Diversity is a topic that is discussed and promoted in every boardroom and in all the C-suites across Europe and North America these days. But the term “diversity” typically means gender diversity or ethnic diversity. But diversity has many dimensions, and my experience is that they matter for investment success. I have always felt more comfortable in investment teams with diverse cultural and educational backgrounds because it seemed they were more open to assess investment opportunities and risks more broadly.

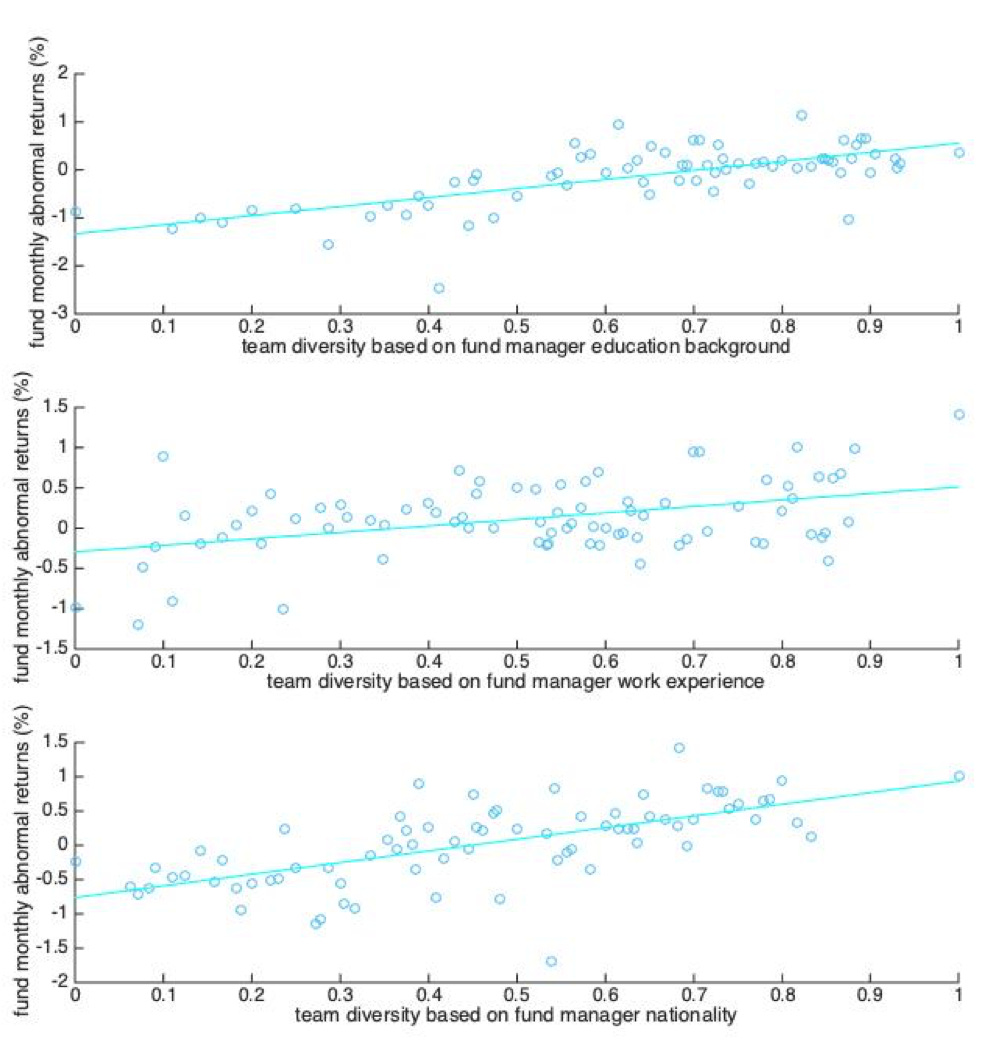

Imagine my satisfaction when I came across a paper by Yan Lu, Narayan Naik, and Melvin Teo that looked at the performance of hedge funds and the diversity of their investment teams. Instead of looking at gender diversity or ethnic diversity, they looked at diversity in terms of educational background, professional experience and nationality (as a proxy for cultural diversity). Then they measured hedge fund performance adjusted for risks and other potential systematic factors and found an outperformance of more diverse teams that is astonishingly high. The charts below show the monthly abnormal returns (i.e. the risk-adjusted monthly alpha) as a function of their standardised diversity measure. The more diverse a fund team is the better its performance. After adjusting for risk, the most diverse teams outperform the most homogenous teams by 5.25% to 5.8% per year.

Relationship between hedge fund team diversity and performance

Source: Lu et al. (2021)

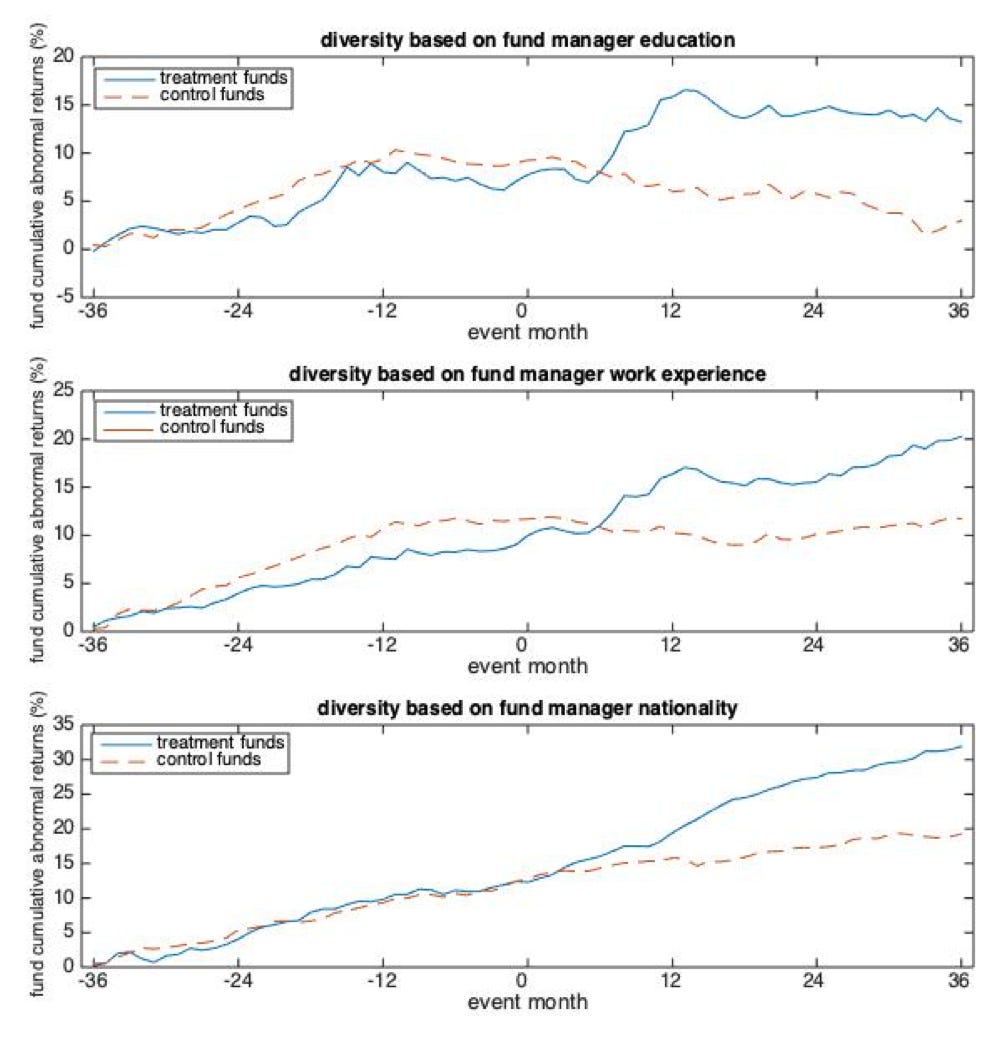

That this relationship is not a coincidence can be shown by event studies when a hedge fund hires a new manager with a different cultural or professional background. In the three years after hiring a diversity-enhancing manager, the fund alpha increases by 4.4% to 7.4%. Most notably – and in line with my experience – is the difference in performance when hiring someone with a different educational background. People with a degree in science think differently than people with a degree in finance. Not that one way of thinking is better than another, but if people with different ways of thinking manage investments, risks and opportunities get assessed with very different eyes and the team overall makes fewer mistakes. So please, if you are running a fund and think about hiring someone new, don’t just look at people with a finance or economics background. Look at people with an education in political science, natural sciences, or philosophy. I promise you, your portfolios and your investors will thank you for it.

Performance of hedge funds after hiring a diversity-enhancing manager

Source: Lu et al. (2021)

Very interesting read. However, why is diversity then still such a major issue in the investment industry? Quite interesting also the recent turmoil at BlackRock, internally by some referred to as WhiteRock, with regards to diversity.