Plenty of conventional funds are green

One area of active fund management that is growing is the group of socially responsible funds. These funds claim that they take ESG investment criteria seriously and invest far more extensively in companies with a sustainable business model than conventional funds. But unlike in the ETF space where socially responsible ETFs follow a clearly defined ESG index with transparent rules actively managed funds can engage in greenwashing and invest in companies with a low ESG rating. This can be justified if the fund is an activist investor that engages with the company to change its business practices but the majority of socially responsible funds engage only in a standardised fashion that is unlikely to create change.

Furthermore, the number of socially responsible active funds, though growing, is much smaller than the number of conventional active funds, so investors who restrict themselves to socially responsible funds only may forego access to skilled managers. But fear not because Harshini Shanker has recently analysed the Morningstar fund database of equity funds to check if there are conventional funds that can be a substitute for socially responsible funds. He looked at 5,161 funds registered for sale in the United States and compared the Morningstar ESG rating of the socially responsible funds with the ESG rating for the conventional funds. Morningstar classifies a fund as “socially conscious” if it follows non-economic motives according to its prospectus.

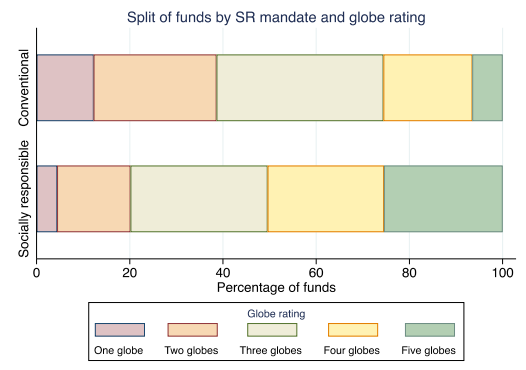

He came up with a couple of surprises. On average, the ESG rating for socially responsible funds is higher than the ESG rating for conventional funds (by about 0.7 “globes” out of five, the measure Morningstar uses for its ESG rating). However, about half the socially responsible funds had a globe rating of three globes or less, indicating that their investments are no better than the average fund in the entire universe (socially responsible and conventional combined). These funds are potential candidates for greenwashed funds where the fund manager claims to invest in a socially responsible way but does not do so in practice. This may be only a temporary phenomenon, but Shanker shows that the ESG ratings for a fund are highly persistent and one and two globe funds that claim to be socially conscious typically stay below average for a very long time – a behaviour highly suggestive of greenwashing.

Even more, up to one quarter of the conventional funds had a Morningstar ESG rating of four or five globes indicating that they invest more socially conscious than the average fund. The number of funds with a four or five globe rating from Morningstar is about twice the total number of socially responsible funds and the assets under management of these conventional funds with above average ESG rating is close to $4tn and about 3.5 times higher than the assets under management of all socially responsible funds.

To me as an investor it is important that a fund does what it says on the tin and many socially responsible funds clearly don’t. Furthermore as studies have shown again and again and again, socially responsible funds underperform their benchmarks just like conventional funds do. What I want to get with a socially responsible investing is protection from risks that are not priced in markets, such as environmental or governance risks. And if I can get that from a conventional fund, I don’t care about the label – and neither should you.

Distribution of ESG rating of funds

Source: Shankar (2019).