Many investors don’t like activist hedge funds’ attacks on companies because they fear these activists are only targeting short-term gains and don’t care about long-term results. Yet, while there is ample evidence that activist hedge funds improve the share price of a company in the short term, little is known about the long-term impact of activist hedge funds.

In his Ph.D. thesis, Shane Goodwin addressed this problem and found that at least on average, investors should welcome activist attacks.

Examining US companies that have been targeted by activist hedge funds he found that just because a company has more short positions outstanding on its stocks isn’t necessarily a trigger for an intervention where a hedge fund tries to gain a seat on the board of directors.

In general, it is incredibly difficult to identify companies that will be targeted by activist investors before the fact. It’s like trying to predict targets for takeover proposals. The press loves to speculate about these events but they are effectively unpredictable.

Essentially, hedge fund activists tend to get involved with companies where they feel the management of the company does not understand the business very well. But this can mean different things to different people, so the only fundamental trend that Goodwin identified as leading to a higher chance of activist involvement is a lack of revenue growth compared to peers.

Once a company has been targeted by activist hedge funds, things get interesting. Of course, share prices tend to rally after it becomes known that an activist has bought a stake in a company. But what about the long run? As I said above, there is little research on the long-run impact of activist investors.

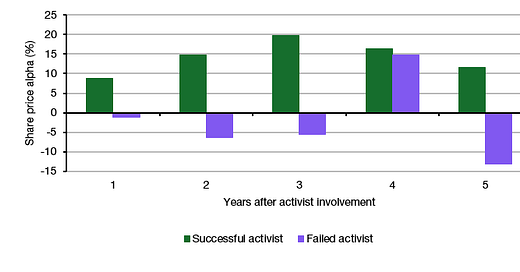

In this new study, Goodwin compared the share price performance of companies that were targeted by activist hedge funds and differentiated between companies where the activists successfully gained a seat on the board of directors and companies where the activist attack failed. As the chart below shows, companies where activists gain a seat on the board show significantly higher share price returns for up to five years after the campaign. This indicates that activist hedge funds are good for shareholders in the long run.

Long-term impact of activist hedge funds on share prices

Source: Goodwin (2024)

But share prices can rise for many reasons and not all of them are necessarily in the best interest of other stakeholders like employees (who may lose their jobs). While Goodwin didn’t look at specific ESG factors, he did look at a battery of financial key performance indicators like return on invested capital, margins, investment spending, etc. There was no material difference between companies that had hedge funds on their board and companies that managed to prevent these activists from gaining influence in measures like profitability or margins.

While this is not proof that activist hedge funds are good for other stakeholders, it shows that on average, they are not making things worse by cutting capex or expanding margins through aggressive cost reductions.

The one financial variable where there was a substantial difference between companies where activists gained a seat on the board and those where they didn’t was revenue growth.

Companies with activist hedge fund representation managed to turn around their lacklustre growth before the attack and substantially outgrow companies where the attack failed in the three years after the event. And again, while this is not proof, my hunch is that a company that grows faster will have to let fewer people go and may even start to hire more people. So, from an ESG perspective, stronger revenue growth should be beneficial for other stakeholders, not just shareholders.

Long-term impact of activist hedge funds on revenue growth

Source: Goodwin (2024)

In the end, it seems like activist hedge funds implement better oversight over the management team of ailing companies and are successful in engineering a long-term turnaround in the companies’ growth trajectory. And this is probably a testament to an overall positive impact on governance from these activists.

A quote from a successful hedge fund manager has always stuck with me: "Company managements which treat short-sellers poorly lose sight of the fact that they are the only *guaranteed* buyers of the stock."