Later today, we will get the September inflation data in the US. It will likely show another small step towards normalisation of inflation, though headline inflation remains well above the 2% target of the Fed. With the Fed starting to cut interest rates, I notice some pundits are starting to celebrate and think the fight against inflation has been won. But we should be careful not to celebrate victory too soon or we might end up the butt of a Schadenfreude video about people celebrating too early.

Yes, inflation has come down to within the Fed’s unofficial 1% range around the 2% inflation target but take a look at the latest output from our inflation forecasting model. It shows inflation bottoming out over the next couple of months before rising again in the second half of 2025.

Inflation model projection for the US

Source: Panmure Liberum

To be clear, I don’t think inflation will get out of control again, but I am not doing a victory dance either. Too many things can happen between now and the summer of 2025. On the positive side, the US economy could slow down more than expected, bringing inflation down faster. On the negative side, an external shock like a trade war with China could push inflation much higher, forcing the Fed to not only stop cutting interest rates but start hiking again.

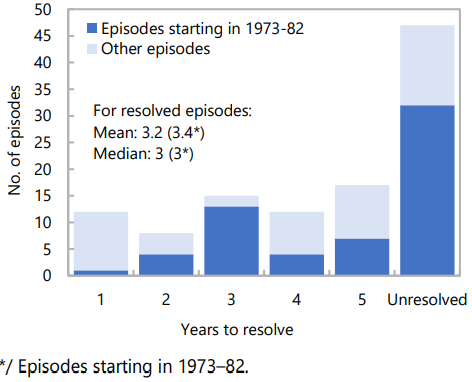

Indeed, the model forecast above reminded me of an IMF study from a year ago. Looking at 100 inflation shocks since the 1970s the authors distilled seven stylized facts. One of them is that only in about 6 out of 10 inflation shocks was inflation brought back to within 1% of the pre-crisis level within five years. Even with these instances of controlled inflation, it took on average three years to control inflation.

Years until inflation declines to within 1% of its pre-shock rate

Source: IMF

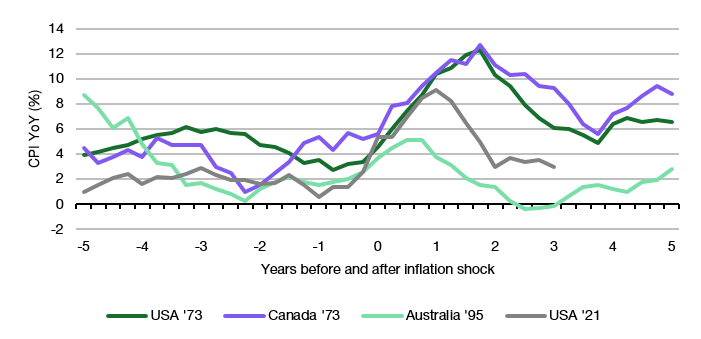

Another one, and one that I did not know before I read the study, was that of the inflation shocks that were not brought back under control about 9 in 10 showed premature celebrations. Inflation declined to within normal levels, central banks and investors celebrated victory and started to loosen monetary policy just to reignite the flames of inflation.

The chart below shows the example of the 1973 oil price shock in the US and Canada together with the Australian inflation shock in 1995 and the latest US inflation shock in 2021. Note the similarity between the inflation episodes. In each case, the inflation dragon appeared to be beaten three years after the shock, just to accelerate again in years four and five after the shock.

Inflation shocks with premature celebrations

Source: IMF, Bloomberg

Again, it’s not a given that inflation rises again in 2025. A lot will depend on the Fed. Another stylised fact of successful fights against inflation shocks was monetary policy that remained disciplined and restrictive even though the economy slowed down fast. If monetary policy switches too soon from fighting inflation to supporting economic growth, the result typically is less economic pain in the short run, but higher inflation and slower growth for longer. Let’s hope the Fed (and for that matter the ECB, BOE, and other central banks) have read the article by the IMF as well.

Have we slayed the inflation dragon?

No, the dragon cannot be slain. It sometime snoozes or even goes into hibernation. We hope for the latter.

While only one particular data point (and I am curious at how close it will be to the official number), IDT Corp released their September report of NRSInsights for transactions that they see through their POS network: it seems that on a dollar weighted basis the top 500 items increased 2.1% yoy (a decline from the 3.5% inflation reported in August) https://www.idt.net/nrsinsights-september-2024-retail-same-store-sales-report/