Why do smart beta ETFs perform so poorly?

Over the last decade, we have seen two major investment trends capture the imagination of investors. In Europe ESG investing became enormously popular while in the United States the reception of ESG investing remains lukewarm. Meanwhile, in the United States, smart beta or factor investing has become extremely popular while European were rather lukewarm about this trend. One should never gloat, but over the last ten years, ESG investing has performed exceptionally well, while smart beta investing has been rather, let’s say, underwhelming (of course, now that I say this out loud, performance is likely to reverse for the next decade…).

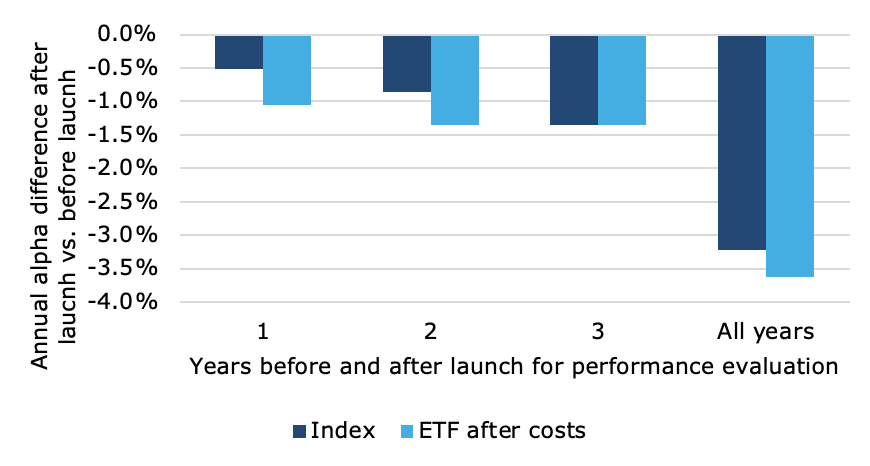

In any case, why did smart beta ETFs, which by 2019 managed more than $500bn in the United States alone perform so poorly after they have been launched? Three researchers from Hong Kong and Seattle have provided a fresh answer to this question. It is by now common knowledge that systematic investment factors tend to perform worse in the years after they have been described in the academic literature than before. However, what this new research did was look beyond the factor itself and focus on the ETFs launched on these factors and their launch date.

ETFs are obviously all launched after a factor has been identified in the literature, but their launch dates are spread out across multiple years so it is not obvious that their weaker performance is solely due to the factor itself not performing anymore. And indeed, the study finds that the ETFs performance after launch is indeed worse than before launch (i.e. in the backtest) but this is not caused by the factor’s overall decline after publication. The lack of performance of ETFs after launch is also not driven by strategic timing by the product providers. They don’t know if a factor will perform well in the future either so they have no ability to launch the ETF right after it has performed well to attract investors.

Factor ETF performance after launch compared to before launch

Source: Huang et al. (2020).

Instead, what seems to happen is that product providers try to outsmart the original factor that was described in the literature and add bells and whistles and different twists to their factor ETFs. These additional twists typically make a backtest look better but have the disadvantage of reducing the true factor exposure of the ETF. The chart below shows that factor ETFs that were launched later tended to have additional features that in general reduced the true factor exposure of these ETFs. For example, newer growth ETFs are less growth-oriented than the earliest growth ETF launched in the United States. The only exception where newer factor ETFs increased the factor exposure are value ETFs – the one factor that continued to perform poorly in the last decade. But it is this fiddling with a good concept that ruins the performance of the ETFs. Once more, this is an example where financial service providers try to reinvent the wheel just a bit more complex than before with the end result of lower returns for investors.

True factor exposure of factor ETFs

Source: Huang et al. (2020).