Back in the years before the financial crisis, I was involved in an argument among different investment specialists in the firm I worked for. The debate centred on the question if commodity investments (to be specific, commodity futures) made sense as a strategic allocation in a multi-asset portfolio. I was on the side that argued based on the research of Gary Gorton and Geert Rouwenhorst that commodity futures provided excess return over cash and low correlation with equities and bonds and thus should be part of a well-diversified portfolio. The other side relied on research by Claude Erb and Campbell Harvey that showed that commodity futures may make sense tactically, but don’t do so as a permanent strategic allocation. Well, turns out both sides were wrong.

Fahiz Yara and Massimiliano Bondatti examine the returns of a large set of systematic investment strategies in commodity futures before and after the onset of what is commonly called the ‘financialisation of commodity markets’. This financialisation started roughly in 2004 when institutional and later retail investors moved more and more money into commodity futures and when ETFs on commodity indices became widely available.

Because most of this money was invested heavily in short-term futures, the shape of the term structure of these futures changed and many commodities that historically traded in backwardation suddenly dropped into contango and stayed there forever. This meant that the roll yield for commodity future investments turned significantly negative most of the time, reducing total returns for investors in the asset class (don’t worry if you don’t know what ‘backwardation’, ‘contango’, or ‘roll yields’ are, just trust me).

This effect essentially killed the argument of Gorten and Rouwenhorst once the commodity super cycle came to an end in 2011 and commodity prices started to drop. Erb and Harvey and their supporters probably felt vindicated then because while they didn’t predict this would happen, they warned that shifts in the term structure could happen and destroy returns.

However, if I look at the results of the new study by Yara and Bondatti, I have to say that Erb and Harvey were just as wrong about commodity investments. Erb and Harvey claimed that i) investments in commodities with the more attractive term structure vs. commodities with the less attractive one (a so-called ‘carry strategy’) have historically outperformed but may cease to do so in the future. And they claimed that ii) using a momentum strategy in investing into the commodity futures with the best historic return (just like momentum strategies in equities) have shown relatively high returns. While not explicitly endorsing a momentum strategy, Erb and Harvey essentially said that this was the best shot an investor has at making money in commodity futures.

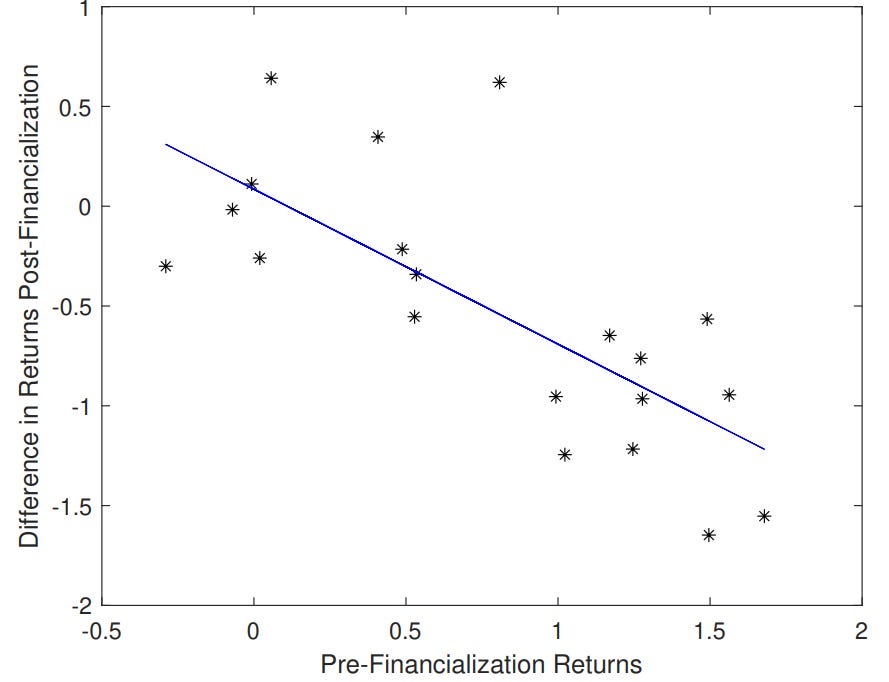

The chart below shows the return of a wide variety of commodity investment strategies from simple buy and hols via carry strategies to momentum strategies and more. On the horizontal axis the chart shows the return before financialisation and on the vertical axis the change in returns between the pre- and post-financialisation era. In essence, what the chart shows is that almost all investment strategies have seen their returns decline significantly and no longer work.

Returns of commodity investment strategies before and after financialisation

Source: Yara and Bondatti (2022)

In fact, only two investment strategies that worked before the massive inflow of investments in the commodity space keep on working today. And ironically one of them is the simple carry strategy of investing in commodity futures with the highest positive carry and shorting commodity futures with the most negative carry – the very strategy that Erb and Harvey said is likely to lose its efficacy. Meanwhile, the strategy that Erb and Harvey expected to do well – momentum – doesn’t work at all anymore.

But there is also a second strategy that has continued to work, which is one where one invests in commodities that have shown the most negative skewness of returns in the last 12 months and shorts the commodities that have shown the most positive skewness. Essentially, this strategy invests in commodities that have been distressed or under pressure in the past and shorts commodities that have rallied significantly or boomed.

Finally, there is one investment strategy that didn’t work very well before commodity market financialisation but seems to work now. This strategy invests in commodities with the highest hedging pressure from producers and shorts the commodities with the lowest hedging pressure. The intuition here is that commodity producers will have to increase their positions in futures where there is the largest hedging pressure, which in turn will drive up commodity prices and shift the term structure of commodity futures in such a way that it leads to higher returns for financial investors.

But in the end, what this study by Yara and Bondatti tells me is that following a carry strategy is a simple and reliable way to invest in commodity futures. Once you do this systematically, these investments can become a strategic position in your portfolio thanks to the systematic risk premia earned with this strategy.

From the title I thought this was going to be an article about Bitcoin 😅

Could you possibly tell me where these two actually assert this: "Meanwhile, the strategy that Erb and Harvey expected to do well – momentum – doesn’t work at all anymore."? Page 24 of the accompanying PDF version of their paper suggests "These results are reassuring if one believes in momentum as a reliable source of return." The word "if" is italicized. Why might the word "if" be italicized? https://people.duke.edu/~charvey/Research/Published_Papers/P91_The_strategic_and.pdf