We’ve done it - at least in some sense…

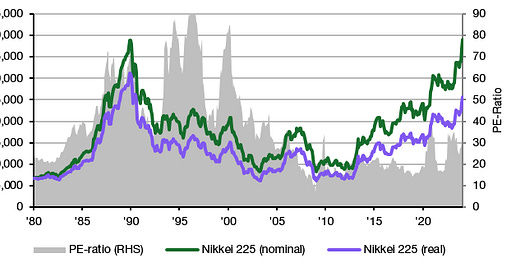

Throughout my entire career, I used the Japanese stock market as a cautious tale of the risks to equity investments even if you are a very long-term investor. But as of today, the Nikkei 225 has finally recovered all its losses created after the bubble burst in 1989. It only took 34 years and a few months and the index dropped 78.8% from peak to trough, but we finally are back to all-time highs in Japan! It’s the real-time example of what I wrote about last week Wednesday.

That is, of course if you ignore inflation. Then you are still down 17.6% in real terms and waiting for the recovery to complete.

which makes one wonder: what is the longest peak-to-trough-to-peak as of yet?

My gom (guess-o-meter) says Russia got back to zero in the 1990s, Germany in the 1960s, Venezuela and Zimbabwe: not yet by a long shot... But do those countries that have defaulted even count?

Glad to see that you are showing the inflation adjusted numbers, however you appear to be missing a key aspect here: dividends. If you run the total returns for the Nikkei 225, you will see that it has already surpassed it 1989 peak some time ago (and the Topic). So the new news is actually old news.

As an aside, given the knowledge and computing power we have today, I'm not sure why we are still using historical and misleading artifacts like price-weighted indexes or price return indexes - rather than using total return indexes for long term data.