Private investments, be it equity or debt, have become the most loved corner of the capital markets. This is no surprise because these assets have smoothed returns that make them look less risky than they are and lock investors in for several years, ‘forcing’ them to become long-term investors and reap the benefits of staying invested for longer. But the infrequent updates to the valuation of portfolio assets in private equity funds can tell us a lot about their future performance.

You see, if you are the GP in a buyout or venture capital fund, your incentive is to show your limited partners the best possible picture of the portfolio. And since you can decide when and how to value the investments, you can choose to ‘put lipstick on a pig’ and hope that its performance will turn around. Of course, a pig will remain a pig, no matter how pretty she is (sorry, Miss Piggy), and typically, a company that struggles will continue to struggle for a long time.

On the other hand, if you have a company that shows strong performance, you might want to mark the company and increase its interim valuation to show outside investors how well you are doing.

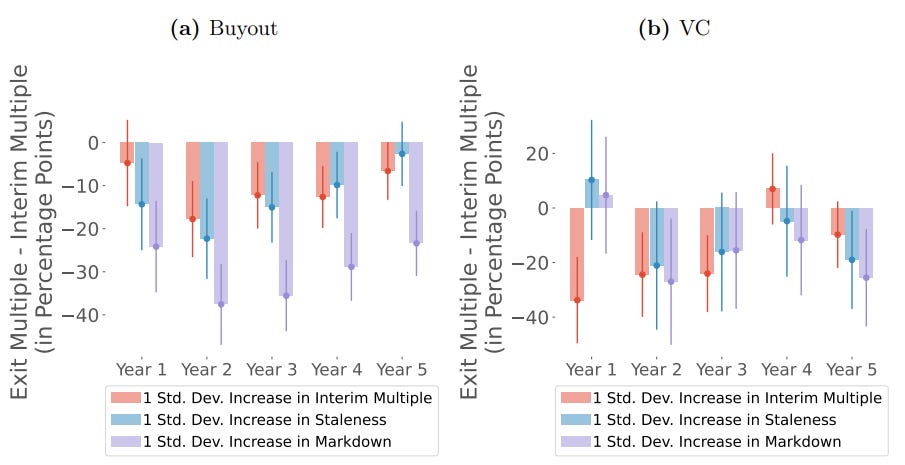

Hence, how interim valuations change and how stale they are provides valuable information about the future performance of assets in a private equity portfolio. The chart below is from an analysis of 551 buyout and 275 venture capital funds in the US. It shows the economic impact of a one standard deviation increase in the interim multiple, the staleness (i.e. how long the investment has not been revalued) and the number of markdowns to lower valuations.

Changes in interim valuation metrics and their predictive power for exit multiples

Source: Ercan et al. (2025)

What does a standard deviation increase mean? For example, look at an investment in year 2 after the fund made it. On average, one in five investments in the portfolio will not have been revalued in the last 12 months. If that increases slightly to something like one in four, the average exit multiple of the investment tends to drop by 20 percentage points. Similarly, about 23% of fund holdings in buyout firms are marked down during any given year. If that increases by 15% to something like 26%, you can expect that the exit multiples will drop by 25 percentage points vs. the interim multiple.

In short, even tiny markdown changes can indicate significant losses further down the road. Of course, by the time these markdowns arrive, the LPs are already locked into the fund, so all they can do at that stage is quiz the GPs what they intend to do to improve the performance and otherwise watch their performance go wherever it may take them…

I have long suspected that this kind of creative valuation was rampant. This is a nice analysis!

It would be interesting if the PE fund had a provision that whatever assets remained in the fund after 10 years would be auctioned off to the highest bidder. Another possibility would an "in kind" distribution to the LPs. It stinks to see the LPs held hostage by the GPs.