Friday posts are always more on the quirky side of finance and sometimes just a pure WTF moment. One such moment occurred when I read a paper by Chao Ma from Xiamen University, who investigated the behaviour of Chinese drivers. Personally, I am a pretty careful driver who has not had an accident in almost 15 years and who is obsessed with keeping his premium discount for accident-free driving. In most countries, and this includes China, drivers get a discount on their car insurance for driving accident-free.

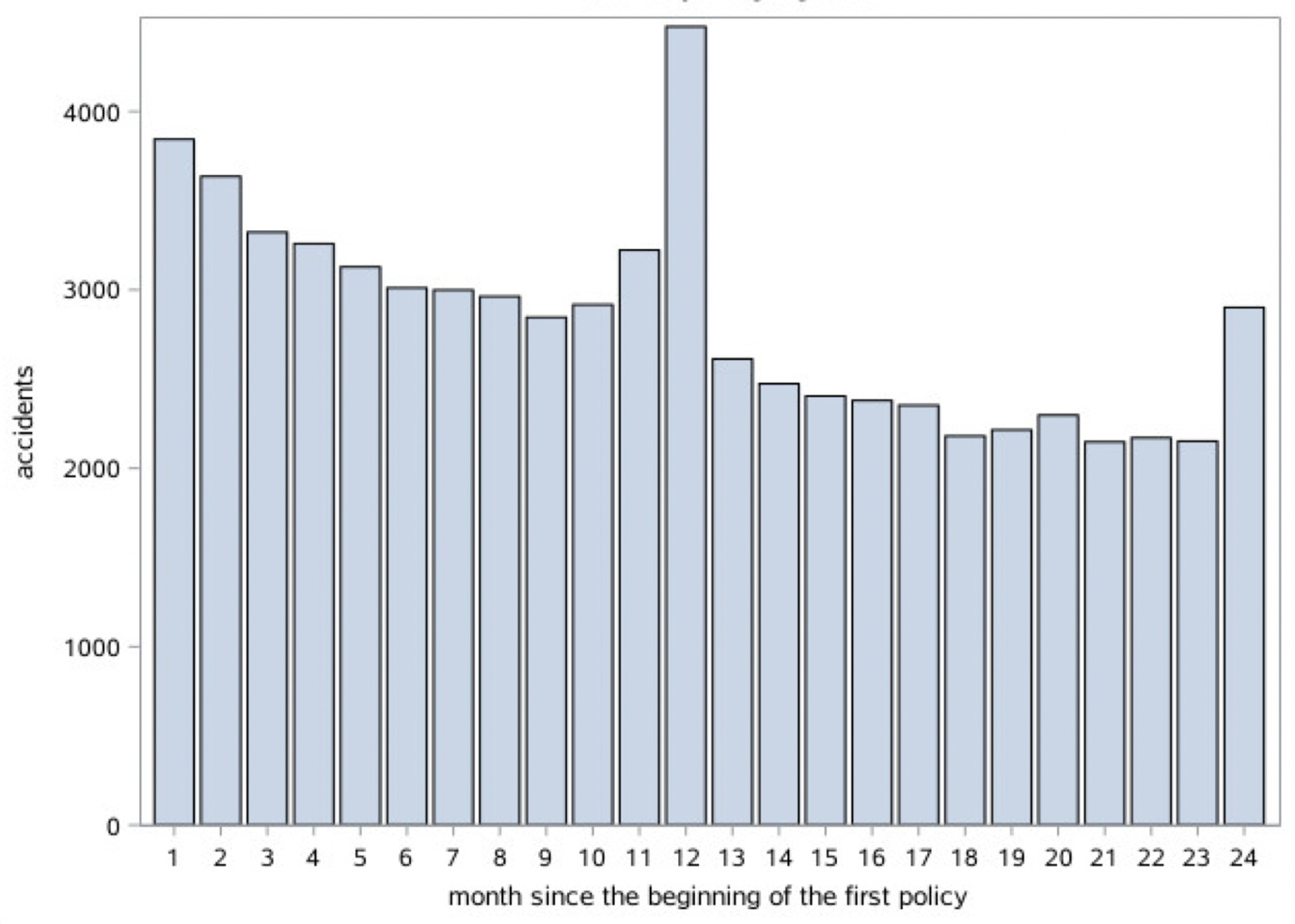

Yet, human beings seem to be unable to remember this unless they are in the process of renewing their policy. The monthly insurance premiums are salient all the time, the discount only once a year. And this triggers the sunk cost fallacy. Towards the end of their contract, drivers are acutely aware of all the money they have spent on insurance without getting anything in return. So, in for a penny, in for a pound, they seem to say and start to drive more recklessly in the last month of their insurance contract. The chart below shows the number of accidents by policy holders sorted by the months since the policy has been taken. The WTF moment is obvious. The two spikes in accidents in months 12 and 24 just before the policy expires. The research indicates that about 2%-3% of all accidents by individual drivers in China are due to this sunk cost effect. Given that Chinese car insurers pay claims of about $69bn each year, this means that somewhere between $1.4bn to $2bn in annual accident claims may be due to drivers forgetting about their insurance discounts in China alone. As Albert Einstein once said, there are only two things that are infinite, the universe and human stupidity, but I am not sure about the former.

Rate of accidents sorted by month after the car insurance policy has been taken

Source: Ma (2021).

The graph does not surprise me. I am however sceptical that this is due to the sunk cost fallacy -- I consider it much more likely that previously unreported damage is reported near the end of the policy as a 'new accident', possibly right before the policyholder changes their insurer. There are clear signs of this in the data ("conditional on an accident occurring, it incurs lower payments from the insurance company on average and is less likely to cause bodily injuries if it occurs in the last month than if it occurs in other months." -- ie the vehicle was still drivable and/or damage was minor).

At autonomous level 3 or better, what does the actuarial math look like for future car insurance premium ? 🤫