People have a hard time understanding inflation

I have recently written about the ineffectiveness of forward guidance to steer inflation expectations. Because most normal people do not understand how inflation works, they cannot form a mental link between the central banks promise to keep interest rates low and rising inflation. And since that mental link breaks down, they don’t change their behaviour.

In a new study by Peter Andre and his colleagues this inability of the general audience to anticipate the effects of certain policy measures on inflation has been put directly to the test. The researchers asked both experts and a representative sample of US households to estimate the impact of four different economic shocks on inflation and unemployment. And here is the good news: Lay people have a pretty good understanding of what causes unemployment. Rising oil prices and a reduction in government spending is expected to increase unemployment. They also understand that a 50bps increase in the Fed Funds rate is likely to increase unemployment as does a one percentage point increase in income taxes.

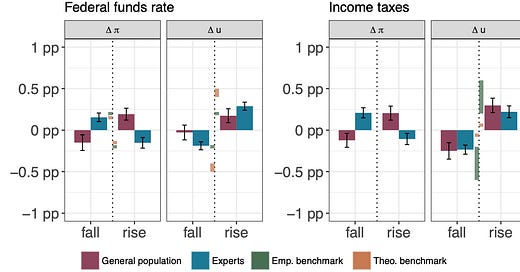

So far so good, but where it gets worrisome is in the expectation of changes in interest rates and taxes on inflation. As the chart below shows, lay people expect inflation to rise after the Fed funds rate is increased and inflation to drop after rates are cut. Also, the general audience expects inflation to drop if income taxes increase and inflation to rise if income taxes drop.

This is worrisome in two ways. First, it means that monetary policy is prone to be ineffective if the central bank and the news media don’t explain the likely impact of policy changes to the general audience. Similarly, if fiscal policy measures are not explained to the general audience in terms of their likely effects on both unemployment and inflation, the reaction of consumers may be less pronounced. Or, inversely, there is the potential to increase the effectiveness of monetary and fiscal policy simply by spelling out the likely effects on the economy in plain English.

And then there are advisers who should learn from the charts below that it is their job to help their clients understand the actions of the central bank and the government and its likely effect on inflation and their investments. We are experts, but our clients are not, and we should never take for granted that they understand basic economic concepts like inflation the same way we do. Even if it sounds stupid to us experts, there is value in spelling things out as clearly as possible to our clients.

The expected impact of monetary and fiscal policy on inflation (pi) and unemployment (u)

Source: Andre et al. (2019).