Why retail traders underperform

A couple of months ago, I wrote a note about what people look at when they look at charts. I use chart analysis as a timing tool to augment my fundamental analysis. And I use chart analysis whenever there is a market panic and markets become (temporarily) disconnected from fundamentals. What I never do and never would do is use chart analysis as a standalone tool to make investment decisions.

But that is apparently what most retail investors do, or rather what most retail investors that are on social media do. A study from Purdue University and CUNY analysed 77 million (!) messages on StockTwits to analyse how retail traders form their investment opinions. They then compared this analysis with trading data on Robinhood and found that StockTwits sentiment does influence Robinhood trading volume, indicating that retail traders follow through in the advice and opinions shared on social media.

First, the good news: Retail investors who use predominantly fundamental analysis tend to outperform the market on average in the next week.

Now the bad news and trust me there is a lot of it in the research.

First, note how I wrote about fundamental investors outperform markets over the subsequent week. This fundamental analysis sentiment among retail investors has some positive information value in the short term. But very quickly, it disappears altogether, and these fundamental investors are no better than the market.

Second, even those retail investors who self-identify on StockTwits as fundamental investors hardly use fundamental analysis at all. Of those ‘fundamental investors’ only about 20% were classified by an AI reading their tweets as fundamental investors. The rest published almost exclusively chart-technical analysis, with almost no-one publishing a mix of chart-technical and fundamental analysis.

Third, while day traders used predominantly technical analysis (about 85% were pure chartists), even people who identify as long-term investors were predominantly (>75%) posting exclusively technical analysis.

Put together, this analysis shows that at least on short-form social media like StockTwits, even those retail investors who claim to be fundamentally driven investors, are anything but. They are all just following the charts.

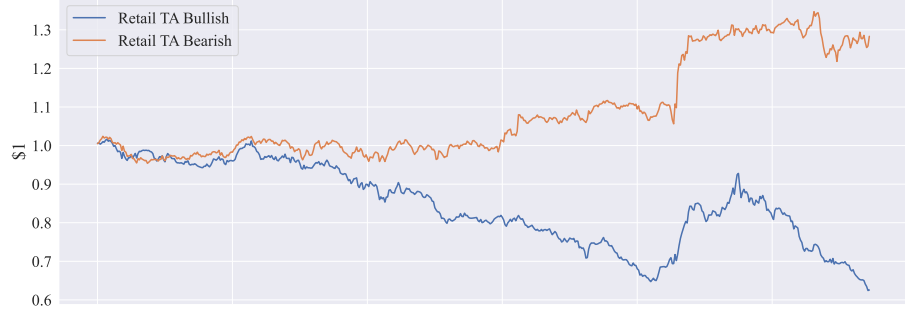

And the problem with using charts, or using almost exclusively charts with no fundamental underpinning, is that it costs you a lot of performance. The authors of the study used the technical analysis sentiment derived from StockTwit tweets to form portfolios of US stocks with the most bullish and the most bearish sentiment. The chart below shows the cumulative performance of these two baskets from 2012 to 2022.

Cumulative returns of portfolios formed by retail technical analysis (TA) sentiment

Source: Chen et al. (2024)

And no, the labels are not switched in the chart. The stocks identified as the ones with the best technical analysis picture not only underperformed but systematically lost money. The stocks identified as the ones with the most bearish charts systematically gained. After ten years, retail traders (I refuse to call them ‘investors’ after having seen this analysis) have lost almost 40% of their initial investment on their ‘buys’ and would have gained about 30% had they held on to their ‘sells’.

It really is quite astonishing how bad retail traders are.

Over the years, I have observed some of the biggest reasons for underperformance for most retail traders who trade stocks and ETFs struggle with emotional decision-making, such as reacting impulsively to market ups and downs and overtrading, often buying and selling too frequently to time the market. They also lack the knowledge, strategy, and risk management to succeed.

In contrast, I have noticed that mutual fund investors often trade less frequently. This may be partly due to mutual funds settling at the end of the day, which gives investors time to reflect on their decisions. Additionally, mutual funds are designed for long-term goals, often come with professional management, and tend to discourage the short-term mindset that leads to overtrading. While mutual funds don't eliminate emotional decision-making, their structure helps reduce the temptation to act impulsively compared to the real-time trading flexibility of stocks and ETFs.

Value > Momentum

it's staggering and logical in the end. These lines on the charts represent real companies and the real economy. They cannot always trade like leaves on a windy tree.