One of the silliest exercises in finance is the habit of people to make return forecasts for the next 12 months or so (and before you complain, yes, I am guilty as of doing that myself). We all know (or at least should know) that such short-term forecasts are hopelessly unreliable. Yet, it is interesting to examine how different groups of investors form their return expectations. To that end, Wang Renxuan from Columbia University has done us all a big favour. He collected all kinds of different return forecasts over time from different sources and compared how they relate to past returns and a “rational” forecast based on a model that includes valuation and other fundamental factors. The chart below shows the messy raw data for the return in the previous 6 months (pink bars) and the expected returns of sell-side analysts, buy-side analysts, CFOs of S&P 500 companies, and the broader consumer base in the United States.

Return expectations of different investor groups in the United States

Source: Renxuan (2021).

If you stare at the chart long enough, you will notice that consumers basically follow past returns, reducing their return expectations after the market declined (e.g. in 2008) and increasing them after the market rose (e.g. 2016-2018). Sell-side analysts, meanwhile seem to do the opposite, increasing their return expectations after the market drops and reducing them after it rose. However, the expected returns of sell-side analysts are much higher than those of buy-side analysts or CFOs.

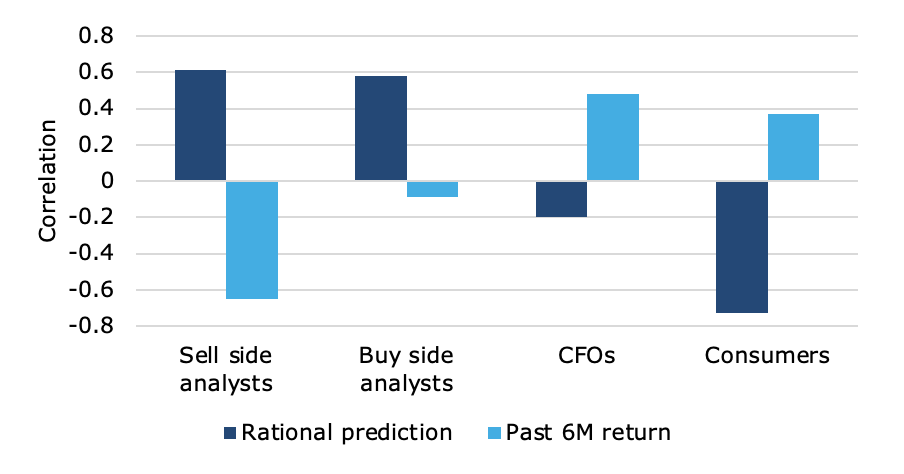

Renxuan did not check how accurate the return expectations of the different investor groups are, but we know that sell-side analysts are chronically over-optimistic about future returns. Yet, it seems that they are overoptimistic in a rational way. The correlation between the return forecasts of a “rational” model and the return expectations of sell-side analysts is pretty high, while the correlation of this rational model with the return forecasts of buy-side analysts is lower and negative when it comes to CFOs and consumers. The correlation with past returns, on the other hand, shows the opposite trend, negative with analysts and positive with CFOs and consumers.

Correlation of return expectations with “rational” model forecasts and past returns

Source: Renxuan (2021).

None of this means that analysts are likely to be right more often than CFOs or consumers, but it shows that they form their return expectations in a way that is more consistent with what we know how markets work, while CFOs and the general public is much more driven by past returns. And that means that depending on who dominates market action influences how markets will move. If the marginal buyers and sellers in a market are the general public, markets will likely be more momentum-driven. If the marginal buyers and sellers are fund managers, markets will likely be less momentum- and more valuation-driven.

Interesting reading! Please, How someone can identify if the marginal buyer is general public or fund managers?