Forgive me for banging on about monetarism and its demise, but I have recently come across that dead theory in a couple of discussions. It seems as if practitioners are simply unwilling to let go of the idea that printing money creates inflation, even if it doesn’t work and hasn’t done so in more than 30 years. For those who still haven’t caught up with my ranting, see here, here, here, here, and here. But more importantly, read the new paper by Alexander Jung.

In his paper, he set out to show that the quantity theory of money works not just in the 20th century but even if one uses data going further back in time to 1870. But he inadvertently showed that the quantity theory of money has collapsed since 1985.

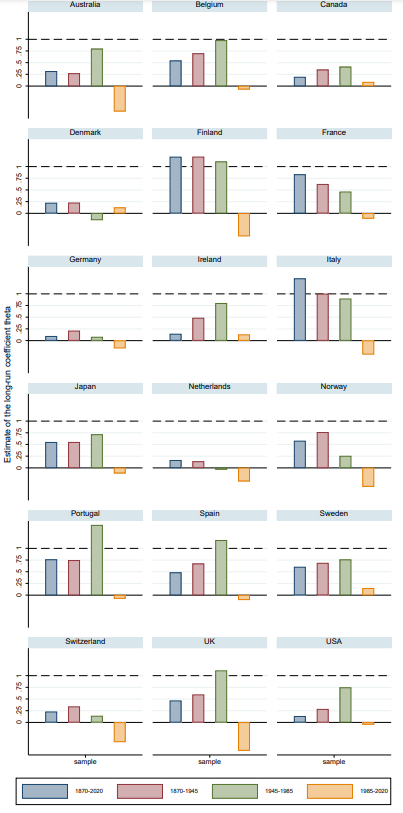

Take a look at two key charts from his paper. In both charts, Jung shows the regression coefficient between inflation and the change in the money supply.

Monetarists argue that over longer time frames of several years, the growth in money supply should lead to a commensurate increase in prices, thus creating inflation. The tests Jung made were designed in such a way that this theory would lead to a regression coefficient of 1.0 in the long run. If the regression coefficient is less than 1.0, printing money does create inflation but less than expected and if it is above 1.0, it creates more inflation than the theory predicts. And of course, if the coefficient become negative, then printing more money leads to lower inflation, which is obviously nonsense…

Or is it?

Here are the regression coefficients for 18 developed countries for the periods 1870 to 2020 (blue bars), 1870 to 1945 (red bars), 1945 to 1985 (green bars) and 1985 to 2020 (yellow bars). The first chart uses narrow money to measure the money supply.

Link between narrow money supply and inflation

Source: Jung (2024).

And here are the regression coefficients using the broad money as a measure of money supply:

Link between broad money supply and inflation

Source: Jung (2024).

In both cases, the results are pretty unequivocal:

The regression coefficients are almost always less than 1.0 indicating that the theory is overstating the amount of inflation from growing money supply.

In general, monetarism has worked best between 1945 and 1985, right at the time when Milton Friedman developed the theory based on his experience with the US economy at the time. It worked less well before 1945.

Since 1985, the quantity theory of money has failed completely (yellow bars). So much so, in fact, that the regression coefficients not only declined to zero, but became negative for almost all countries. In other words, since 1985, printing more money has led to less inflation, not more.

Which brings me back to what I have been saying for a long time: We really don’t know what drives inflation. For sure, money supply is no good as an explanation of inflation. But there are also doubts whether inflation expectations matter for inflation or if the Fed really brought down inflation in the 1980s by pushing real rates to very high levels. In the end, we still lack a convincing theory about inflation and as a result, central bakers are stumbling in the dark. Is it any wonder that they get inflation periodically wrong?

So, let's hand out a million dollars to all the citizens of the world, and everybody will live happy everafter? What you suggest defies gravity. I don't doubt the findings to which you refer, I just don't think they are correctly intepreted. I think a reasonable assumption is that the amount of FIAT money that allows for stable prices is related to the economic activity. If you step out of line, it must have consequences. By the way, thank you for a great blog.

I am not an economist, but I have heard the following ideas:

(1) as well as the Quantity of money (M2 doubled in last 10 years), the Velocity is relevant (fallen from c. 2.2 x in late 1990s to under 1.2 x in 2020, and now is c. 1.37x I.e. lower Velocity in part counters growth in M2.

(2) the large increase in M2 from the GFC, in part caused by QE, has caused Inflation - in real assets eg stocks, real estate rather than goods & services.

(3) since 2020 (Coronavirus) there has been inflation in goods & services, because Government largesse in giving out ‘free money’, increased fiscal spending, so giving the money to the wider economy. The Deficit and increase in $ interest paid out on Treasuries could be harmful. Todd M above mentions this.

This is an observation on money supply, not an argument.