…company executives get nervous. But apart from that, the share price starts to suffer, though, if we believe a new study from researchers at HEC Paris by far not as much as short-sellers say they should.

For every analyst, it is part and parcel to give a price target or a target range for a stock. For short-sellers that has only recently become more common. But as more short-sellers like Muddy Waters have started to provide price targets, we can test, how good these short-sellers are at achieving their targets and how share prices react to attacks by short-sellers.

Analysing some 1,500 short-selling attacks, out of which 637 explicitly included price targets for a stock showed that short-sellers are biased in their target prices, and not just a little. The average price target issued by short-sellers was roughly 65% below the share price at the publication of the report.

Price targets issued by short-sellers vs. share price at the day of issuance

Source: Madelaine et al. (2021)

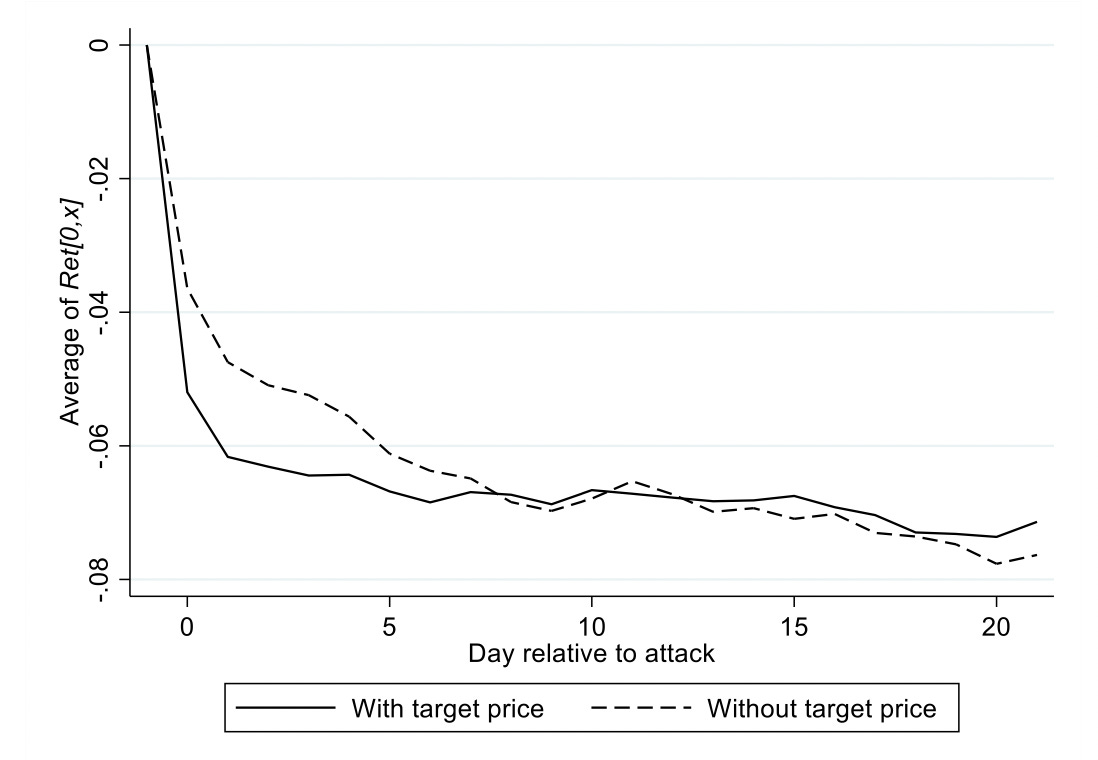

Initially, these extremely negative reports do influence the share price with an average price drop on the day the short-sellers publish their report of some 5%. But after four weeks of trading, the average share price drop is a mere 7% or one tenth of the average return forecast by the short-sellers.

Share price behaviour after short-seller attacks

Source: Madelaine et al. (2021)

Obviously, nobody expects the market to buy into the story of short-sellers immediately so let’s look at the share price return over different time spans ranging from trading day 0 to 5 (one week) to trading days 0 to 252 (one year). The chart below shows the average performance of attacked stocks depending on the target return the short-sellers predicted the stock would have. Of particular interest are the white bars which depict return in the year after the initial attack by short-sellers. Note how stocks with a short-seller target price up to 60% to 70% below the share price at issuance show positive returns on average after a year. It is only stocks with a target return of -70% or worse where the share price takes a permanent hit and even then it is a hit of 20% to 30%, not 70% to 100%.

Average share price returns after a short-seller attacks

Source: Madelaine et al. (2021)

To me, this teaches several lessons. Most importantly, short-sellers are biased. They issue fare more negative target prices than can be justified by fundamentals. This isn’t surprising. Short-sellers make money if a share drops, so they systematically overstate the negatives and understate the positives. As a rule of thumb, it seems a good idea to divide the target return of a short seller by ten and you get the true reaction of the share price in the first week or so after the short-seller attacks.

After the first week, it’s a good bet to invest in the stocks if the short-sellers provide a target price that is about 60% to 70% or less below the current share price. On average, these attacks by short-sellers are not convincing enough and quickly lose steam so that share prices recover after the initial shock.

For stocks with a short-seller target price of more than 60% or 70% below the share price at issuance investors should be careful. The issues identified by the short-seller are often so material that they prove a persistent drag on the share price and traditional investors are better off getting out of that stock and watching the battle from the sidelines.

Nice article.

Short-selling is always interesting.

If you’re calling a downward price target an “attack”, I think that shows a significant bias.