I have written before about the problems value investors face when dealing with companies with lots of intangible assets. There is now more and more evidence from the US that the simple value factor of sorting companies by their book value per share is a much more reliable indicator when the book value is stripped of its intangible assets first.

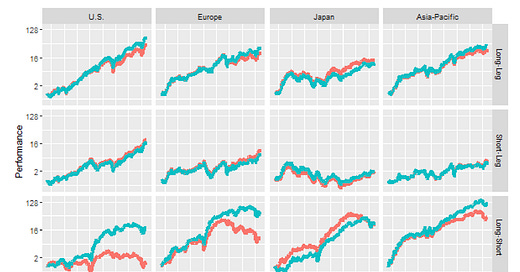

Stefan Vincenz from WU Wien has not only confirmed this effect in his latest research but examined if it holds in other regions as well. The short answer is yes, stripping valuation metrics of their intangible assets helps to improve performance worldwide. But it is interesting to take a quick look at the summary performance by region below.

Traditional value factor (HML) vs. value factor ex intangible assets (HMLINT)

Source: Vincenz (2023)

Crucially, the outperformance of the value stocks is more pronounced for the long leg in the long-short strategy, i.e. value stocks outperform by a larger amount when stripped of intangible assets.

Most importantly, drawdowns and time under water for value portfolios based on book value ex intangibles are both smaller than for value portfolios based on the conventional book value. This means that value investors can significantly reduce their “suffering” when value is out of fashion by stripping intangibles out of the book value. And especially for value fund managers who must keep their investors calm and invested in times of underperformance, this is a crucial benefit.

Note, also that the long-short performance is best in the US and practically zero in Japan and Asia, indicating that intangible assets are less of an issue in Asia than in Europe or the US. I am not sure why this is, but I suspect that it has something to do with the prevalence of tech companies in the US and the greater propensity for companies to acquire other businesses using stocks instead of cash. These could lead to higher intangible assets on the balance sheets of US companies than in Europe or Asia and eventually lead to a larger distortion of valuation metrics in the US.

Just randomnly choosing this one article of yours to tell you how much I enjoy reading your articles blending investing, sociology and psychology.

I have some interest in valuation of marketing services businesses and this resonates.

In advertising conglomerates, for example, there is a very high level of intangibles.

They're also hard to value and often walk out the door.