Sin stocks are an interesting area to explore if you want to understand why people follow ESG investments. In theory, if ESG investors shun sin stocks (gambling, defense, alcohol, tobacco) the risk premium on these stocks should increase offering investors higher returns in the long run. In practice, though, it is unclear if there is any risk premium to sin stocks. Now, thanks to a series of lab experiments we get a better understanding of why people invest in sin stocks and who invests in these stocks.

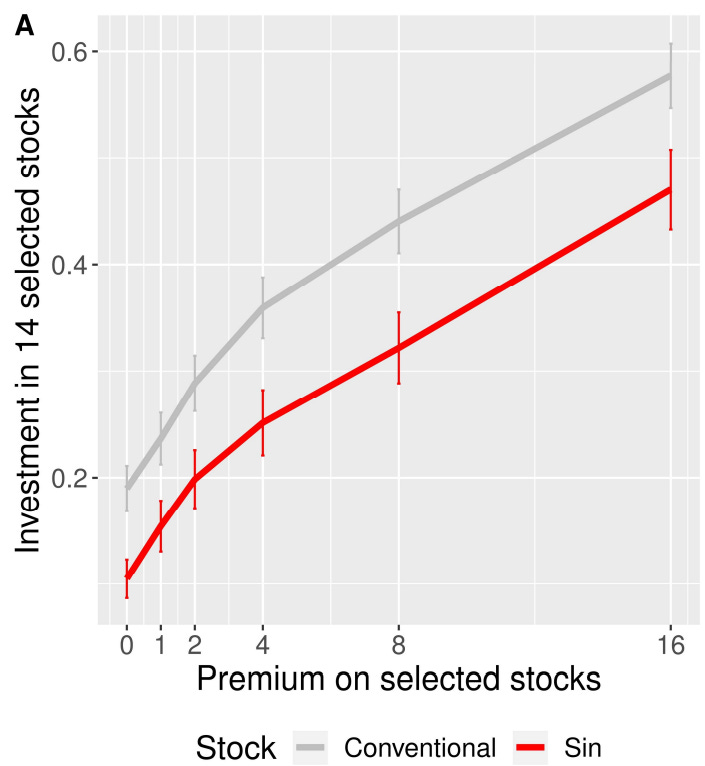

The researchers recruited several hundred volunteers and asked them how much money they would invest in different stocks. The first chart I want to show is the baseline result of these experiments. It shows for a range of risk premia how much money investors would allocate to conventional stocks vs. sin stocks.

Investment in conventional and sin stocks for different risk premia

Source: Niszczota et al. (2023)

Note how investors would invest less in sin stocks than conventional stocks if there is no risk premium on sin stocks. But as the risk premium on sin stocks increases, investors are willing to put more money into them. For a risk premium of about 2%, investors are willing to invest the same amount into sin stocks as for a conventional stock with no risk premium, i.e. investors demand a 2% premium for sin stocks over conventional stocks to consider them of equal ‘utility’.

The beauty of lab experiments is that one can dig deeper than that and ask volunteers a lot of questions about their attitudes to life and their psychological profile. The second set of charts shows how investors differ in their attitudes to sin stocks. All three charts show the inclination to invest an additional dollar into sin stocks or conventional stocks for a changing degree of certain personality traits.

The chart on the left shows the willingness to invest more in sin stocks or conventional stocks depending on how religious people are. More religious people or people with high moral standards are much less inclined to invest in sin stocks even for high risk premia. For them, their personal values and beliefs dominate the decision to invest.

In the middle, we have the usual utilitarian or ‘rational’ investor. This investor type invests more in sin stocks for higher risk premia but note how the sensitivity to risk premia is always lower than for conventional stocks, meaning that sin stocks are always less preferred than conventional stocks.

And finally, the right chart shows the dark triad dimension, i.e. people with increasing narcissism (excessive self-love and a feeling of importance), Machiavellianism (manipulative behaviour), and psychopathology (a lack of empathy). These people are indeed different. The more a person displays characteristics of the dark triad, the more they are inclined to invest in sin stocks and the less they care about conventional stocks. In other words, these people enjoy holding sin stocks for the sake of holding sin stocks.

Willingness to invest additional money for rising risk premia

Source: Niszczota et al. (2023)