I have recently been interviewed for the CFA Institute’s Enterprising Investor blog on the geopolitical trends for the coming years. I mentioned that the rise of China is one of three major geopolitical trends that will have a significant influence. No surprise there but I also said that most investors aren’t aware how influential China already is and how much the country works behind the scenes and under the surface to further its interests. Not even 24 hours after I finished the interview, a report by a group of researchers from Georgetown University, the Kiel Institute for the World Economy, and the Center for Global Development at William and Mary University landed on my desk.

These guys were able to get a hold of 100 lending contracts between Chinese government entities or state-owned lenders and 24 developing countries around the world. Even though these contracts cover only 5% of the estimated total lending of China between 2000 and 2017, it provides some important insights into the implementation of the Belt and Road Initiative and how China uses money as a tool to increase its political influence.

First, it is interesting that the Chinese loans are far more focused on the energy, transport, and telecom sectors than the global average. This is no surprise since the Belt and Road Initiative is an infrastructure project, but it is nevertheless interesting to note that lending in “social infrastructure” like healthcare or education is almost never done by Chinese entities.

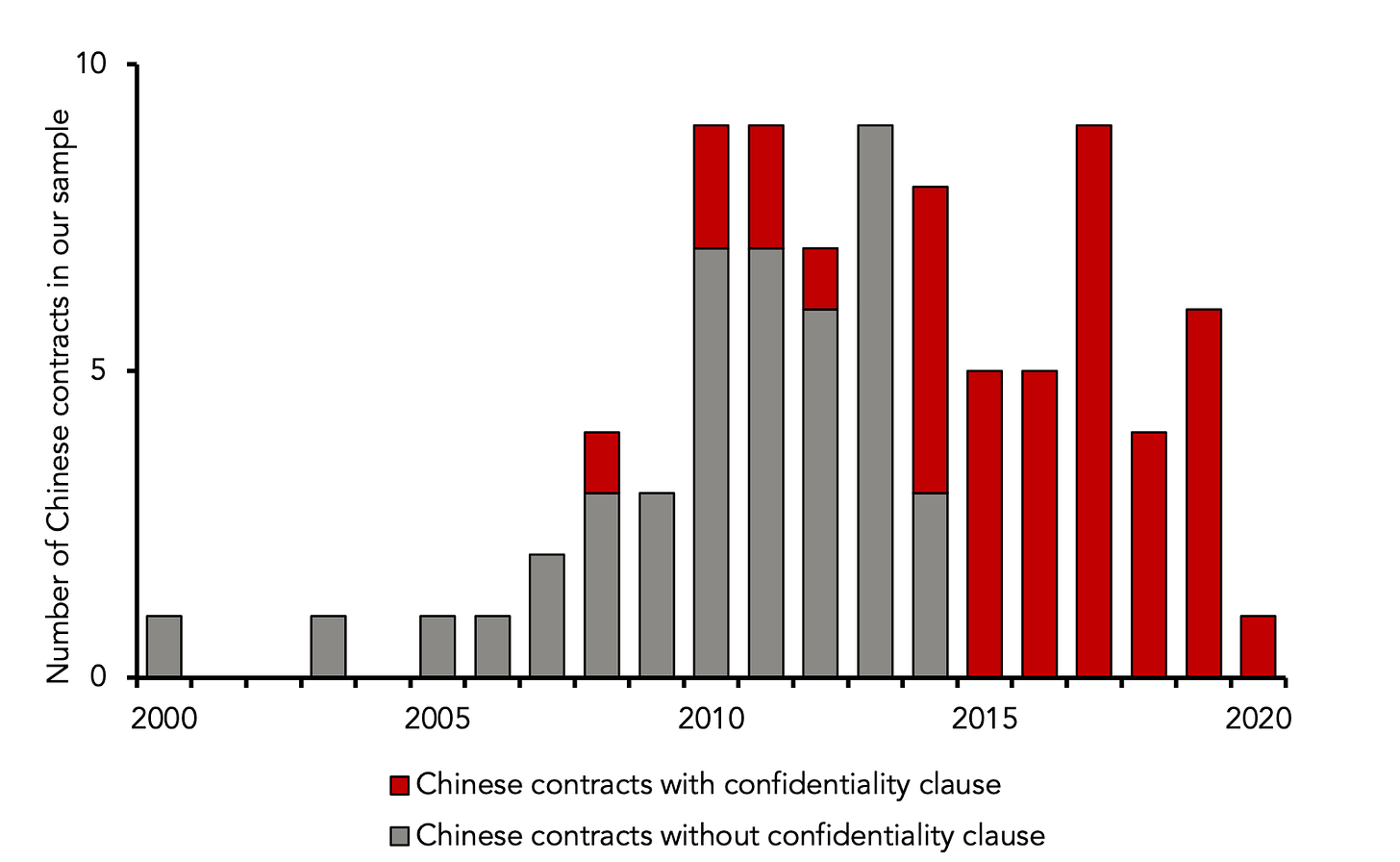

But here is what is surprising: In recent years, Chinese government lenders have increasingly insisted on confidentiality clauses to the extent that many of the loans officially don’t exist. All the contracts by China’s Eximbank since 2014 have such confidentiality clauses as do all contracts of the Chinese Development Bank. Not only are such confidentiality clauses highly unusual, in the case of Chinese lenders they may even go as far as prohibiting the borrower (or the lender) to even acknowledge the loan exists in the first place.

Contracts by China Eximbank over time

Source: Gelpern et al. (2021)

Second, about one-third of the Chinese contracts use collateralisation - often via very convoluted structures - to increase the security of the loans and give China access to commodities or other assets if the lender defaults. This is a much higher ratio of collateralisation than the 7% global average.

Third, Chinese loans come with a special clause that these loans are not subject to common debt restructuring mechanisms like the Club of Paris agreements. In fact, China ensures that in the case of a default, its loans will not be restructured and that China has first dibs into the remaining assets of the borrower, thus shunting investors who hold regular emerging market bonds and loans in their portfolios.

and finally, in many contracts, China reserves the right to demand compensation if policies change and make a project uneconomical. Such stabilisation clauses are common in bank loans, but the Chinese loans are so big and done directly with government entities in the borrowing countries that in case of a default, the stabilisation clauses in these loans can give China direct political influence over the borrower countries. At the very least, it allows Chinese lenders to unilaterally cancel a loan and ask for immediate repayment if they don’t get a carve-out from new laws on health and safety, human rights, taxes, etc.

So, there you have it. My guess is that many developing countries have ticking time bombs in their Treasuries and investors who currently hold common emerging and frontier market bonds should reconsider, how secure these bonds really are in case of default. Ah, and did I mention that one of the biggest borrowers of China in the newly uncovered sample of loans is Argentina? I wonder how that could happen…

I remember reading this book that tells you all you need to know about doing business in China or with Chinese :

Mr China by Tom Clissold ( https://tinyurl.com/4vbmw48b).

Dear Klement ,

You should recommend it to all your clients/subscribers.

And the more I think of it since this morning, the more I believe that the best way to deal with them, is to apply their own methods. Very simple

Chinese are the first people to renege and cheat on contracts barely before the ink is dry. True at personal and professional levels.

Why don't the other parties apply to the Chinese the Chinese method.

Short of China invading the defaulting parties, I don't see how they can really enforce the contracts. And I don't think China will want to go to war to enforce contracts that are blatantly rigged. In France it is called a " Contrat Léonin" i.e favoring too much a party to the contract https://fr.wikipedia.org/wiki/Clause_l%C3%A9onine