Currencies are hard

I sometimes joke that I have never lost money trading currencies – mostly because I have never traded currencies. Unlike investments in equities, bonds, or real estate, the problem with currencies is that it truly is a zero-sum game. What one person wins, the other must lose. There is no value creation, no dividends or coupons.

This leads to weird things like Siegel’s paradox for currencies. In simple terms, if I am based in the UK and invest in the US Dollar, the Dollar is a risky investment for me because it can appreciate and depreciate in value. Thus, if there is a systematic risk in the US Dollar, I should only invest in the US Dollar if it promises to give me a risk premium in the form of higher returns in the long run (i.e. in the long run, the US Dollar should appreciate vs. Sterling).

But if I put myself in the shoes of an American investor the same thing applies in reverse. For an American, Sterling is a risky investment and thus should command a risk premium, leading Sterling to appreciate vs. the US Dollar over time.

How can both be true at the same time? For those who want to know the answer to this puzzle, I recommend this paper.

In any case, in equity markets, we know that there are some fundamental risk factors that can be exploited by investors. Fama and French have shown that their three factors combined with the momentum factor explain somewhere between 75% and 95% of the variation between small-cap and large-cap stocks, between value and growth stocks, etc. For bonds, it is even easier. The starting yield of a bond explains more than 90% of the return an investor will achieve by holding the bond to maturity. In that respect, stocks and bonds are easy.

But currencies are hard.

We know of only very few systematic risk factors available in currency markets. On the one hand, there is purchasing power parity as fundamental value, carry trade based on interest rate differentials, and simple price momentum. But the profits from these factors have declined steadily and may no longer be available in a world of zero interest rates.

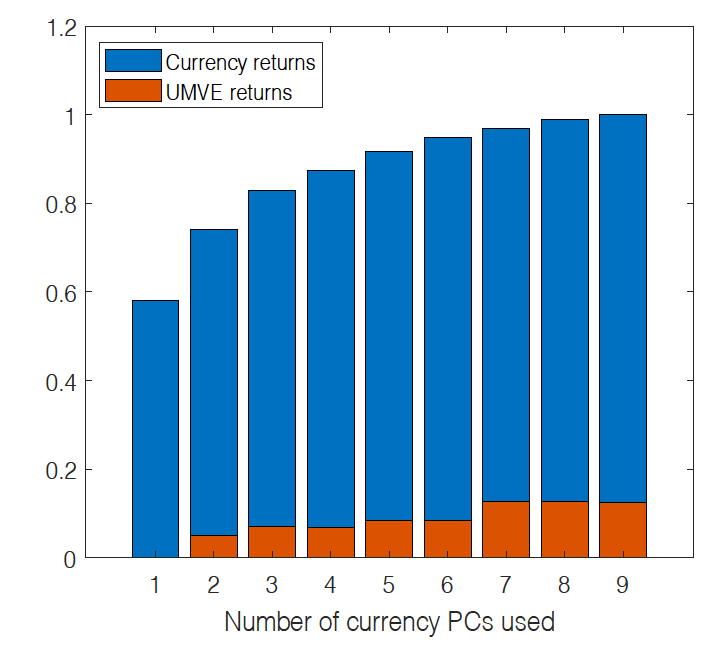

But even if we go back to 1980 and look at how much of the variation in exchange rates can be explained by these factors the answer is: not much. The chart below looks at the percentage of the variation in exchange rates between the G10 currencies (the 10 most liquid currencies from developed markets) that can be explained either by abstract principal components (blue bars) that can only be calculated after the fact or by the optimal combination of carry, momentum and value trades (UMVA).

Share of exchange rate variation explained by systematic currency factors (UMVA)

Source: Chernov et al. (2020).

In the end, the optimal combination of carry, momentum, and value can only explain about 10% to 20% of the variation in currency returns. In other words, the vast majority of currency movements cannot be explained and are beyond our grasp (or simple noise).

Let this be a lesson to you if you are tempted to trade in currencies or willing to speculate in currency markets: Don’t do it. If you win or lose is not a matter of skill but luck, pure luck.