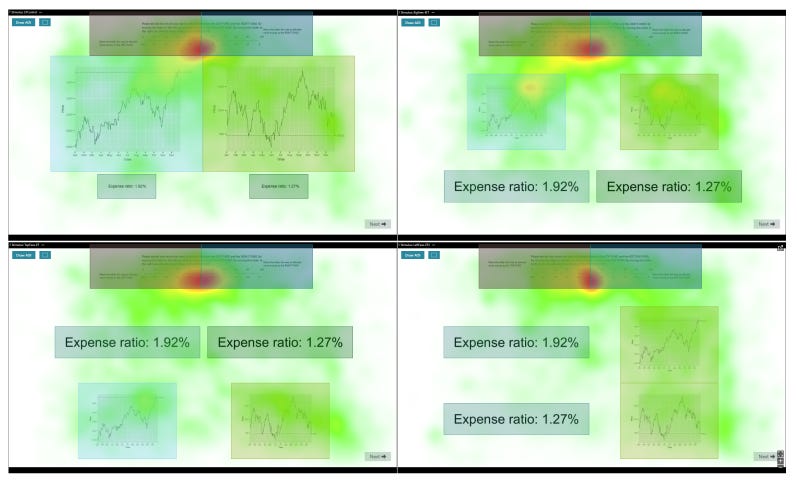

Then they tracked the eye movements of the participants, similar to another experiment I have written about in the past. Here is a graphic representation of the focus of attention by the participants in the different treatment conditions. By increasing the font size of the fees, the focus on past performance charts is reduced by 47% to 75% and the time participants focus on the fees charged by the funds is increased by 3% to 6%, depending on the position of the fee information.

Focus of attention in different salience conditions

Source: Khoo et al. (2025)

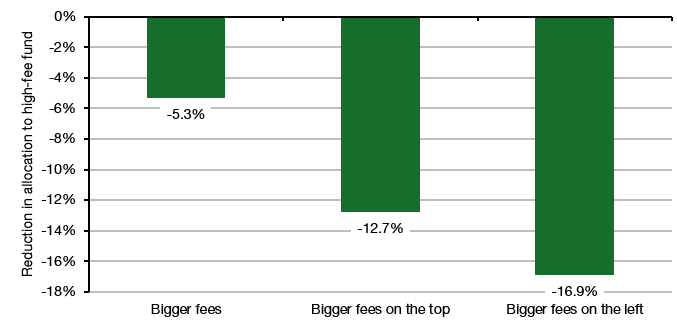

The final decision which funds to invest in were significantly shifted by these differences in salience. If fund fees were made more salient by using a larger font, investors reduced their investments in the high fee fund by 11.2% on average. The reduction was largest if fund fees were displayed on the left of the performance charts (i.e. when ‘read first’ in the Western world) and lowest if fund fees were displayed on the bottom.

Reduction in participants investing in the high fee fund

Source: Khoo et al. (2025)

We know that fees are one of the key determinants for a fund’s performance in the long run. So, getting one in ten people to switch from a high fee to a low fee fund just by changing the way fee information is shown on a factsheet is a huge effect. And while the fund industry is not going to like it, it shows how simple changes can do a lot of good to investors worldwide.

but what if the lowest fund fees crowd too many people in a weak idea they dont comprehend?

(like weighting investments on the size of the company as somehow a logical indication of future performance)

TLDR: always read the small print