ESG data becomes much more widely available and more and more investors include it in their decision-making process. Nevertheless, when I talk to investors in the United States, there is always a bit more scepticism about ESG investing than in Europe.

A study with US and German investment professionals has tried to figure out how these cultural differences manifest themselves in investment recommendations. To do this, the professionals were asked to participate in a series of lab experiments.

They were introduced to hypothetical furniture company “Furniturama” and received background information about the company as well as a simplified set of financial statements for the last three years. Some investors additionally received ESG-related data like the share of wood recycled, number of accidents and injuries in the workforce, or the amount of money spent by the company on health and safety training for employees.

Then, the investment professionals were told that they had a budget of €10,000 or $10,000 to invest in furniture stocks and asked how much they would invest in Furniturama if they were making investments for their personal accounts.

The chart below shows that if presented with additional ESG data, both German and American investors decided to invest more in Furniturama than without ESG data. Further analysis showed that the ESG data increased the expected financial performance of the company as predicted by the investment professionals. They may not consciously do it or admit it, but companies disclosing their ESG credentials are seen by professional investors as more profitable and better investments.

Effect of ESG disclosures on investment professionals’ decisions

Source: Arnold et al. (2020).

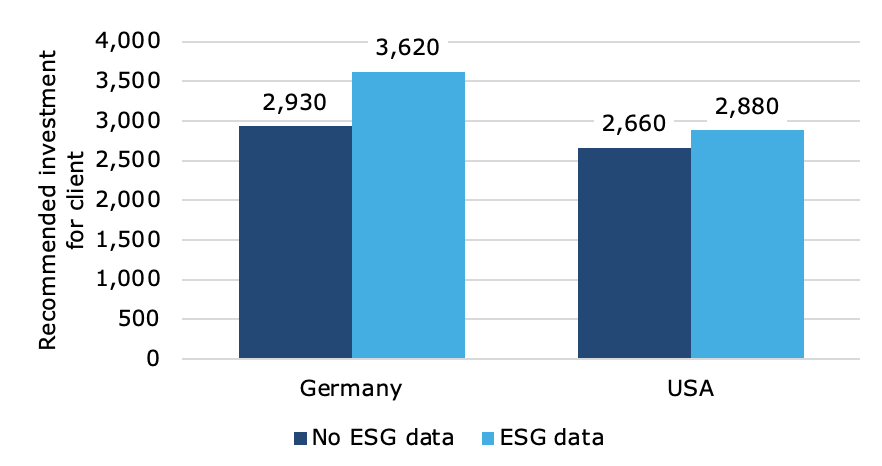

Then, the professionals were again asked about Furniturama but this time, they were asked to determine how much they would recommend a client to invest. The chart below shows that the same trends are at work. Investors who see ESG data, as well as fundamental data, recommend a higher investment to their clients. The effect strength in both countries is about two-thirds of the effect strength in the case of their personal investments indicating that investors recommend to clients what they would invest in themselves but moderate their recommendation somewhat when investing for others.

Effect of ESG disclosures on investment professionals’ recommendations

Source: Arnold et al. (2020).

But while there are broadly the same outcomes for Americans and Germans, there is an obvious difference. Why is the effect so much stronger for German investment professionals than for Americans?

The researchers looked at the reasons these investment professionals gave for expecting higher returns for companies with ESG data disclosed. German investors were more likely to engage in motivated reasoning, arguing that a company that does well for society will get higher financial rewards. American investors did not engage in this kind of motivated reasoning and as a result, expected lower financial benefits when dealing with ESG data than their German peers.

And this is a worrisome outcome because it shows that with German investment professionals (and I would argue with many investors across Europe), ESG investing is increasingly detached from reality where it is not entirely about risks and empirical evidence. This is to my knowledge the first study that there is some form of magical thinking going on that because a company does well for the environment and society it somehow has to be rewarded with higher returns and higher share prices.

I am a big advocate for ESG investing but that is not how markets work. Just because a company is a good citizen and does well for the environment it doesn’t have to have higher returns or higher valuations. The important thing for a company and investors is to know which ESG activities will lead to higher valuations and higher share returns because they reduce material operational risks and thus overall risks for the bottom line of the financial statement. That is how I use ESG data and how the most successful ESG investors I know use that kind of data. Markets still are about profits and financial performance. They do not, have not, and never will reward companies for being do-gooders. And not every action a company takes to support the local community, the environment, or their employees is material or reduces risks.

Sorry if I popped your little ESG bubble there.

I think there's a generation of investors coming through for whom this thesis does not hold true - certainly at a retail level and, when those investors hold institutional power, quite possibly at the institutional level as well.

Who says that "investing" should be limited to the search for financial performance and financial returns? An investment, a shareholding in a company, should provide for many positive outcomes and the stock price should reflect the value of those outcomes. ESG goals and behaviours represent valuable outcomes and are something that deserve to be rewarded. (Unless you're so cynical about them that you don't believe concerted efforts on ESG can address the problems we face globally and societally and therefore don't feel that they deserve any compensation.)