As the West and China/Russia drift apart economically, both the US and the EU try to decouple their supply chains from China, Russia, and their allies. This has created a lot of concern about the supply of critical raw materials like rare earth metals that are used in wind turbines and other modern applications. Obviously, if supply becomes constrained, prices for these commodities have to rise. How much exactly is something a new research paper by the IMF has tried to calculate. And the results are not pretty.

The vulnerabilities of global supply chains have been laid bare in the aftermath of the pandemic. When all of a sudden cargo cannot be transported between China and Europe or Africa and China, much of modern industrial production comes to a standstill. Nowhere are these bottlenecks tighter than in global commodity markets, I think. While one can often get machinery parts from several suppliers in different countries, the supply of certain critical metals like cobalt is heavily concentrated in one or two countries.

The chart below is quite scary because it shows the global share of production of the top three producers of the most important commodities.

Global share of production of top three producers

Source: Alvarez et al. (2023)

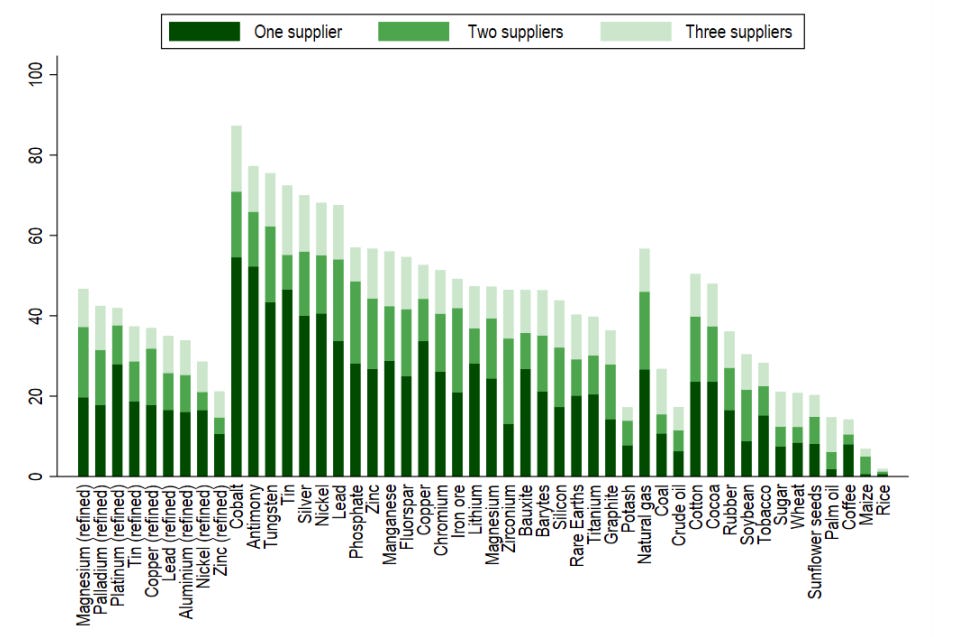

But it is not just production that is highly concentrated in the hands of a few countries. Most countries import metals and other commodities only from a very small number of supplier countries.

Share of countries that import commodities only from one, two or three suppliers

Source: Alvarez et al. (2023)

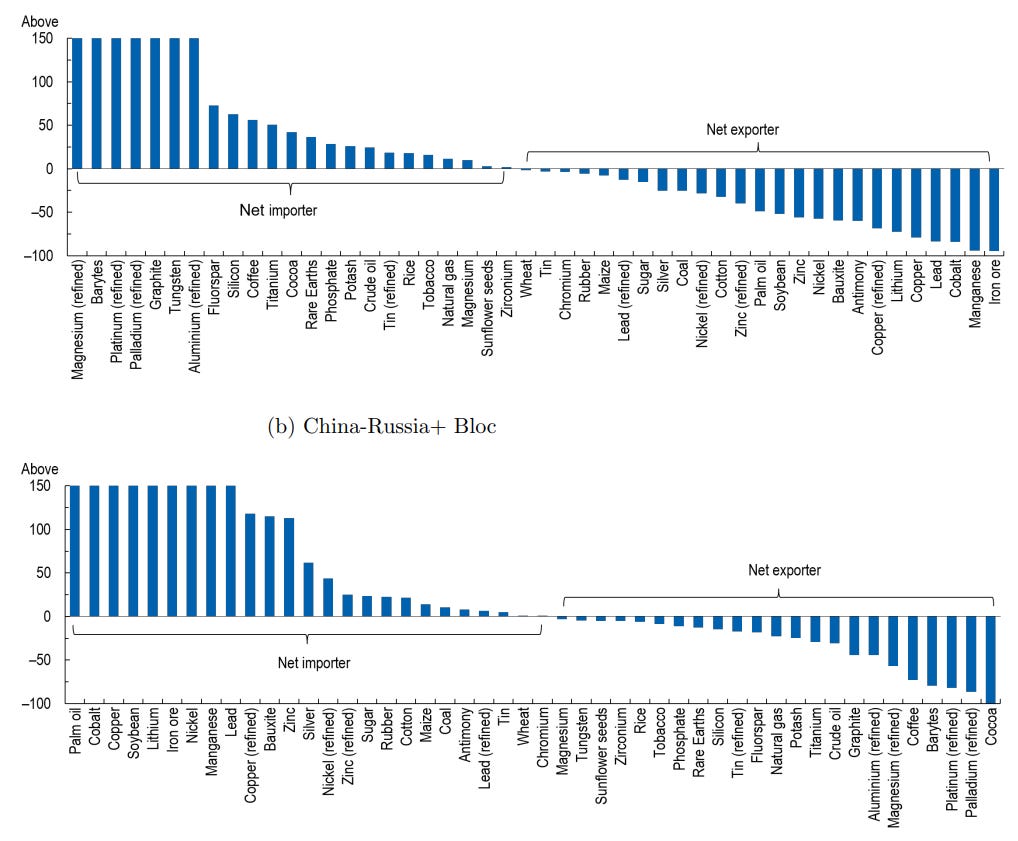

A team from the IMF has now built a model that looks at the global trade links of the 48 most important global commodities from crude oil via metals to palm oil and cocoa. They use this model to estimate how much prices in the Western bloc and the Russia/China bloc would change if trading between the two blocks stopped altogether.

Obviously, this is an extreme case, because even in an all-out trade war, trade in these commodities between the blocs would not stop altogether. Just look at Russia still being able to sell its oil and gas despite Western sanctions against it. But what this simulation does show is the sensitivity of commodity prices to a trade interruption and a trade war that affects them.

Effectively, what would happen is that the Western bloc would end up with a surplus of some commodities like iron ore or copper where there is more production than is needed in the region. Hence, steel prices would drop a lot in the West and rise dramatically in China, which undoubtedly would put an end to a lot of the growth in infrastructure and real estate in that country.

But prices for magnesium and graphite, used extensively in the production of batteries and other renewable energy equipment as well as platinum, group metals, and rare earth metals would skyrocket in the West since we would be cut off from supply from China.

Expected price changes in commodities after a geopolitical decoupling of the West from China and Russia

Source: Alvarez et al. (2023). Note: y-axis cut off at 150% to improve readability.

This is why I call the current standoff between Russia/China and their allies with the US and its allies a situation of mutually assured economic destruction. China can hurt the West just as much as the West can hurt China with economic sanctions. An all-out trade war between China and the West would have no winners, only losers. And I think many of the people who call for economic isolation of China through sanctions do not realise this problem, or wilfully ignore it for ideological purposes.

A hopeful argument that trade will continue; but:

(1) I have read there is a limit on (some of?) the minerals not yet extracted from mines, and already it is increasingly expensive as ores quality declines - if yes, what do we do in 2050s?

(2) The environmental damage done by mines, and the use of slave & child labour seem to be breach of the Greens ESG measures, or just humanity.

Meanwhile governments encourage EVs which use multiples more minerals to make and whose batteries will need replacement in time.

Is it they or I who is mad?

I fear that the continued de-coupling plus a scramble for "transition metals" will likely lead to some very brutal proxy wars (just like the 70s). Just my 2c.