One of the more esoteric topics that fascinates me about the psychology of investing is whether our risk preferences are determined by our genes or our environment. I have written about that in a past paper, but now a new study has shed some additional light on this topic.

The most common approach to examine what share of our risk preferences are genetically coded is the ACE model of twin studies. In essence, you ask many monozygotic and dizygotic twins to fill out the typical questionnaires to elicit risk or time preferences.

The risk preference questions are the common ones in the style of ‘Do you prefer the safe choice with payoff X or the risky choice with a potentially higher payoff Y or a certain possibility of losing Z?’ Time preferences are elicited with the usual tradeoff questions, such as ‘Do you prefer small payoff X today or larger payoff Y in a year?’

Then, you can use the results to differentiate between similarities and differences in behaviour between twins. The share of risk preferences that explains the behaviour of both twins is either due to the genetic component (A for the additive genetic component) or the shared common environment (particularly during childhood, abbreviated with the letter C). The share of risk preferences that differs between twins is due to the unique environment of each twin (abbreviated with the letter E and typically the individual lifetime experiences of each person).

By comparing monozygotic twins which have the same gene code and dizygotic twins which have different gene codes and are no different than any other siblings, one can further differentiate between the influence of genes and the shared common environment during childhood.

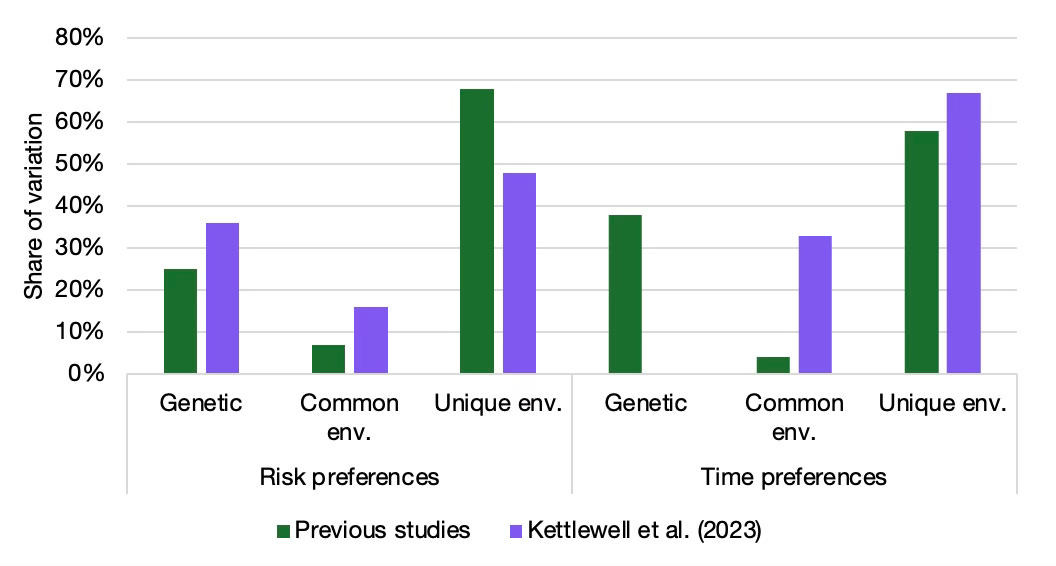

The resulting split between the three components of this so-called ACE model is one where about 25% of risk preferences are attributed to genetic drivers and 68% to the unique environment, while the common environment is of negligible importance. When measuring time preferences, the results typically indicate 38% heritability and 58% of preferences due to the unique environment.

However, the new study made a keen observation. All these measurements are subject to measurement error and this measurement error looks just like the influence of the unique environment of the person answering the questionnaire. Hence, the influence of the unique environment may be vastly overstated in past studies.

Using a rather complicated econometric approach that in my view makes a lot of assumptions I am not willing to take for granted, the authors try to estimate the three components while also accounting for possible measurement errors. Their results are contrasted with the average of previous studies below.

Influence of ACE factors on risk and time preferences

Source: Kettlewell et al. (2023)

In general, the new study finds a significantly smaller genetic influence for time preferences and a significantly larger genetic influence for risk preferences. However, and this is the only important conclusion I would take with me, of the three components, the unique environment is always the most important driver of risk preferences and time preferences, no matter which methodology one uses.

We are not slaves of our genes and no matter what happens to us in life it is not a result of our genetic make-up or our shared environment. The key driver of our life is what we make of it. And this is great. As I said in a post last year, we can achieve anything, if we just set our mind to it. And that is the great thing about life. It truly is what you make of it.

Klement: We are not slaves to our genes, we can achieve anything, if we just set our mind to it.

Me: *looks at expaneding waistline, looks at extra slice of cake, promises self not to eat more cake, eats more cake* *through mouthfull of cake, spraying crumbs onto phone screen* Yes, this guy's right

I know two male identical twins quite well who are about 35 years old. They lived together until they were at least 25 years old and always did the same job by sharing the activity (a commercial activity). Well, not only do they have two completely different personalities but also two opposite sexual orientations: one is married with children and heterosexual beyond any reasonable doubt, the other lives with a partner and has always had his orientation clear without any second thoughts. I can see it in two ways: free will exists and is the greatest force in the universe. Or, the complexity of the individual human being is so great that even living in a deterministic universe the so-called butterfly effect disrupts the attempts we make to predict human behavior. BUT… when we apply that same attempt to collective behaviors, the basic instincts prevail and certain dynamics become recurrent and manipulable. It’s like when you consider different time frames in financial markets. The individual represents the intraday in which the background noise prevails, in the long term (the collective consciousness) the fundamentals win. Sorry for the extreme simplification