There is a bit of a divide in the community of professional investors about financial news media like the Wall Street Journal, the Financial Times, or The Economist. Arguably, all these publications are extremely valuable to retail investors and people who are working in the financial industry but are not directly involved in investment decision making or security analysis. For these people, these publications are a good way to get information about markets. But for the folks who have an enormous amount of specialised financial data at their fingertips and spend their days analysing that data, there is nothing these publications can write that is truly new.

This is why I don’t read these publications. Not because they are bad (they aren’t) but because I cannot get an edge as an investor from anything that is written in them. The pushback, I get to this opinion is usually that it is worthwhile reading these publications to know what “the street” is thinking and how market sentiment swings. If you believe this, then let me show you some data that hopefully will convince you that you can just as well give up on reading that stuff.

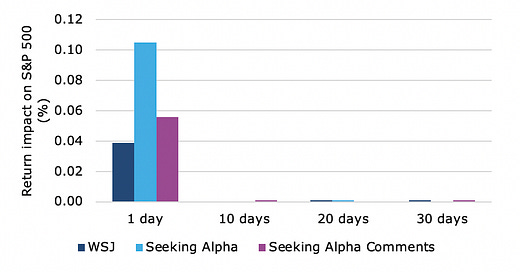

Ioanna Lachana and David Schröder from Birkbeck College in London have looked at thousands of articles in the Wall Street Journal and the financial website Seeking Alpha about US stock markets to measure how they influence the S&P 500. They created a variable that measure how optimistic or pessimistic an article is about the market and tried to find out if there is an impact on S&P 500 returns the next day, or further in the future. Using a variable that measures net pessimism (which I have reversed into a net positivism variable) they found that more positive articles in the WSJ or on Seeking Alpha lead to higher S&P 500 returns the next day. But before you get excited, the impact is a whopping 0.05% to 0.1% difference in returns. And if you go beyond one day, there is absolutely zero impact (the chart below isn’t empty, it’s just that all the bars are zero).

Impact of more positive articles in financial media on the S&P 500

Source: Lachana and Schröder (2021)

Using the New York Times archive, they could even show how the influence of news media on the market declined over time.

Declining impact of news articles on S&P 500 returns the next day

Source: Lachana and Schröder (2021)

Since the 1960s markets, reading the news to get a “feel for the market” has been a waste of time. If you aren’t a professional investor, you get important information out of financial news, but if you are a professional, you are wasting your time reading that stuff. You cannot get an advantage from the FT, the Economist, or the WSJ.

No edge over other investors on individual securities, but for me an edge over speculators through columns like Jason Zweig's The Intelligent Investor. Advice on investing, not investments.

I get my advantage by reading Klement on Investing