About that energy inflation

Investors are freaking out about inflation. The strong surge in oil and gas prices has created a large increase in energy inflation which has driven headline inflation numbers to multi-decade highs in the United States, the UK, and Europe. And Russia hasn’t even invaded Ukraine, yet…

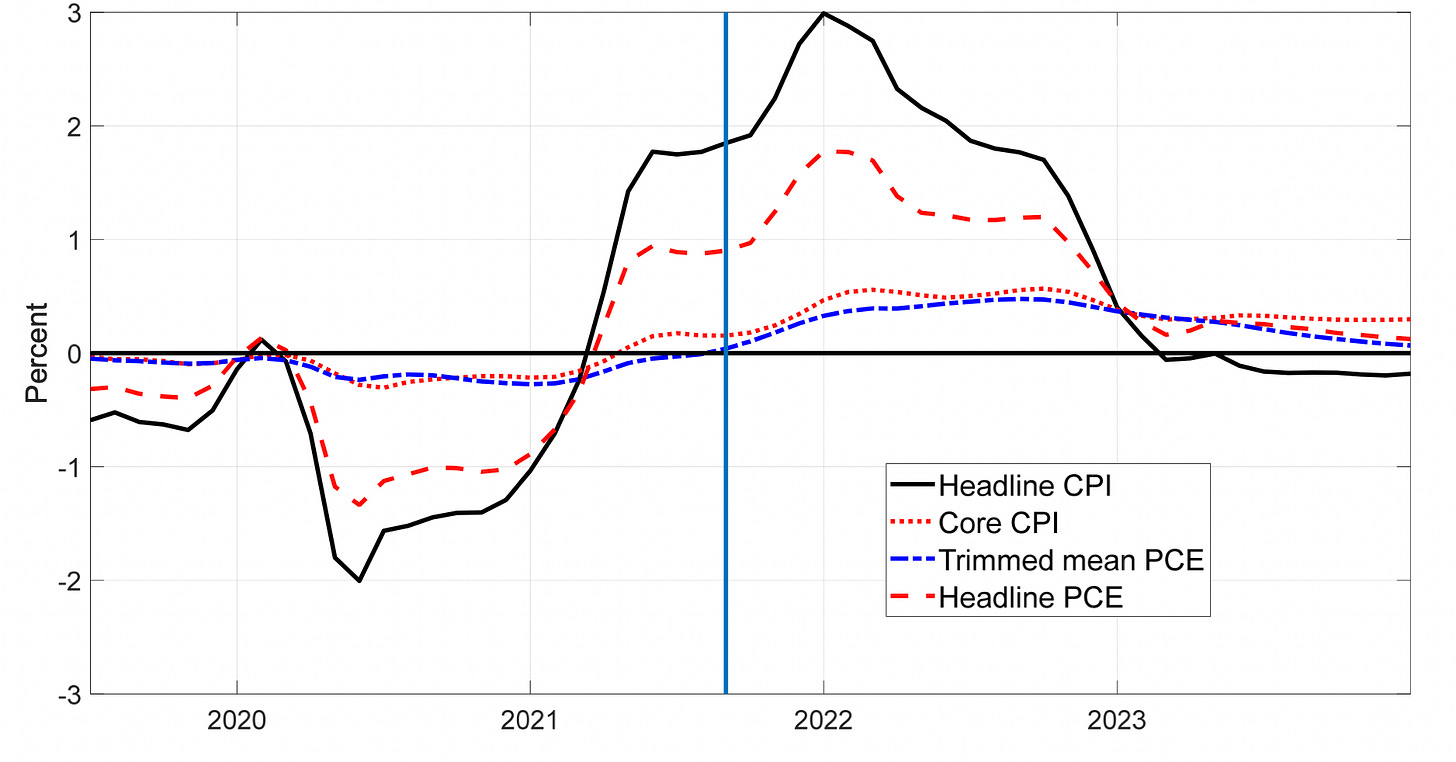

There are obviously concerns about wage inflation and other components, but when it comes to energy inflation, I am not worried about its persistence nor am I worried about energy inflation creating persistently higher core inflation or higher inflation expectations. I have written about the simple statistical effects of why energy inflation is likely to decline dramatically in 2022 here, but Lutz Kilian and Xiaoking Zhou from the Dallas Fed have tried to predict the impact the current energy price spike will have on inflation and inflation expectations over the next two years. Furthermore, to make things worse, they assumed that crude oil prices would remain at $100/bbl, well above current oil prices. Thus, their projections can serve as an upper limit to where energy inflation will go in 2022 and 2023. Below is the key chart from their note.

Impact of energy price spike on US inflation until 2023

Source: Kilian and Zhou (2021).

Their calculations stopped in autumn 2021 and they expect that the contribution of energy prices to inflation will peak right about now pushing headline inflation in the US about 3 percentage points higher than it would otherwise have been. But by the end of 2022, the contribution from energy inflation is going to be a mere 0.4 percentage points or less. That is a drop in inflation by 2.6 percentage points in 2022 even if oil prices stay above $100/bbl. And by 2023, the contribution of energy inflation to total inflation would be zero or even negative.

Core inflation would experience a somewhat more persistent push higher of 0.4% at the end of 2021 that would remain roughly constant throughout 2022. Meanwhile, inflation expectations for the coming year are likely to rise substantially (something we have already seen in bond markets), but 5-year inflation expectations, a key variable watched by the Fed, would hardly change.

In sum, their results suggest that US headline inflation is likely to drop significantly in 2022 and much more than most investors expect right now.