Robo-advisers are easy to blame

I have written about robo-advisers and their difficulties to attract investors in the past. In my last post on this topic, I mentioned that the results I showed there indicated that not only younger investors, but also older ones above the age of 45, seem willing to pay a robo-adviser the same as they would a human.

Now, I came across another study that asked 550 Swedish people to decide if they want to delegate their investment decisions to a financial professional or an algorithm. The participants came from all strata of Swedish society. They were aged from 20 to 70 with half the participants aged between 40 and 60 and half the participants having at least a college degree.

Each of the participants were asked if they trust other people, financial professionals and algorithms. To nobody’s surprise, financial professionals were less trusted than the general public and algorithms were less trusted than financial professionals.

Trust in financial professionals and investment algorithms

Source: Holzmeister et al. (2019).

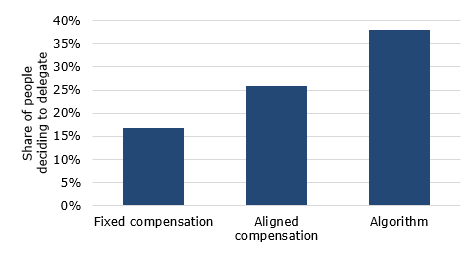

Then the participants were given a choice to either manage their money themselves, delegate it to a financial professional who got paid a flat fee independent of the outcome of his advice, delegate it to a professional who had incentives aligned to the investor’s (i.e. the professional got higher pay if he performed well and lower if he lost money), or delegate it to a robo-adviser.

Some results of this delegation experiment aren’t surprising:

Investors are more likely to delegate to professionals when the incentives of the professionals are aligned to the performance of the portfolio.

Investors are more likely to delegate to professionals they trust more.

Investors who are more likely to blame others for failures are more likely to delegate their investments

To me a former wealth manager, the last point strikes a particularly familiar chord…

Then there is the inevitable surprise. Investors are more likely to delegate to an investment algorithm than to a human!

Willingness to delegate financial decisions

Source: Holzmeister et al. (2019).

The study doesn’t explain why this is the case, so I can only speculate. And my best guess is that it has something to do with the perceived objectiveness of the algorithm and the ease to blame an algorithm if things go wrong. I have written about the perceived objectiveness of robo-advisers here, but what strikes me is that the ability to shift blame may be a significant driver of the use of robo-advisers as well. Remember that we humans are social animals. We do not like to admit that we have made mistakes and it is difficult for most of us to blame other humans for mistakes because that will put us in a conflict with our fellow citizens. Being able to blame a machine is such a nice way out of that conundrum. It turns the entire investment decision into a head I win, tails the machine loses situation.