When the small stuff matters

The key driver of most of our investment decisions is how much risk we are willing to take on at any given point. And for several decades we have solid evidence that our experiences are key determinants of our willingness or aversion to rake on risks. This can be exploited by advisers through simple techniques as I have described here.

But so far the evidence on how experiences determine risk aversion was based only on extreme events like recessions or periods of high inflation. This makes the life of advisers easier because they can simply explore these extreme events in a client’s past and get a pretty good picture of someone’s risk aversion in a relatively short time. But now, it seems, examining risk aversion has become much harder again because a study found what to my knowledge is the first evidence that small, seemingly irrelevant, events can have a lasting effect on a person risk aversion.

In the study, 743 volunteers were recruited and asked to participate in a classic lottery game. The game consisted of three rounds. In each round, the participants could choose either a safe return of $2 or play a lottery with a 50% chance of winning $3, $4, or $5 and a 50% chance of winning nothing. Depending on their personal risk aversion, the participants will choose either the lottery outcome or the safe return and they may choose a lottery with a higher return but not with a lower return. So, the more frequently a participant chooses the risky option, the lower his or her risk aversion.

But that wasn’t the task, really. The real task came a year later when the same participants were asked to come back and play the same game again. First, they were asked if they could remember, whether they chose the safe asset or the lottery a year ago and if they remember whether they won or lost the lottery. It is widely known that people tend to remember good outcomes better than bad outcomes. This is why we tend to romanticise our past and speak of “the good old days”. The same was observed in this experiment. Though the game was a year in the past, about 40% of participants could remember their choices a year earlier, but those who won in the lottery outcomes were remembered their luck more frequently and more accurately than those who lost.

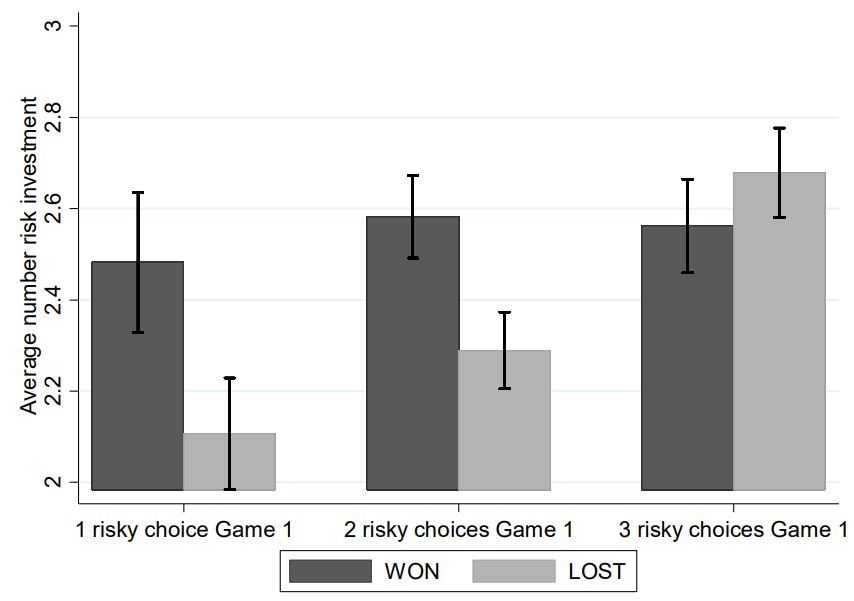

Nevertheless, independent of the accuracy of their memory of past lottery outcomes, participants who won in the lottery games a year ago were significantly more willing to play the lottery again. This effect was particularly strong for the more risk averse participants who chose to play only in the most lucrative lottery, a little weaker for those participants who chose to participate in the two most lucrative lotteries and non-existent for the participants who chose to participate in all three lotteries.

Likelihood of playing a risky lottery depending on outcome of same lottery a year earlier

Source: Angerer et al. (2021)

What this shows is that even a small positive event makes people less risk averse a year later. And the effect is visible for the most risk averse people. Meanwhile, the risk takers are taking risks no matter the outcome of past lotteries. They enjoy the game for the sake of it, not because of the outcome.