Another reason why interest rates have to stay low for a decade

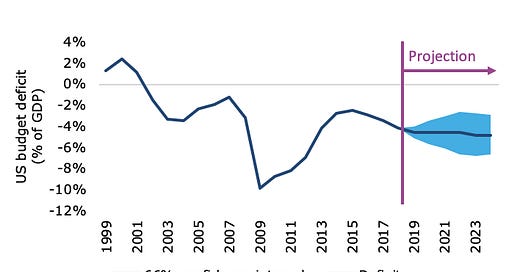

Yesterday, the US Congressional Budget Office (CBO) published its latest set of projections for the coming decade. This time it includes the two-year budget deal that was struck at the beginning of August. As always, the report is full of interesting tidbits, but here is the gist of the story: The US budget deficit is expected to rise much faster than previously forecast and reach $960bn (4.5% of GDP) in 2019. Over the next ten years, the deficits are expected to be $809bn larger than previously thought. The chart below shows the CBO’s estimate for the Federal deficit until 2024 including a 66% confidence interval.

Projected US deficit

Source: CBO.

But what I want to focus on here is the large uncertainty around interest rates and their impact on the deficit. Unlike GDP, inflation rates and interest rates are notoriously hard to forecast and come with a large uncertainty. This can be seen by comparing the CBO projections of the average interest rate the US has to pay on its debt. In January, the CBO expected this average interest rate to rise from 2.6% in 2019 to 3.5% in 2029. Now, interest rates have fallen and the CBO simply assumes they are going to stay lower forever. In the August projections, the CBO assumes that the average interest rates on Federal Debt start at 2.5% in 2019 and rise to 3.0% in 2029.

Compare this to my own long-term projections based on a model that includes the projected demographic changes in the US, changes in consumption patterns, productivity and investments etc. According to this model, the average interest rate on US debt should rise to 4.9% in 2029. For my younger readers, I probably need to explain that a 5% interest rate on public debt is nothing spectacular and does not imply a 1970s-like inflation scenario. Instead it would simply be a return to the interest rate levels we have lived with between 2000 and 2008. What would be the impact on Federal net interest costs if interest rates would climb to these levels?

Of course, there is always the possibility that interest rates keep falling as they have done over the last decade and we enter a Japan-like scenario, where the average interest cost on US debt is somewhere around 0.5% in ten years. The chart below shows these two scenarios for interest rates together with the CBO projections from January and August.

Interest rate scenarios

Source: CBO, Fidante Partners.

None of these interest rate scenarios are extreme. Instead they represent a reasonable range of possible outcomes. But the impact on Federal interest expenses and the deficit is large. The chart below shows the projected net interest expense for these four scenarios if everything else is being held equal. That is, the projected tax revenues and GDP growth are all correct – arguably a heroic assumption.

It turns out that just by assuming the lower interest level on Treasuries, the CBO managed to reduce the expected interest expense by $1.3 trillion over the next ten years! That is 0.4% of US GDP per year. If interest rates would normalize towards 5%, as I expect, interest expenses would rise by about $4 trillion over the next decade and the deficit would increase by 1.3% of GDP per year on average and reach 6.6% of GDP in 2029.

Currently, the CBO predicts the debt/GDP ratio of the US to climb from 70.6% in 2019 to 88.0% in 2029. With higher interest rates the debt/GDP-ratio could quickly approach 100%. Remember that these calculations imply that GDP growth, tax revenues etc. all remain unchanged, something that is not necessarily a given if interest rates rise significantly.

Projected net interest expense

Source: CBO.

Of course, all of this need not happen. Instead, the US could face a Japan-like scenario where interest rates keep falling and thus interest expenses will be much lower than expected. This would be the “get out of jail”-card for the US. All that needs to happen for this scenario to materialize is the Fed to keep long-term interest rates very low for a long time. In other words, the reality of these numbers is that the Fed will face enormous pressure to enter in a QE infinity scenario, where it manipulates the entire yield curve for years to come, just like the Bank of Japan does.

This pressure to keep interest rates low for long will not subside once Donald Trump leaves office. While Donald Trump may publicly bully the Fed into lower rates, the Democrats are flirting with Modern Monetary Theory and large deficits to finance large-scale investment and welfare projects. Furthermore, fiscal stimulus might be the only weapon we have left to fight the next recession. And the bigger the deficit gets, the higher the pressure will be on the Fed to keep rates lower for longer.