Geopolitics remains a major factor that can derail stock markets at a moment’s notice. However, as I emphasise in my book on Geopolitics for Investors (it’s available for free so check out the link) the vast majority of geopolitical events do not create long-term drawdowns in stock markets. Rather, they create a short and sharp setback in markets followed by a recovery. How big that recovery is depends on the market and whether we are looking at threats of war or acts of war.

The most common measure of geopolitical risks is the GPR developed by Dario Caldara and Matteo Iacoviello. It measures how many newspaper articles have been written about topics covering geopolitical risks and differentiates between geopolitical threats (the risk of war, revolution, acts of terrorism) and geopolitical acts.

Two researchers from the University of Turku analysed how changes in the GPR and its components influence excess returns of 40 different stock markets worldwide. They found that the size of the stock market reaction to a change in geopolitical risks differs widely across countries and can be positive, negative or (most commonly) insignificant. Particularly in the UK, and most Western European countries like Germany and France, they find a significant impact of geopolitical risks on stock market excess returns over 3-month government bills. In the US that link tends to be very small and typically insignificant in the short term (more on the long-term effect tomorrow).

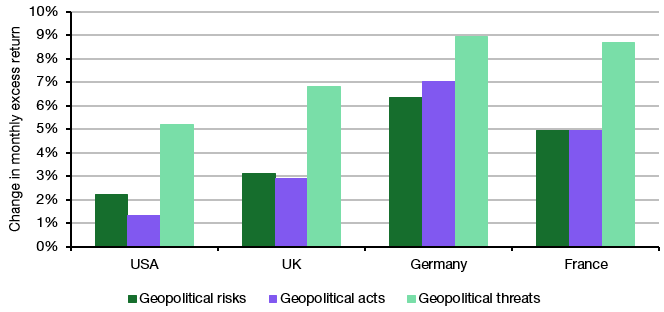

Having said that, European stock markets show quite a substantial increase in excess returns in reaction to an increase in geopolitical risks. The chart below shows the contemporary reaction of the stock market to an increase in geopolitical risks. For every country, geopolitical threats have a larger impact than geopolitical acts.

Change in excess return in reaction to an increase in geopolitical risk

Source: Rafi and Ali (2024)

In simple terms, stock markets react more to words (threats) than to acts. Investors seem to be perpetually on edge and once they get a whiff of rising geopolitical risks, they tend to act first and ask questions later. They sell shares and then assess the situation. If these threats recede (which they typically do) stock markets recover nicely. Acts of war, meanwhile, tend to come after threats have been identified and digested by the market, so markets tend to react less volatile unless the acts come without prior warning.

But what this study shows again is that geopolitical risks are not something to fear. For the astute investor, they can provide attractive buying opportunities. As Baron Rothschild allegedly said: “The time to buy is when there’s blood in the streets”. Sometimes, this can be taken literally.

good to know! But if we are in a new era -- if American Exceptionalism is over -- is that a geopolitical risk, or just a new framing?

It's tricky, because I think in our lifetimes, we haven't experienced an extended trade war. Our grandparents did, and they are not to be envied.

We do know that Bunga-Bunga economics lead to stagnation. We know that Banana Republic economics (where a Caudillo is motivated by personal animosities and crackpot theories) leads to impoverishment. But how geopolitical would it be to include this in a scenario?

I guess I need to read your book.

Dear Joachim, so the changes in excess return - which are significant - represent the subsequent market recovery after initial sell-off on the increased newsflow/GPR?