The term “attention economy” is increasingly thrown around to describe the trend towards better performance of stocks of companies that grab the attention of the public. Companies like Tesla, Facebook or Amazon come to mind as the prime examples of companies that manage to attract investor attention through both a charismatic or controversial CEO and a ubiquitous product familiar or even used by most people.

The ability of these companies to grab the spotlight as well as their ability to inspire passionate support by some and equally passionate resistance by others is in my view what helps them attract a loyal investor base and achieve lofty valuations.

The media, which often prides itself as the watchdog against corporate and market excesses certainly isn’t helping. A team from Arizona State University surveyed 462 financial journalists in the United States about their practices of covering a company. The majority of these journalists said that holding companies accountable is one of the most important objectives of their work. Yet, if you look at their responses on how they write stories and which sources they use, one has to wonder how that is supposed to work.

I know that journalists are under enormous pressure to attract clicks and page views so they have less and less time to write an article. The times are difficult for investigative journalists, but if I look at the responses of that survey, I would say journalists don’t even tap into easily accessible sources that could help them investigate a company and better understand the risks and flaws of the corporate story.

Let’s take a look at some survey responses. First, what makes a company attractive to a journalist. Clearly, larger companies have a broader investor base and thus articles about these companies are likely to attract a larger readership. Similarly, if the products and services of the company are popular. A good growth story and a prominent CEO also help. But the list is topped by companies that are controversial.

Top ten reasons why financial journalists cover a company

Source: Call et al. (2021)

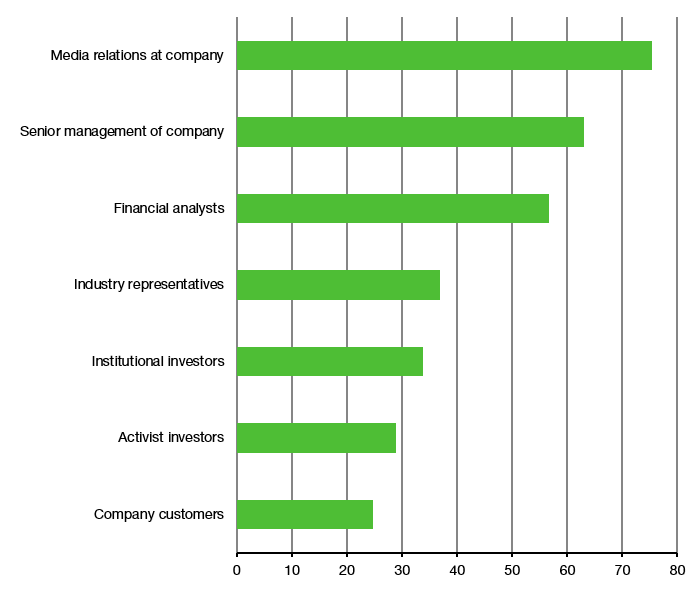

Controversial is good because it attracts attention both from lovers and haters but these are also the companies were opinions diverge significantly. And in extreme cases, these are the companies like Enron or Theranos were corporate fraud is threatening investors. But if you then ask financial journalists what sources they use to cover a company, it becomes really problematic. The three main sources are the company’s own media relations team, their senior executives and financial analysts. The first two have every incentive in the world to spin the story in their favour and no incentive whatsoever to give a journalist real insight. Meanwhile financial analysts in general are trying to stay in the good graces of a company in order not to endanger the flow of lucrative capital market and investment banking deals. This is why so many sell side analysts are overly optimistic about thew prospects of a company. And this is why interviewing financial analysts on the sell side is unlikely to get a journalist a comprehensive picture of a company.

Most important sources for financial journalists

Source: Call et al. (2021)

Finally, which analysts are journalists calling upon to comment on a company? Mostly analysts who have experience covering the company in question and analysts that have been helpful to the journalist in the past. That makes sense. You want to talk to experts who know the company well and because time is precious, you want an answer quickly. But apparently a diverging opinion isn’t that important. So, how is a journalist going to hold a company accountable and be critical about a company’s own story when the most likely sources for the story are the company itself and analysts most of which have a skewed incentive?

The fact is that journalists are well aware that writing a critical article about a company may result in complaints from the company and potentially cut their access to company management in the future. Just like financial analysts, journalists have an incentive to softball their questions and not burn bridges. The result is that the long-term objective of holding companies accountable and informing the market and the investment public goes out the window in favour of the short-term goal of preserving access. No wonder than that controversial CEOs are able to hold the spotlight but are rarely called out on their past mistakes or the nonsense they utter.

Example of how dailies get their source:

https://m.youtube.com/watch?v=d3Q1-CfX6Ik&feature=youtu.be