I picked that stock, so it won’t go down

The other day, I was writing about evidence that when people get an ordinary object like a mug or a hat, they are more likely to ask a higher price for it and are less likely to sell it at any price offered to them. This is the well-known endowment effect. But I also discussed how people who were asked to write a story about these mugs and how these objects are personally significant to them (even though they got a random mug and were asked to make things up) increased the value in the eyes of the people who told the story about these mugs by 25% to 80%, depending on the circumstances. This implies that stocks that people own are more highly valued by them than by people who don’t own the stock. Furthermore, if these stocks come with a great story (narrative), people will value them even more.

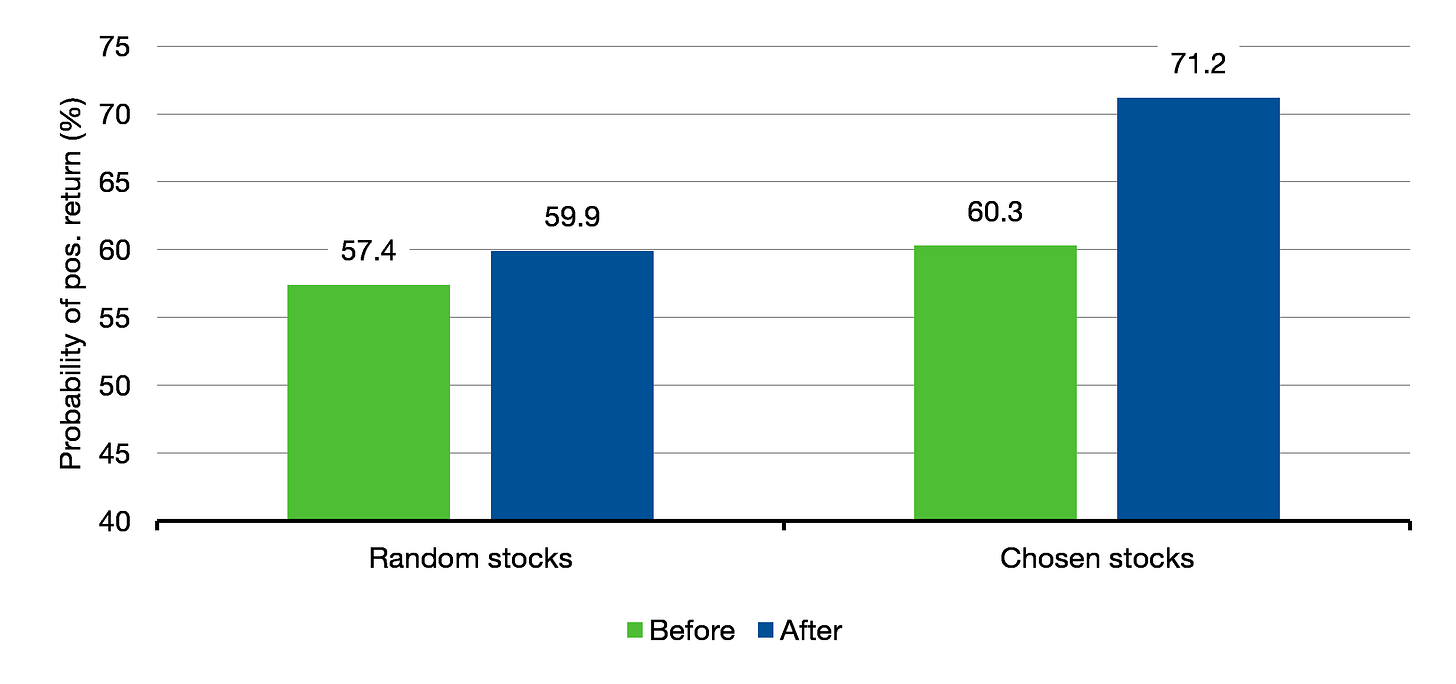

In an independent piece of research, two academics from the University of Alicante tested that both in the lab with an artificial stock market and in real life with trendy glamour stocks. In the lab experiment, they gave each participant six artificial stocks to observe. The stocks had slightly different returns so over time their share price would diverge. After ten periods, the participants were asked to estimate the return for the next ten periods of each of these socks. Then they were either given three of these stocks by random, or the participants could choose three of the stocks they liked the most (and that they thought were most likely to have a positive return). The chart below shows that before the participants owned these stocks, they thought in about 57% to 60% of the cases that the stock would have a positive return. When they were randomly assigned some stock, these estimates remained stable, but when they could choose their own stock, the expectations for positive returns increased. Just because they actively picked those stocks, they thought they had to have a higher return, even though they did not think so before they chose these stocks.

Share of estimates with positive returns for artificial stock market

Source: Cueva and Iturbe-Ormaetxe (2021)

But things got really interesting in the second experiment, where the same people were asked to guess the return of six glamour stocks every day for the next day: Alibaba, Facebook, Uber, Netflix, Tesla, Zoom. After trying to predict daily returns for these six stocks for a month, they were then either assigned three of these stocks at random, or they could choose three of these stocks that they liked best.

And while the people who were randomly assigned the stocks didn’t materially increase their return predictions, the people who could choose their favourite stocks afterward increased their predicted returns from 4.1% to 6% to 6.5% per quarter. That is, by buying into these stocks, the return expectations increased by two-thirds. The study doesn’t say if the effect would be smaller for more boring stocks without the glamour of a good story. But it shows that the effect of ownership of real stocks tends to distort the perception of investors to a similar degree as the ownership of a random mug in a lab experiment. And that is something we need to be aware of when we think about our own investments and why they should have a positive return or what the risks are. Chances are if we picked the stocks ourselves, we tend to substantially underestimate their risks.