In the UK and across Europe, the focus of governments increasingly shifts towards the long-term costs of rebuilding our economy after the worst economic crisis in 80 years. There is a clear preference in the public to use government investments and subsidies to foster green technology and use the recovery efforts to accelerate the transition towards an economy that is better adapted to climate change.

The problem, of course, is that someone has to pay for all that. Ignoring the rescue packages of 2020, the cost of climate change adaptation in the 21st century to the US economy alone is estimated to be $21.7tn in 2005 Dollars. If the government has to raise taxes to pay for climate change adaptation (e.g. higher flood walls, compensation for farmers in the case of droughts and floods, etc.) then the cost increases $28.8tn because the higher taxes reduce investments and income and thus consumption.

If you are fiscally conservative like me and not a fan of unlimited budget deficits, then it is clear that taxes have to rise in order for the government to pay for climate change adaptation. There is no way we can simply create $21.7tn out of thin air (though, the Fed and Congress seem to think otherwise).

Lint Barrage from the University of California Santa Barbara has made first steps towards answering this question:

How close can we get to the minimum 21.7tn cost if we have to raise taxes to finance climate change adaptation?

He uses a simple model that has essentially three variables:

Introduction of a price for CO2 and other greenhouse gases

Changes in income tax rates

Changes in capital income tax rates

Then he considers three scenarios:

The government can vary income taxes, capital income taxes, and put a price on carbon.

The government keeps income taxes fixed but can vary capital income taxes and the price of carbon

The government keeps capital income taxes fixed but can vary income taxes and the price of carbon.

The results are quite interesting and contrary to what I would have anticipated.

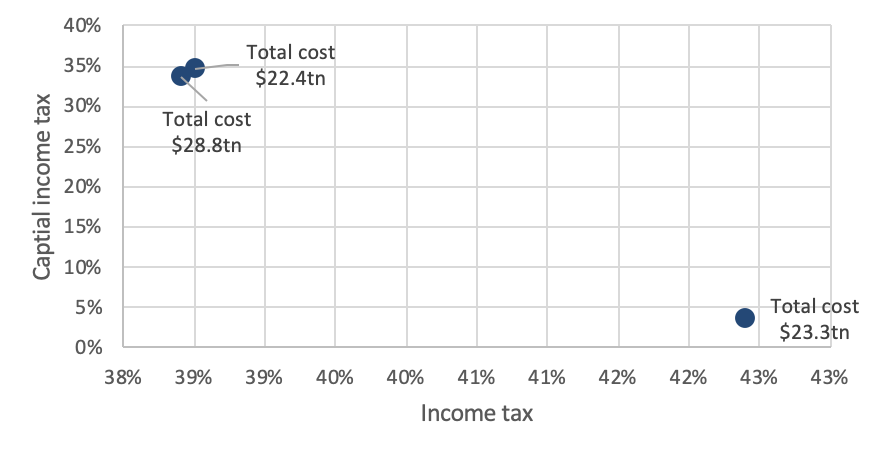

The worst solution is to keep income taxes fixed and use taxes on capital income (i.e. dividends and bond coupons) to finance climate change adaptation. Without putting a price on carbon, capital income taxes would have to average 37.5% throughout the 21st century while income taxes would have to stay at 38.4% top marginal tax rates (note that the model assumes tax rates will revert to the rates before the Republican tax cuts of 2018). If the government puts a price on carbon the optimal price would be around $51/tCO2 (in 2015 Dollars), in which case capital income taxes could be as low as 33.7%. Yet, if this path is chosen, the cost of climate change adaptation to the US economy would be the full $28.8tn mentioned above.

The situation gets better if the government can change all three variables. If the price of carbon is set to $62/tCO2 then income taxes would have to average 42.4% (top marginal rate) while capital income taxes would average a mere 3.6%. Huh? The trick is that as the price of carbon increases with inflation, capital income taxes can be reduced over time from a peak of 57% in 2025 to 0% thereafter. In this scenario, owners of capital would of course be much better off, and yet, the total cost of climate change adaptation to the US economy would shrink to $23.3tn.

But here is the surprising result. If we keep capital income taxes constant at current levels and only use carbon taxes and changes in income taxes as levers, then we can reduce the cost of climate change adaptation even more to $22.4tn. In this case, the price of carbon would have to be set at $61/tCO2 (so almost identical to the previous scenario) while income taxes would have to rise. But get this. They would have to increase by a mere 0.1% to 38.5% to pay for climate change adaptation!

Note that these simulations all include the reduction of economic growth through higher taxes etc.

So, in order to finance the green revolution, we need to put a price on carbon that is about three times as high as current prices and introduce a minuscule increase in income taxes. The problem is that this seems politically impossible. Raising income taxes is almost certain to lose you the next election while raising capital income taxes or putting a price on carbon is less controversial. So it seems that political considerations are setting us up for higher costs of climate change adaptation than necessary.

Cost of climate change adaptation for different tax scenarios

Source: Barrage (2020)

I don’t give investment advice here and don’t know the product. Having read the description it looks interesting but it also looks like it almost exclusively in the European emission trading scheme, which would bother me from a diversification perspective.

I would want something that is exposed to the US, Canada, Europe, Sweden, China all in a meaningful way.

What’s a vehicle you might use to get long exposure?