The crypto fan club likes to argue that cryptocurrencies like Bitcoin are a better alternative to fiat currencies like the US Dollar and that cryptocurrencies (Bitcoin or others) could replace fiat currencies one day. Well, let’s have a look if cryptocurrencies are indeed currencies.

Many moons ago when I was a student, I learned that currencies have three main functions: store of value, means of transaction, and unit of measurement.

When it comes to currencies as a store of value holding cash or money market investments with very short duration is certainly acting as a store of value in nominal terms. Clearly, there is the problem with inflation, but we will address that later when we talk about currencies as a unit of measurement. For now, let’s focus on currencies as a store of value. The problem with the term ‘store of value’ is that one must define a unit of measurement in which to determine a currenci’s ability to act as such.

Clearly, the natural unit of measurement is the US Dollar, but I would propose a more generic unit, which is your wealth in the eyes of the government. As they say, only two things in life are certain, death and taxes. Many countries have wealth taxes and income taxes and to assess these, government tax authorities require you to file your taxes in their local currency. But whether that currency is the US Dollar, the Euro, special drawing rights, or copper bars, doesn’t matter that much. The important thing is, are you going to be assessed as wealthier or poorer by the government if you hold all your savings in cryptocurrencies and file your tax returns?

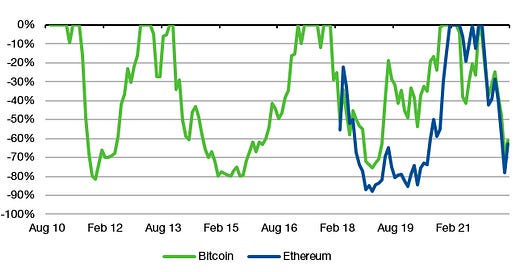

If we think of the two largest cryptocurrencies as a store of value, the crypto fan club will say, they have doubled in value over the last four years, so they clearly are a store of value. But that is not the definition of store of value, that is the definition of return on investment. A store of value is only a store of value if you can access it at any time you need to with minimal loss due to transaction costs, liquidity, or price fluctuations. And the chart below shows that for much of the last twelve years, you would not have been able to access your Bitcoin or Ethereum without a loss. If you had invested in Bitcoin and Ethereum randomly and tried to take money out of your savings equally randomly, about half the time you would have experienced a significant loss, sometimes as large as 80%.

Drawdowns of Bitcoin and Ethereum

Source: Bloomberg, Liberum

The enormous volatility of Bitcoin and Ethereum makes them an awful store of value, which is exactly why stablecoins like Tether or USD Coin were developed. These stablecoins are backed by US Dollar assets in cash, money market investments, or Treasuries. But that is exactly why they are not currencies either. They are just another form of money market investment like buying a money market fund, just wrapped in a new digital cloak. Nothing new under the sun.

This brings us to the question of means of transaction. For a currency to be a currency, you must be able to buy stuff with it. And while cryptocurrencies are apparently popular means of transactions on the dark web if you want to buy drugs or hire a contract killer, I will be concerned here with legal transactions.

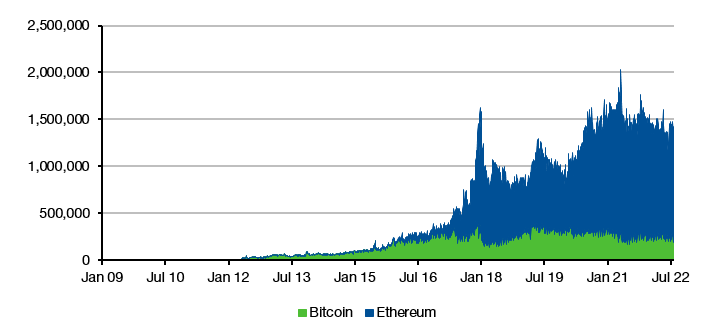

To give you an idea of the number of transactions needed to act as a currency, let’s take the credit card company Visa as an example. They can handle up to 24,000 transactions per second and typically handle about 150 million transactions a day (c.1,700 transactions per second). And that is just one credit card company. The Bank of England estimates that in the UK alone, there are some 35.6 billion transactions a day. Now compare this to the transactions per day in Bitcoin and Ethereum. They are currently at 1.3 million per day and falling.

Number of transactions in Bitcoin and Ethereum per day

Source: Bitcoin.com

The major problem with cryptocurrencies is that the technology is incredibly slow. To accept a transaction, the majority of the network has to accept the transaction which is very time and energy intensive. And even if current attempts to develop cryptocurrencies that are much faster at making transactions are successful, we are talking here about the need to speed up transactions in cryptocurrencies by a factor of 10,000 to 100,000. To put this in distance terms, if using cryptocurrencies is like going to Mars, traditional currencies are like going to our nearest neighbouring star.

Finally, let’s look at cryptocurrencies as a unit of measurement. How many goods and services can we buy with cryptocurrencies? This is supposedly where the strength of cryptocurrencies like Bitcoin and Ethereum are. They have limited supply and thus are not prone to devaluation and loss of purchasing power due to inflation like the US Dollar and other fiat currencies. There is a reason why Bitcoin and other cryptocurrencies are called ‘digital gold’. Well, we just had the highest inflation rate in 40 years so cryptocurrencies and gold as an inflation hedge should have had their day in the sun. And if they didn’t shine now, what hope is there that these ‘currencies’ will ever work as an inflation hedge?

I took the 8.5% inflation rate in US Dollars from July 2021 to July 2022 as a starting point and calculated the inflation rate in gold, stablecoins like Tether and USD Coin as well as cryptocurrencies like Bitcoin and Ethereum.

If we had adopted Bitcoin as a unit of measurement for goods and services, inflation in the United States would currently run at 56.3%. That is Banana Republic territory. In fact, I could only find four countries in the world that currently have higher inflation rates than that: Lebanon, Venezuela, Turkey, and Argentina.

Inflation rates expressed in different units of measurement

Source: Bloomberg

In short, cryptocurrencies are not currencies. They are not a store of value, not a good unit of measurement, and pretty useless as a means of transaction. But we knew all that. And I suspect cryptocurrency fans knew that as well.

Cryptocurrencies are speculative investments without any use case. For speculative investments to rise in price, you need a good story and a bunch of promoters that push that story. The story doesn’t have to be true it just has to sound true and ideally inspire fantasies about the myriad of opportunities that lie ahead. And this is where the true genius of cryptocurrencies lies. They are a great story, and the crypto fan club was able to suck in many people with their story of a digital currency and it being outside the control of governments, it being a good inflation hedge, etc. But in the end, they are nothing more than a gimmick, as I wrote more than a year ago. Back then, I got lots of criticism from the crypto fan club for calling it a gimmick. Let’s see how many of them will respond this time.

There was the Dream the we could escape the incompetence and foolishness of central bankers and politicians managing the currencies as US Dollar and Euro. Destroying the value and end in high inflation. Escape at least partly.

Ok, it was a dream.

For the average person in a developed country, buying BTC makes as little sense as buying a foreign currency for the purpose of speculation. But not everyone in the world has access to the banking and payment system that we have. For a low-wage Kenyan worker in Mexico, sending money to his family in Kenya, BTC probably would be a much more accessible alternative than others. I doubt other crypto projects will ever achieve the universal status that BTC has achieved, both because of network effects, as well as the name recognition from being the first