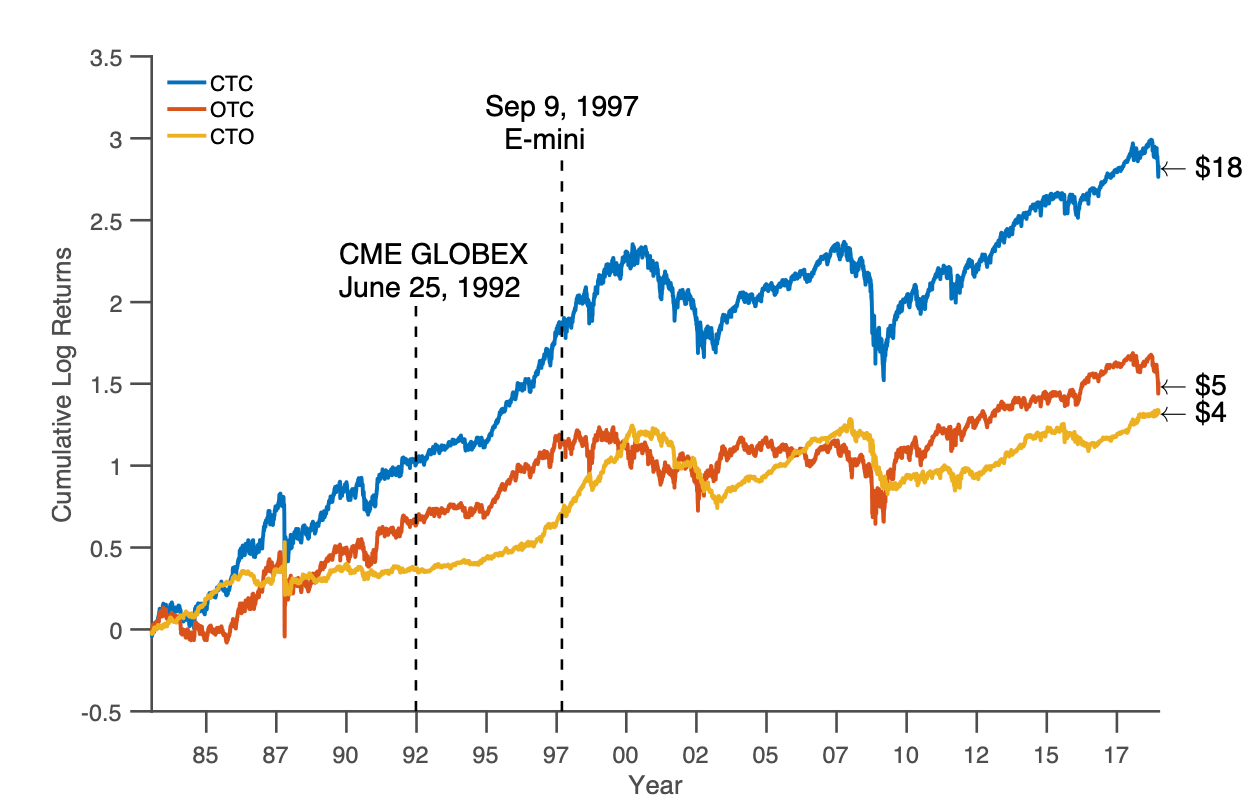

One of the charts that have become somewhat infamous on social media over the last couple of years is the one shown below. It shows the returns to an investment in the S&P 500 held every day from close to the next day’s close (CTC), from open to close (OTC) and from close to the next day’s open (CTO). Just investing in the S&P 500 when it is closed delivers about the same return as investing in it when it is open. How can the return of the stock market be the same when it is open and millions of trades are executed than when it is closed?

Half of the returns of the S&P 500 are recorded during hours when the market is closed

Source: Boyarchenko et al. (2020).

One explanation of this phenomenon is obviously, that while the market is closed, there still is new information issued around the world. Investors incorporate this new information into their price expectations and as a result, prices jump when markets open, creating the appearance of an overnight return.

That this is not the explanation for these overnight return has been shown by Nina Boyarchenko from the Federal Reserve Bank of New York and her colleagues from Copenhagen Business School. They looked at trading in S&P 500 futures, which happens round the clock across different global stock exchanges. They could isolate this overnight drift and narrow the time window down to 2 am to 3 am New York time. In the chart below, they show the return of holding futures from close to the next day’s close (CTC) just like in the chart above. Then, they show the return of buying futures at 2 am and selling them at 3 am every day (OD). Finally, they show the return of shorting the futures in pre-market trading from 8.30 am to 10 am (-OR) and the return of the risk-free asset (RF). Systematically shorting the market before open is about as profitable as holding futures from 2 am to 3 am each day and almost as profitable as a buy and hold strategy.

Overnight drift (OD) returns are almost as high as buy and hold returns

Source: Boyarchenko et al. (2020).

What is astonishing is that almost all of that overnight drift seems to happen in the hour from 2 am to 3 am. What happens at 2 am New York time?

Simple: European stock markets open.

The study shows that market makers in New York cannot always balance their futures positions at the end of each day. Hence, they are left with either a net long or a net short position in futures. And market makers are human, just like the rest of us, and don’t like to sit on a naked short position for too long. Hence, they try to cover their shorts at the first opportunity they get. Historically, that was the European market open because Tokyo had only very limited trading in S&P 500 futures. The chart below differentiates between days when market makers in New York have a net short position on their books at the end of the day (Negative closing signed volume) vs. days with a net long position (Positive closing signed volume) and days with a balanced book (Zero closing signed volume). The massive rally from 2 am to 3 am on days when market makers in New York have net short positions on their books is clearly visible. In effect, there is a tiny short squeeze happening every day after US market makers were forced to hold a net short position at the US market close.

Overnight drift (OD) returns are high when market makers sit on short positions

Source: Boyarchenko et al. (2020).

If you are running a hedge fund, this is the kind of chart that makes your mouth water, because it hints at a potentially profitable trading strategy. But before you get carried away, let’s look at the strategies in the second chart above, but this time with transaction costs included. The profits of holding futures from 2 am to 3 am every night are so tiny that the transaction costs easily overwhelm any returns one might capture by this strategy. Hence, this market anomaly cannot be arbitraged away, and we have to just accept that in the foreseeable future, the overnight drift will continue to exist. But at least, it is no longer a mystery, why it happens.

Overnight drift (OD) returns with transaction costs

Source: Boyarchenko et al. (2020).

super interesting!