Why ESG matters: The case of sexual harassment

One of the most common criticisms levelled against ESG investing by traditional investors is that it deals with fluffy stuff that is hard to quantify and doesn’t play a major role in financial markets anyway. They may accept that extreme events like the BP oil spill in the Gulf of Mexico or the Volkswagen Diesel scandal play a role but that such extreme events are so rare, that they cannot be predicted or reflected in a portfolio.

There are thousands of studies that show that ESG risks have a substantial impact on corporate performance and a free book by the CFA Institute Research Foundation, the Swiss CFA Society and Swiss Sustainable Finance does a good job at summarising many of them.

Of course, new research constantly provides new insights and so I want to focus here on the case of sexual harassment. Sexual harassment in companies and other organisations has long been a topic discussed in management and human resources circles, but only the #MeToo movement has put it centre-stage of the public debate in 2018. Starting with luminaries of the entertainment industry, the topic of sexual harassment at the workplace is taken much more seriously everywhere today.

Ten years ago, we knew a lot about the negative impact of sexual harassment (and its coverups) on organisations. Anne O’Leary-Kelly and her co-authors summarised the key impact on organisations in a 2009 paper like this:

“[A meta-analysis] found negative relationships between sexual harassment and both work withdrawal and job withdrawal, suggesting that targets of sexual harassment may respond with missed work and work distraction as well as intentions to leave the organisation.”

Other studies found higher turnover in the military and the US court system by people who became victims of sexual harassment and studies of team behaviour in corporations showed lower team productivity and cohesion in teams with a climate of sexual harassment.

Higher workforce turnover, more sick days and lower motivation of workers should all combine to reduce productivity and increase costs for companies that allow a climate of sexual harassment to fester.

In what could be a first, three Canadian researchers looked at the impact a climate of sexual harassment can have on company profitability ratios like return on assets (ROA) or return on equity (ROE). Because only about 6% of sexual harassment cases are prosecuted in court, it is hard to measure such incidents reliably. They thus looked at 1.65 million reviews of c. 1,100 companies on sites like Glassdoor.com or Indeed.com. The advantage of these sites is that they include reviews of former employees that have left the company and who can be open about their former workplace and the reasons for leaving. Of course, there is the possibility that a company is stalked by a disgruntled employee making stuff up, which is why the researchers only looked at companies with reviews by at least 200 different individuals.

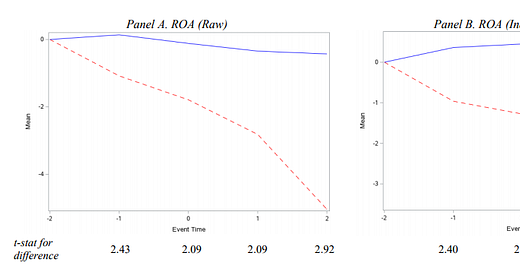

Return on assets of companies with high incidents of sexual harassment

Source: Au et al. (2019). Note: The red dashed line denotes companies in the top 2% in terms of sexual harassment incidents, the solid blue line represents all other companies in the sample.

The results of their study speak a clear language. The 2% of companies with the highest rates of sexual harassment incidents have significantly lower ROA in the 4 years surrounding the time when harassed employees leave the company than the rest. This effect prevails even when the ROA is adjusted for company size and industry. One has to note, that the top 2% of companies with the most sexual harassment incidents are likely companies where incidents are covered up or tolerated which can lead to a pervasive climate that demotivates employees and leads to higher turnover. It is unlikely that individual incidents of sexual harassment that are prosecuted within a company will get a company into this group. The chart above shows the trends in ROA for companies with lots of sexual harassment incidents vs. the rest. Over four years, the ROA diverges by four percentage points, something that can have a significant impact on the share price of these companies.

In the past, such effects would have been ignored by the market, but thanks to the increased acceptance of ESG risk analysis by investors, companies are increasingly held to account for their actions (or inactions). And at the same time, ESG investors can get an edge over traditional investors by using this fluff.