Who’s following the herd?

I have written before about the advantages ESG information provides to a fund manager. For example, the more successful fund managers tend to incorporate ESG news flow about a company and by doing so attract more fund flows from investors but also remove risk in their portfolios because ESG news typically alerts these fund managers early to potential operational risks for the companies they invest in.

This integration of ESG news flow also helps these fund managers avoid herding effects in markets. It is common for investors (professional and individual alike) to invest in stocks that garner a lot of attention in the market. This attention may not be due to the glamorous nature of a company like Tesla. Even value investors exhibit herding and are attracted to certain stocks that are “darling value stocks”.

But with increased herding comes the risk that different funds are increasingly invested in the same stocks. And if these stocks then get into trouble all funds suffer more or less at the same time. This is particularly unnerving for pension funds and endowments which often split up their assets to several funds with a similar mandate in the hope that if one manager underperforms, the other might make up for it with outperformance.

A recent study investigated how much fund managers exhibit that herding behaviour. They looked not just at the average fund manager but also at fund managers sorted by the ESG ratings of their funds (after all this is a Monday post when I write about ESG, so why would I write about this study if it just looked at the average fund manager?).

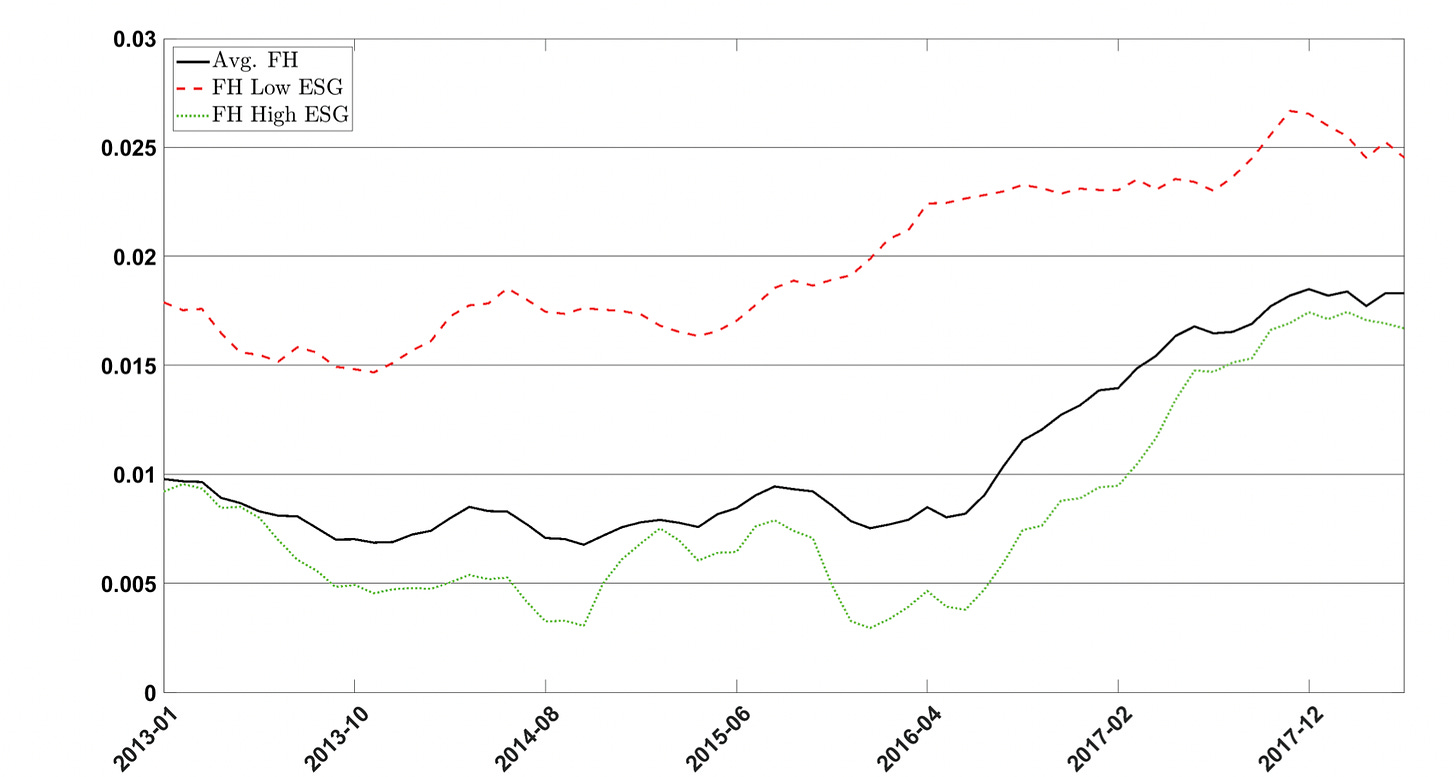

The chart below shows the degree of herding amongst fund managers of more than 10,000 funds across the globe between 2012 and 2018. It seems that the fund managers with top quartile ESG credentials herd quite a bit less than fund managers with bottom quartile ESG credentials or the average fund manager.

Herding amongst fund managers

Source: Ciciretti et al. (2021)

This is good news for pension funds because it shows that they can reduce systematic risks in their portfolios by handing mandates to fund managers with strong ESG credentials (which in this study meant a high ESG rating from Morningstar) where the likelihood of having large overlaps in portfolio holdings is reduced.

This finding is also bad news for ESG skeptics who sometimes insist that ESG investing drives fund managers into a narrow set of tech and renewable energy companies and thus reduces diversification. This study indicates that on average ESG funds may be slightly more diversified than comparable traditional funds.