I recently attended a conference on cryptocurrencies, and I have to say I was impressed by the state of this technology and the many things that are going on in that space. Yet, as I was listening to the different presentations, something occurred to me.

Cryptocurrencies have moved from the fringes of finance to the mainstream, yet if you listen to the promoters of cryptocurrencies, they use an awful lot of technical expressions and jargon. When somebody explained the different “epochs” of Bitcoin mining I could follow the conversation. It took a bit longer, but I eventually figured out what “DeFi” means, but honestly, when the discussion came to “ASIC” vs. “GPU” I had to google the answer. This is something that happens to me time and again. Whenever I hear a presentation on cryptocurrencies, I walk away more confused than at the beginning.

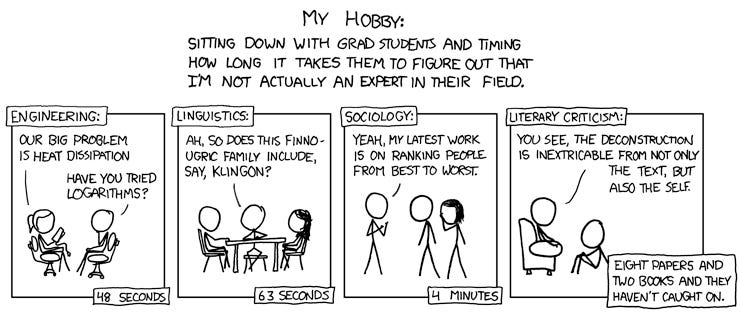

Now, I am not stupid. I studied physics at university with a specialisation in theoretical physics and particle physics. I can explain to you how a quantum computer works and the challenges that remain before it can be built in real life. If you think of Sheldon Cooper in the sitcom The Big Bang Theory, you can think of me because I studied almost the same as he did. Yet, whenever I try to understand cryptocurrencies I am at a loss. Either, I manage to translate the jargon into something in plain English at which point I often end up with trivial conclusions, or I am unable to translate the jargon and technical terms into something that makes sense. I feel a little bit like promoters of cryptocurrencies don’t talk about engineering but practice a form of literary criticism (see below).

Impostor

Source: XKCD

So here is my dilemma. Either one of these statements is true, and I cannot tell which one:

I am like Warren Buffett in the 1990s. New technology is revolutionising the world and it has serious applications and a great future. Yet, I am unable to understand the drivers behind this new technology or simply too old to understand it. In this case, I should act like Warren Buffett and stay away from investing in something I do not understand.

This new technology will eventually change the world, but a lot of the current applications and investment opportunities are not viable and will eventually disappear while others will become dominant. In this case, I should try to understand this technology as best I can and build a portfolio of the most promising investments, hoping that one of them will become the next Amazon.

I am like the analyst on an Enron earnings call who tries to understand what they are doing but can’t. And this is not because I am too stupid but because it is all smoke and mirrors and the emperor really doesn’t wear any clothes. In this case, cryptocurrencies are all worthless and I should stay away from this investment as far as I can.

I reached pretty much the same conclusions. However, my recent reading about Tether has moved me strongly towards your last bullet point. If you haven't read it, I'd suggest reading the relevant article on singlelunch.com (google 'tether ponzi'). It seems to me there's a huge problem sitting in plain sight in the cryptosphere with that situation. It's all verifiable and it's all very very murky indeed (think of a 'bad FED' freely printing crypto for it's own gain).

Notwithstanding that, I think we could all see how amazing the internet was in the 90's. We didn't know how it'd pan out exactly, but it was cool right from the off. Crypto is over 10 years old now, what are we really doing with it apart from trading it like pogs? It's a sham.

Well...someone might say "am I too young to understand the world's love affair with fiat currency and the oligarchy pulling the strings?". Of your three bullet points, I am in the 2nd camp. This is true for AI (artificial intelligence), EV (electric vehicles), climate change, gene sequencing/editing, and yes, even crypto and blockchain technology. If we look back at Internet 1.0 (1995 - 2000), I think we can see a lot of similarities. This seems true for any inflection point in history with enough innovations, wherein there is a general lag in the S-curve adoption. We can include "failures" that even when technically viable, we may have a poor execution (A+ idea, C- management team) or just poor timing or bad funding. I do not think we see many televisions by Farnsworth or riding Wright brothers airlines.

But, I empathize re: annoyance with jargon use. A common affliction of many presenters (some do it subconsciously because their mind is racing, or some are autistic, yet some deliberately doing it to make the audience feel helpless or not part of the clique/generate fear of missing out ). This is true for many topics - not just crypto, but techno schmucks, financial gurus...present company excluded :-). I hate it even in my own field they use acronyms and will not have the courtesy to define and contextualize.

Cheers!